A Simplified Tax Invoice is basically a simplified version of a Tax Invoice, in which fewer details are required to be mentioned, as compared to a Tax Invoice.

A Simplified Tax Invoice is to be issued by a registrant for taxable supplies of goods or services in either of the following 2 cases:

- The recipient is not registered under VAT or

- The recipient is registered under VAT and consideration for the supply does not exceed AED 10,000

Hence, Simplified Tax Invoices are the type of invoices to be issued by all registered businesses in UAE which supply to consumers or to registered businesses where the value of the supply does not exceed AED 10,000.

Understanding the details that are required to be given in a Simplified Tax Invoice is extremely important for such businesses. Let us understand this in detail:

Simplified Tax Invoice format

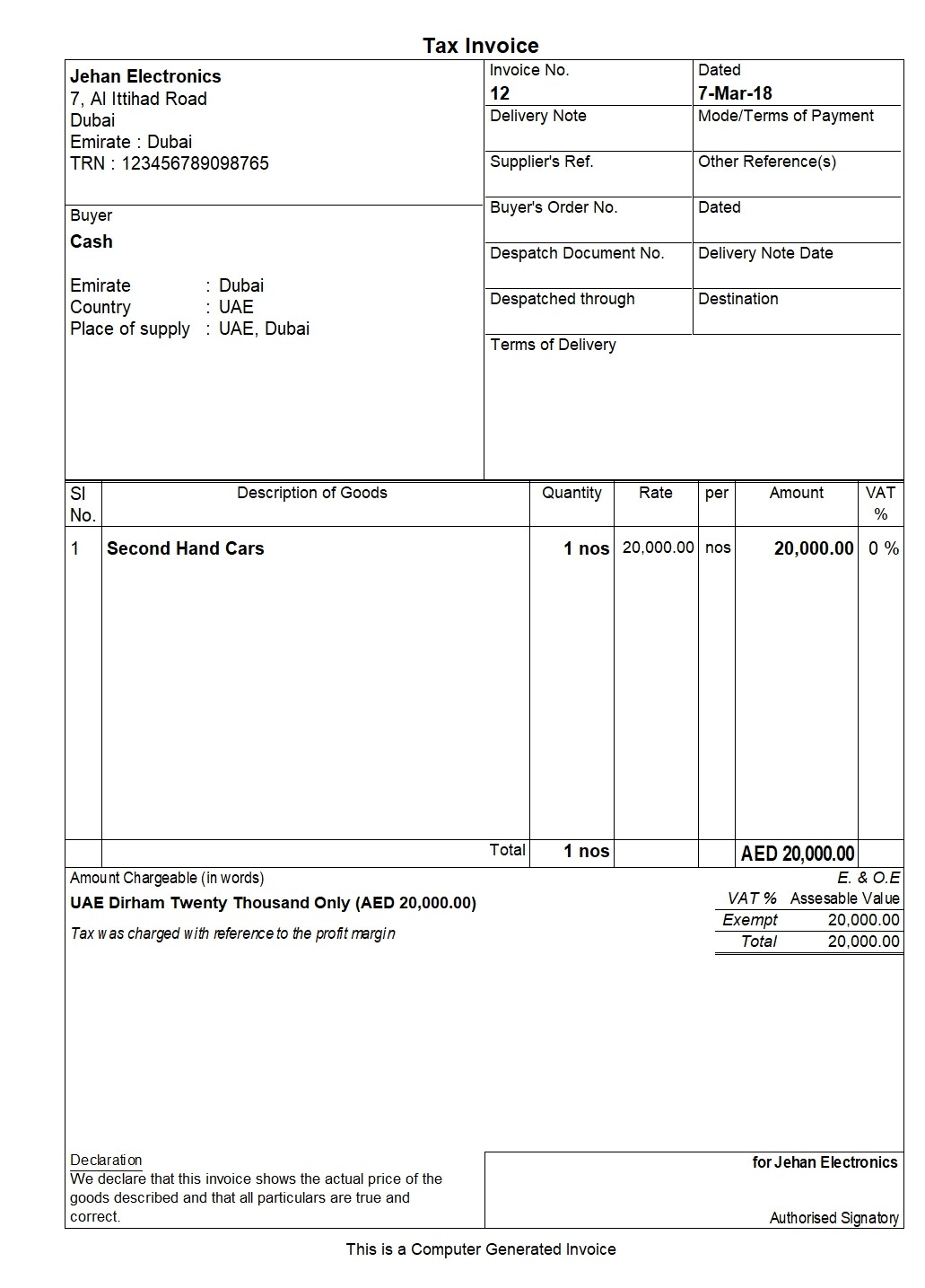

As per the mandatory details required, a sample format of a Simplified Tax Invoice is shown below

Invoice for cash sales generated from TallyPrime

As you can observe, the details required to be shown in a Simplified Tax Invoice, are lesser as compared to a Tax Invoice. While both a Tax Invoice and Simplified Tax Invoice have to be prepared with the same heading 'Tax Invoice', a significant difference is that in the Simplified Tax Invoice, the recipient's details are not required.

Hence, a Simplified Tax Invoice is easier to prepare, as compared to a Tax Invoice. However, for retail businesses and businesses whose supplies to registrants are for a value less than AED 10,000, it is important to ensure that simplified tax invoices are issued for all taxable supplies of goods or services. Similar to a Tax invoice, Simplified Tax Invoices are important documentary proof of taxable supplies having taken place. These invoices will also serve as the basis for return filing by suppliers and for the claim of the input tax credit by registered recipients. For businesses which are required to issue Simplified Tax Invoices, using a VAT software which will automate the task of preparing the invoices, will make it easier. It is important to select a software which automatically prepares a Simplified Tax Invoice based on the nature of a transaction, fills the details required in a Simplified Tax Invoice and maintains the details of these invoices in a secure manner for future reference.

Read more about UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT, Checklist for Tax Return Filing under VAT in UAE, Bill–to-Ship-to Supplies in UAE VAT, Single Composite Supply in UAE VAT, VAT Applicability on Different Types of Supplies in UAE

VAT Rate

VAT Rate in UAE, VAT Rates Applicable to Education Sector in UAE, Difference between Zero Rate, Exempt and Out of Scope Supplies in UAE VAT, UAE VAT Rates- Handbook, Standard Rated Purchases/Expenses in VAT Form 201, Zero-Rated and Exempt Supplies in VAT Form 201, Zero-Rated Supplies in UAE VAT, Use of Exchange Rates in VAT Invoice, Freelancer’s Guide to VAT, How to handle Multiple Supplies in UAE VAT