In our previous article 'Steps to submit e-guarantee in FTA portal', we have learnt the process to submit an e-guarantee in the FTA portal. Once an e-guarantee is submitted and approved, goods imported can be cleared at the Customs. The scenarios of import by non-registrants where an e-guarantee is required are:

- a. Transfer of goods from one VAT designated zone to another VAT designated zone.

- b. Import of goods into UAE under customs duty suspension.

The scenarios of UAE import where an e-guarantee is required, are typically scenarios where the importer is not liable to pay VAT on import, on satisfying certain conditions. If the conditions are satisfied, VAT is not liable on the import, whereas if the conditions are not satisfied, the e-guarantee serves as financial security for payment of the VAT due. In cases where the conditions for waiver of import VAT are satisfied, the e-guarantee submitted earlier can be cancelled.

Let us understand the steps to cancel a submitted e-guarantee in the FTA portal.

Steps to cancel e-guarantee in FTA portal

Step 1:Login to FTA portal.

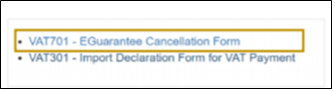

Step 2:Click the 'VAT' tab as shown below:

Step 3: Click 'VAT 701- E-Guarantee Cancellation form'.

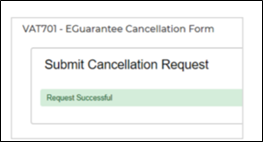

Step 4: Fill in the e-guarantee cancellation form and provide the required information, including the import declaration number, import declaration date and the e-guarantee number.

Step 5: Once the form is filled, click the 'Submit' button.

Step 6: Once the submission of the e-Guarantee cancellation form is done successfully, a confirmation message will appear on the screen, specifying that the request is successful and you will receive a confirmation email.

Hence, non-registrants who import goods in certain specified scenarios are required to submit an e-guarantee for the import in UAE. Once the goods are cleared by Customs and the conditions for waiver of import VAT are satisfied, the e- guarantee submitted earlier can be cancelled by following the process given above.

Read more about FTA

VAT Support Channels by FTA in UAE, Steps to Submit e-guarantee in FTA portal, Administrative Penalties under Tax Procedures Law by FTA in UAE, Change in business details to be notified to FTA, FTA Accredited Tax – Accounting Software Requirements, What is FTA Audit File (FAF), Benefits of using FTA Approved Tax Accounting Software in UAE

UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Payment

VAT Payment in UAE, How to Make VAT Payment using GIBAN, How to make VAT Payment to FTA in UAE, VAT Payment on Import of Goods in UAE, VAT Payment through e-guarantee in UAE, VAT payment on commercial property in FTA Portal, VAT payment on import in FTA portal

FAQs on VAT

VAT FAQs on Education Sector in UAE, VAT FAQs on supply of real estate in UAE, VAT FAQs on implementing VAT in your business, VAT FAQs on Zero Rate and Exempt Supplies in UAE, VAT FAQs on UAE Free Zone, VAT return FAQs