Value-added tax popularly known as VAT is an indirect tax that is levied on the supply of goods and services. It has been implemented in more than 160 countries and on 16th April,2021, Oman will join the league of countries that have implemented VAT. The VAT being a new system, it is important for businesses to understand the concept of VAT and how the system works.

What is VAT?

VAT is a general consumption tax that is levied on taxable goods and services that are bought and sold in Oman including the import of goods and services. It is levied and collected at every stage of the supply chain right from the manufacturer’s purchase of raw materials to a retailer’s sale of an end-product to a consumer. Since it is an indirect tax system, the registered businesses act as agents to levy, collect and remit the tax to the authorities.

| VAT Rate Structure |

How does VAT System work?

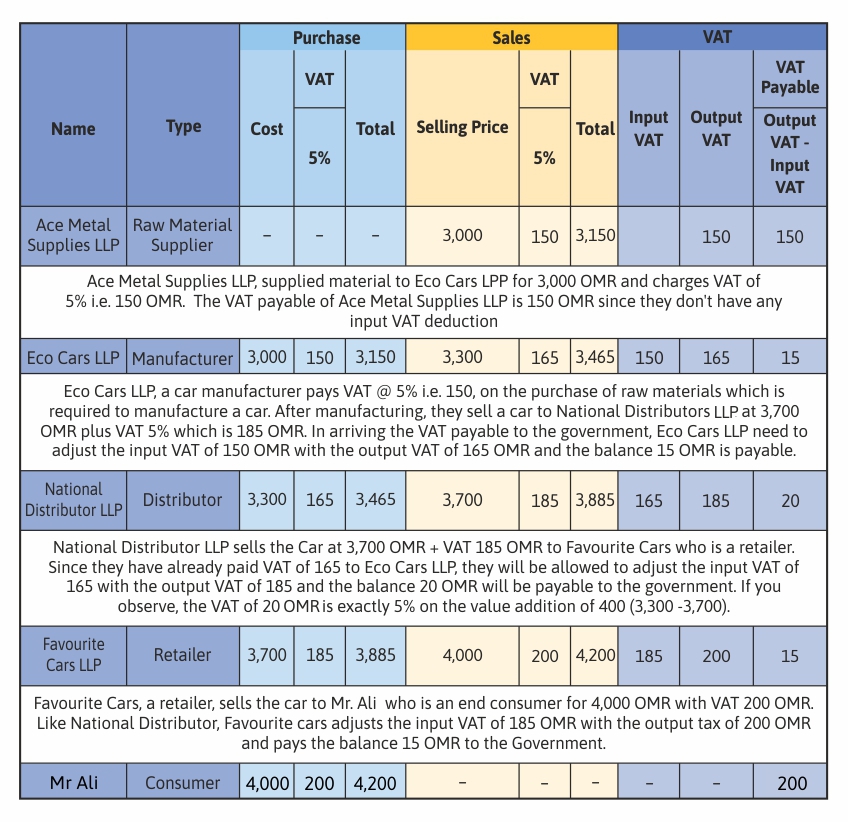

Under the VAT system, tax is levied tax levied on value addition in each stage of the supply chain. This is achieved through the concept of input VAT deduction, which allows the business to set off the VAT paid on purchases (Input VAT) with the Vat collected on the sales (Output VAT). Let’s understand how Vat system works with an example.

When you look at the above example, the total Vat paid by all parties (Ace metal Supplies LLP 150 + Eco Cars LLP 15 + National Distributor LLP 20 + Favorite Cars LLP 15) is 200 which is the same amount paid by Mr Ali on purchasing the car. This tells us that:

- All the registered business in the supply chain will pass the burden of tax to the next stage of the supply and avoids cascading effect.

- Under this system, VAT is ultimately paid by the end consumer.

- Vat is incrementally charged on value addition in each stage of the supply chain.

In Oman VAT, not all supplies are levied with a VAT rate of 5%. The Vat laws allow certain notified supplies to be levied with zero-rated VAT and some are exempted. Read “ VAT Rate in Oman’ to know the tax structure.

Read more on Oman VAT

Oman VAT, VAT Invoice in Oman, Best VAT Software in Oman, Input VAT Deduction in Oman, Stay VAT Compliant with TallyPrime’s Amazing Capabilities, Exempt Supplies in Oman VAT, How to Calculate VAT in Oman, What are the Benefits of Applying VAT in Oman, How is Introduction of VAT going to Affect Oman Economy

VAT Rate

VAT Rate in Oman, Zero-Rated supplies in Oman VAT, Food Items Subject to Zero-rate VAT in Oman

VAT Registration

VAT Registration Guide in Oman, VAT Registration Deadline in Oman, Who Should Register Under Oman VAT, Business Benefits of Voluntary VAT Registration, Oman VAT Registration Guide for Persons with CRN, What is Tax Group Registration in Oman VAT

VAT Return

VAT Return in Oman, Oman VAT Return Format, FAQs on Oman VAT Return, How to File Oman VAT Return