Businesses registered under Oman VAT are mandated to file VAT returns in a format prescribed by the Tax Authorities (TA). The VAT return is a statement that needs to be submitted quarterly by all the VAT registered businesses to the Tax Authorities (TA) at the end of each tax period. The authorities have prescribed the VAT return format that acts as a self-assessment of the VAT due or refundable for a given tax period. In this blog, let us understand the VAT format in detail.

Oman VAT return format

The VAT return format prescribed by Oman Tax Authorities (TA) is broadly categorized into 7 sections as mentioned below:

- Supplies in the Sultanate of Oman

- Purchases subject to reverse charge mechanism (RCM)

- Supplies to countries outside of Oman

- Import of goods

- Total VAT due

- Input VAT Credit

- Tax liability calculation

Section-wise details of Oman VAT return format

The details and type of supplies that needs to be captured under each of these sections are explained below:

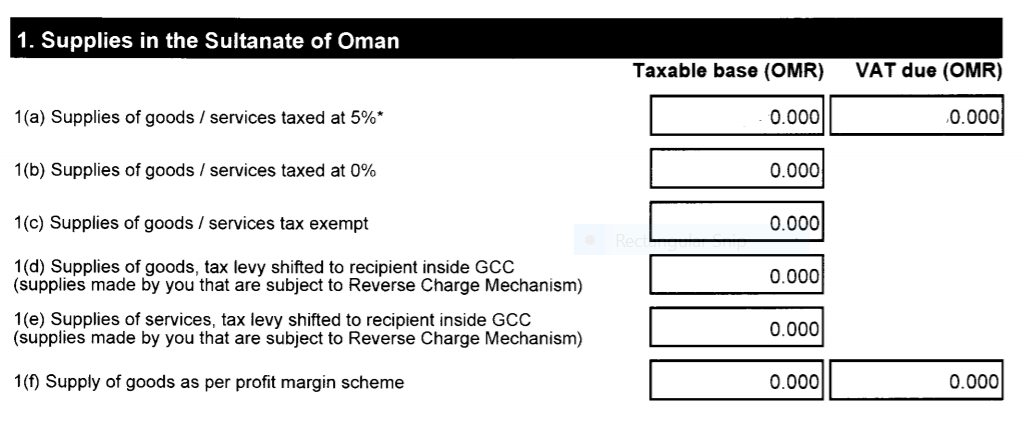

Supplies in the Sultanate of Oman

- Supplies of goods/services taxed at 5%: Here, the total value of standard-rated supplies of goods and services made in the Sultanate, including deemed supplies need to be mentioned. The value needs to be VAT-exclusive since the portal is designed to auto calculate it in ‘VAT due (OMR) filed

- Supplies of goods/services taxed at 0%: The total value of zero-rated supplies of goods and services in the Sultanate, excluding exports of goods or services, needs to be captured

- Supplies of goods/services tax exempt: Certain notified supplies are exempt from Oman VAT. The total value of such supplies made in the Sultanate needs to be mentioned here. Out of scope supplies are to be excluded

- Supplies of goods, tax levy shifted to recipient inside GCC (supplies made by you that are subject to Reverse Charge Mechanism): Currently left blank, until GCC rules apply to such transactions

- Supplies of services, tax levy shifted to recipient inside GCC (supplies made by you that are subject to Reverse Charge Mechanism): Currently left blank until GCC rules apply to such transactions

- Supply of goods as per profit margin scheme: The total profit margin for any supplies of goods as per the profit margin scheme needs to be captured

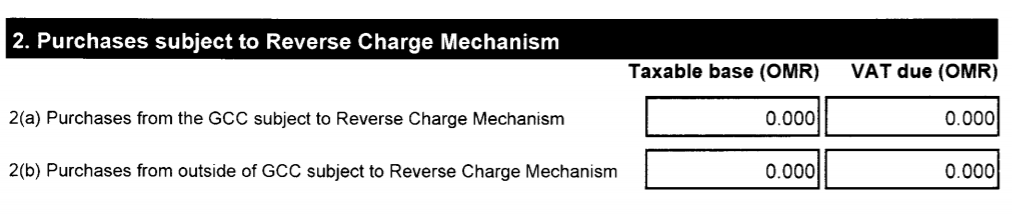

Purchases subject to reverse charge mechanism

- Purchases from the GCC subject to reverse charge mechanism: ): Currently left blank, until GCC rules apply on such transactions

- Purchases from outside of GCC subject to Reverse Charge Mechanism: Here, mention the total value of standard-rated supplies received from outside GCC which are subject to reverse charge mechanism (RCM)

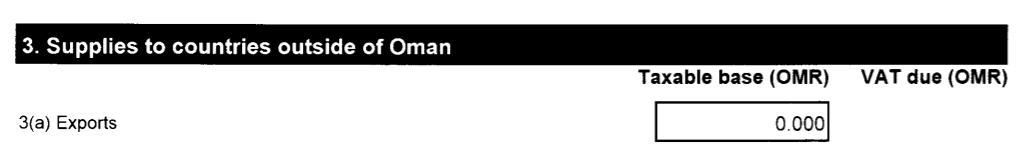

Supplies to countries outside of Oman

Here, the total value of goods and services exported outside of Oman on which zero-rated VAT is levied. Out of scope supplies are to be excluded.

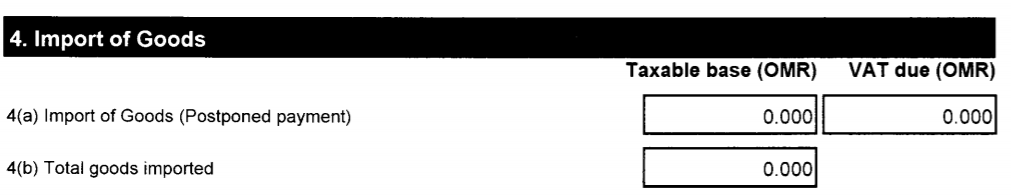

Import of goods

- Import of goods (Postponed payment): If you have availed postponement option that allows you to defer the VAT payment (return filing date) on import of goods, you need to mention the total value of such imports here

- Total goods imported: Here, the total value of all imports, including exempt/zero-rated goods and imports on which VAT has been paid at customs. You need to exclude imports reported in Box 4a

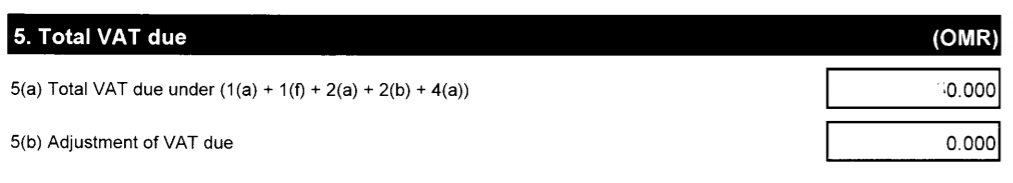

Total VAT due

- Total VAT due under (1(a)+1(f)+2(a)+2(b)+4(a)): Here, total VAT due (before adjustment) on all taxable supplies declared in the above fields are auto calculated in the portal

- Adjustment of VAT due: Here, any adjustments to output VAT due such as bad debts related to standard-rated supplies, refunds, returns, and any other adjustments that affect VAT due

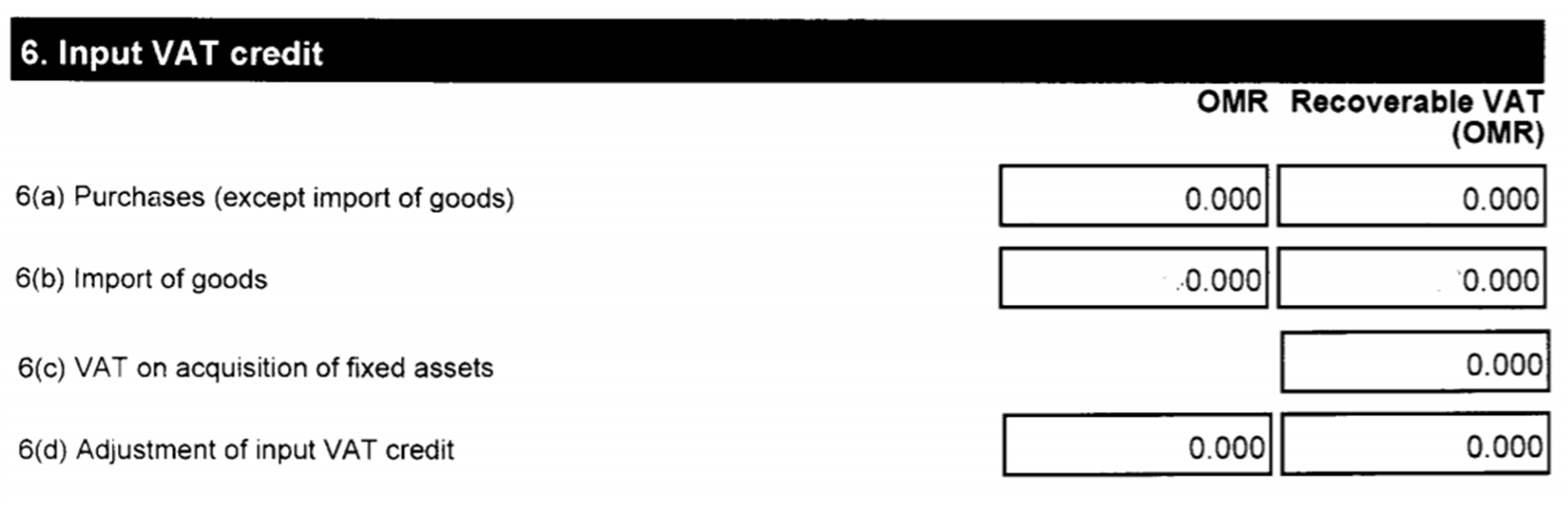

Input VAT credit

This section is categorized into 4 parts as detailed below. The value under this section needs to be mentioned in 2 columns. In the first column, you need to mention the total value of supplies (excluding VAT). In the second column ‘Recoverable VAT’, you need to declare deductible input VAT related to your purchases as per the provisions of VAT law and regulation.

- Purchase (except import of goods): Total value of all purchases i.e., exempt/standard/zero-rated purchases and reverse charge purchases need to be mentioned here. You need to exclude imported goods, out of scope expenses and purchases of fixed (capital) assets

- Import of goods: Here, mention the total value of imports of goods that attracts VAT including VAT paid at customs as well as under postponement scheme

- VAT on acquisition of fixed assets: This includes deductible VAT related to purchases, acquisition, or construction of capital assets

- Adjustment of input VAT credit: Here, any adjustments to input VAT deductible such as bad debts related to standard-rated supplies, refunds, returns, and any other adjustments that affect input VAT deductible should be mentioned

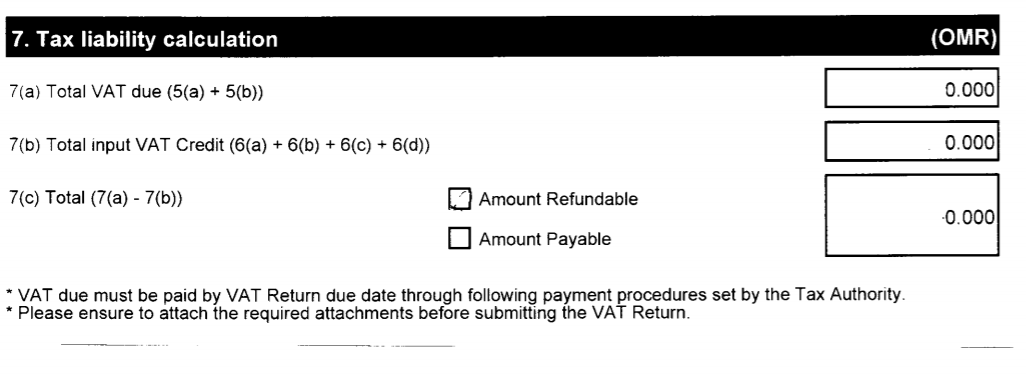

Tax liability calculation

- Total VAT due (5(a) + 5(b)): Total value of VAT due if any is automatically calculated

- Total input VAT Credit (6(a)+6(b)+6(c)+6(d)): Total value of deductible input VAT in this period will be auto-calculated

- Total (7(a) + 7(b)): The net VAT which may be either payable or refundable is automatically calculated. If VAT due is higher than the total input vat credit, it results in VAT payable. If total input VAT credit exceeds total vat due, it results in VAT refundable

Download Oman VAT Return Format

VAT return in TallyPrime

Periodic filing of VAT return is one of the key compliance requirements that all the registered businesses should adhere to it. Failure to submit a VAT return attracts hefty fines and penalties. Though the VAT return format is designed to be at a summary level, businesses are required to show the break-up of different types of supplies along with the VAT due and input VAT deductible.

Given the level of detail required, using business management software would be highly beneficial for businesses. The software will not only help businesses to account VAT, but also helps them to generate valid VAT return forms in the format prescribed by the Oman tax authorities. Using TallyPrime, a complete business management software, you can manage all your VAT requirements easily. Right from generating VAT compliant invoices to filing VAT returns, TallyPrime is a one-stop solution for your complete business needs.

Read more on Oman VAT

Oman VAT, VAT Invoice in Oman, Best VAT Software in Oman, Input VAT Deduction in Oman, Exempt Supplies in Oman VAT, How to Calculate VAT in Oman, Reverse Charge Mechanism in Oman VAT, What is VAT and How does it work, What are the Benefits of Applying VAT in Oman, How is Introduction of VAT going to Affect Oman Economy

VAT Rate

VAT Rate in Oman, Zero-Rated supplies in Oman VAT, Food Items Subject to Zero-rate VAT in Oman

VAT Registration

VAT Registration Guide in Oman, VAT Registration Deadline in Oman, Who Should Register Under Oman VAT, Business Benefits of Voluntary VAT Registration, Oman VAT Registration Guide for Persons with CRN, What is Tax Group Registration in Oman VAT

VAT Return

VAT Return in Oman, FAQs on Oman VAT Return, How to File Oman VAT Return