- What is a tax group registration?

- What are the conditions for tax group registration?

- Example of tax group registration in Oman

- Benefits of VAT group registration

In Oman, the VAT law allows group VAT registration if two or more persons are related or associated with businesses. Here, the tax group will be treated as a taxable person independent from all tax group members. All the members in the tax group will be severally liable for the group’s tax obligations that arise during their membership.

What is a tax group registration?

Two or more persons conducting businesses may apply for VAT registration as a tax group. A tax group comprises two or more persons registered with the authorities as a single taxable person subject to fulfilment of conditions prescribed in the Oman VAT law.

| Reverse Charge Mechanism in Oman VAT | Input VAT Deduction in Oman |

What are the conditions for tax group registration?

To be eligible for VAT Group registration, all of the following conditions need to be fulfilled.

- Each person has a place of residence in the Sultanate

- All members are legal persons.

- Each person must be registered for tax per law.

- One person, whether a member of the group or not, has control over all other members of the tax group

- None of the persons is a member of another tax group

- None of the persons is a person registered with the authority operating a special zone as specified under regulations

Example of tax group registration in Oman

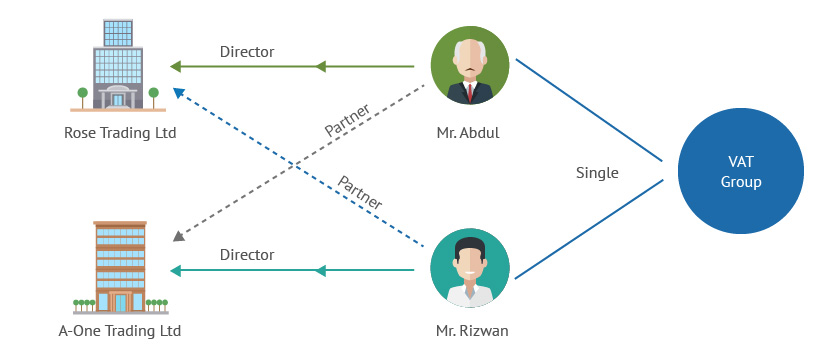

As illustrated above, Mr Abdul is a Director in Rose Trading Ltd and a Partner in A-One Trading Ltd. Mr Rizwan, is a Director of A-One Trading Ltd. Also, Mr Rizwan is a Partner in Rose Trading Ltd.

Therefore, Mr Abdul and Mr Rizwan will be eligible to apply for VAT group registration provided the conditions are fulfilled.

Benefits of VAT group registration

The following are the benefits of VAT Group Registration for the business

- Since all the entities within a VAT Group will be treated as ‘ONE’ taxable person for VAT, it will help the businesses to simplify accounting for VAT. Also, compliance reporting like VAT returns must be prepared and reported at the group level instead of each entity

- Any supplies within the entities of a VAT group are not subject to VAT. However, supplies made by the VAT group to an entity outside the VAT group are subject to VAT

Read more on Oman VAT

Oman VAT, VAT Invoice in Oman, Best VAT Software in Oman, Input VAT Deduction in Oman, Exempt Supplies in Oman VAT, How to Calculate VAT in Oman, Reverse Charge Mechanism in Oman VAT, What is VAT and How does it work, What are the Benefits of Applying VAT in Oman, How is Introduction of VAT going to Affect Oman Economy

VAT Rate

VAT Rate in Oman, Zero-Rated supplies in Oman VAT, Food Items Subject to Zero-rate VAT in Oman

VAT Registration

VAT Registration Guide in Oman, VAT Registration Deadline in Oman, Who Should Register Under Oman VAT, Business Benefits of Voluntary VAT Registration, Oman VAT Registration Guide for Persons with CRN

VAT Return

VAT Return in Oman, Oman VAT Return Format, FAQs on Oman VAT Return, How to File Oman VAT Return