VAT being an indirect tax, the levy of tax is going to be at the transactional level. In other words, when you make a taxable supply, you need to calculate the VAT at 5%. That’s exactly what all the registered businesses in Oman started doing from 16th April, 2021.

Check out: What is VAT and How does it work?

In this article, let’s understand the process of VAT registration for persons with commercial registration number aka CRN.

According to the registration process guide, only those with a “commercial registration number” (CRN) can register for VAT through the tax authority’s online portal. Domestic persons and non-residents with no CRN must complete other registration forms that are available on the Oman tax authority’s website and then submit these forms to the Oman tax authority via a specified email address.

Read more on: VAT Registration Guide in Oman

The registration process guide and the forms were provided after the Oman tax authority decided for a “staggered” registration schedule for those required to register for VAT (the schedule is based on monetary thresholds).

Those eligible for voluntary VAT registration may apply for registration anytime on or after 1 February 2021. Persons with an annual turnover exceeding OMR 1 million started applying for VAT registration during the period from 1 February 2021 to 15 March 2021.

Find out Who Should Register Under Oman VAT?

Also read: Business Benefits of Voluntary VAT Registration

How to register for VAT for persons with CRN

Only persons with Commercial Registration number (CRN) may register through the online portal. Persons with no CRN must complete the form available on the Tax Authority’s website and send it via email.

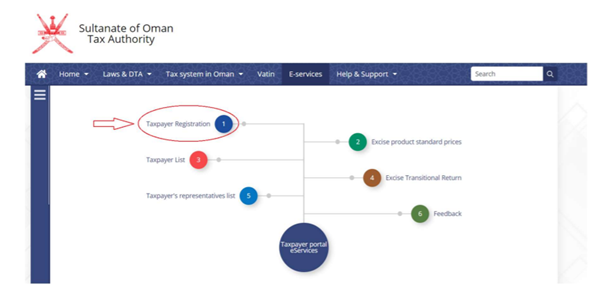

Step 1: When logged in to portal select Taxpayer Registration.

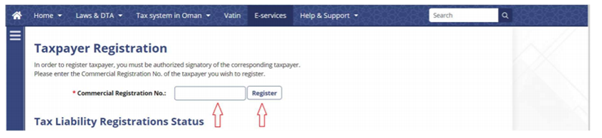

Step 2: In the field “Commercial Registration No”, enter commercial registration number of the company and then select “Register” button.

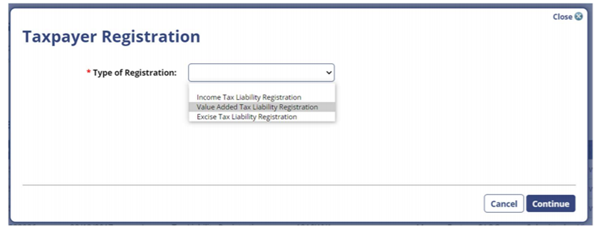

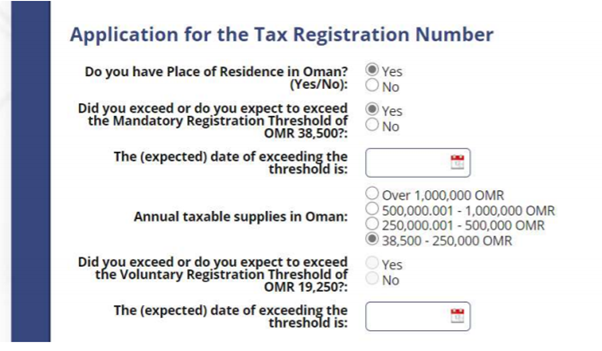

Step 3: Taxpayer Registration” window will appear. From the drop-down list of “Type of Registration” select “Value Added Tax Liability Registration” and then select “Continue” button.

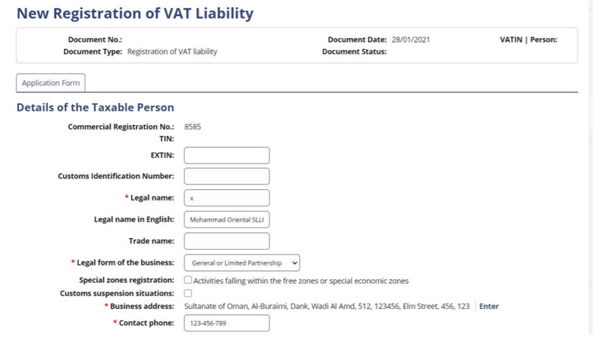

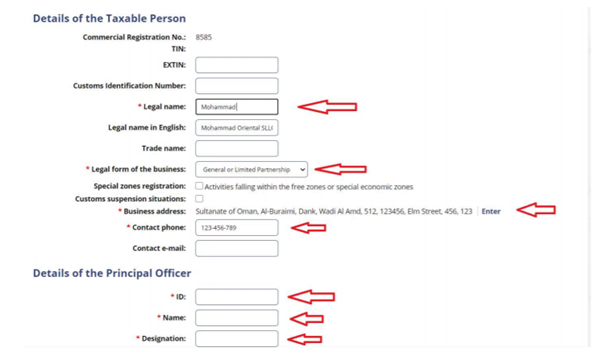

Step 4: If successful, system will display “New Registration of VAT Liability" form. Fill the required fields with the correct information.

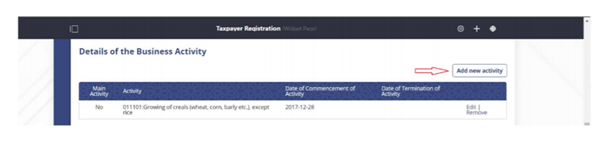

Step 5: Select “Add new activity” button to mark activity as main or to add more activities.

Step 6: System will display “Activity” Window. Tick the “Main Activity” checkbox and fill the required fields (Activity and Date of commencement of Activity) and select “Add and close” button.

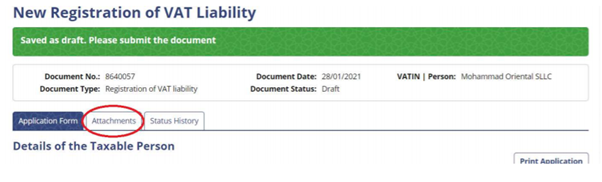

Step 7: Fill the required fields and select “Save Draft” at the end of the form

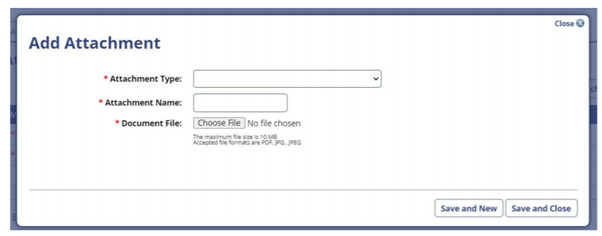

Step 8: Select “Attachment” to add the necessary attachments. You can also add as many attachments as you need, by selecting the “Add new attachments” option

Step 9: Fill with the needed information and select “Save and Close”. Once you save you will see “Submit” Button (Available in “Application form” tab), select that to submit your form

Step 10: Select “Print Decision” and Select “Print VAT Certificate” from the E-services page and you’re done!

Applications are reviewed carefully by the OTA and more information may be requested from applicants.

Once the VAT registration certificate is obtained, the following actions would be required –

- The VAT registration certificate must be clearly displayed at every location in which the activity is conducted

- The VAT identification number must be included in all documents issued, such as tax invoices, communications, and all other documents issued by the taxable person.

Being tax compliant is extremely crucial for business owners. TallyPrime ensures that the software is always prepared for any latest statutory changes for smooth functioning of your business. Get a free-demo and stay updated with all compliance-related changes.

Read more on Oman VAT

Oman VAT, VAT Invoice in Oman, Best VAT Software in Oman, Input VAT Deduction in Oman, Stay VAT Compliant with TallyPrime’s Amazing Capabilities, Exempt Supplies in Oman VAT, How to Calculate VAT in Oman, VAT on Free Zones and Special Economic in Oman, VAT Payment on Import of Goods and Services in Oman, What are the Taxable Goods and Services Under VAT in Oman

VAT Rate

VAT Rate in Oman, Zero-Rated supplies in Oman VAT, Food Items Subject to Zero-rate VAT in Oman

VAT Registration

VAT Registration Guide in Oman, VAT Registration Deadline in Oman, Who Should Register Under Oman VAT, Business Benefits of Voluntary VAT Registration, What is Tax Group Registration in Oman VAT

VAT Return

VAT Return in Oman, Oman VAT Return Format, FAQs on Oman VAT Return, How to File Oman VAT Return