VAT is a general consumption tax that is levied on taxable goods and services that are bought and sold in Oman including the import of goods and services. It is levied and collected at every stage of the supply chain right from the manufacturer’s purchase of raw materials to a retailer’s sale of an end-product to a consumer. Since it is an indirect tax system, the registered businesses act as agents to levy, collect and remit the tax to the authorities.

Oman VAT registration opened on February 1, 2021, for taxable persons with annual supplies exceeding — or expected to exceed — 1 million Omani Rial.

| Personalise the Business Reports the Way You Want | 5 Things in TallyPrime for Enhanced Business Efficiency |

Businesses in Oman will need to keep VAT records for a minimum of ten years from the end of the year to which they related. These records will need to be made available for review at any time. The first step to prepare yourself for VAT compliance is by generating invoices adhering to Oman VAT laws from the day of implementation.

VAT returns must be filed with the tax authority electronically. It is expected that the VAT period will be a minimum of one month, and VAT payments and returns should be filed within 30 days of the end of the tax period. Transactions with non-VAT-implementing GCC states will be treated the same as transactions with non-GCC states.

| Who Should Register Under Oman VAT? |

Here’s how TallyPrime capabilities will help you stay VAT compliant

With VAT implementation just a few weeks away, businesses are all set to welcome the new taxation system with open arms. From system configuration to gaining compliance knowledge, business owners in Oman are prepping themselves to create substantial cash-flow and absolute tax costs.

Using TallyPrime, you can:

- Easy and simplified configuration of VAT rate

- Configure tax rates based on their taxability

- Recording and generating accurate invoices

- Generate invoices in Arabic/English or both

- Get exception reports for mismatch transactions

- You can manage all types of VAT transactions in TallyPrime

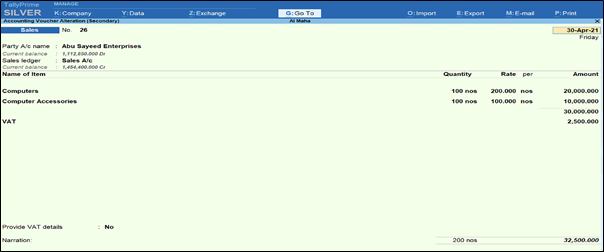

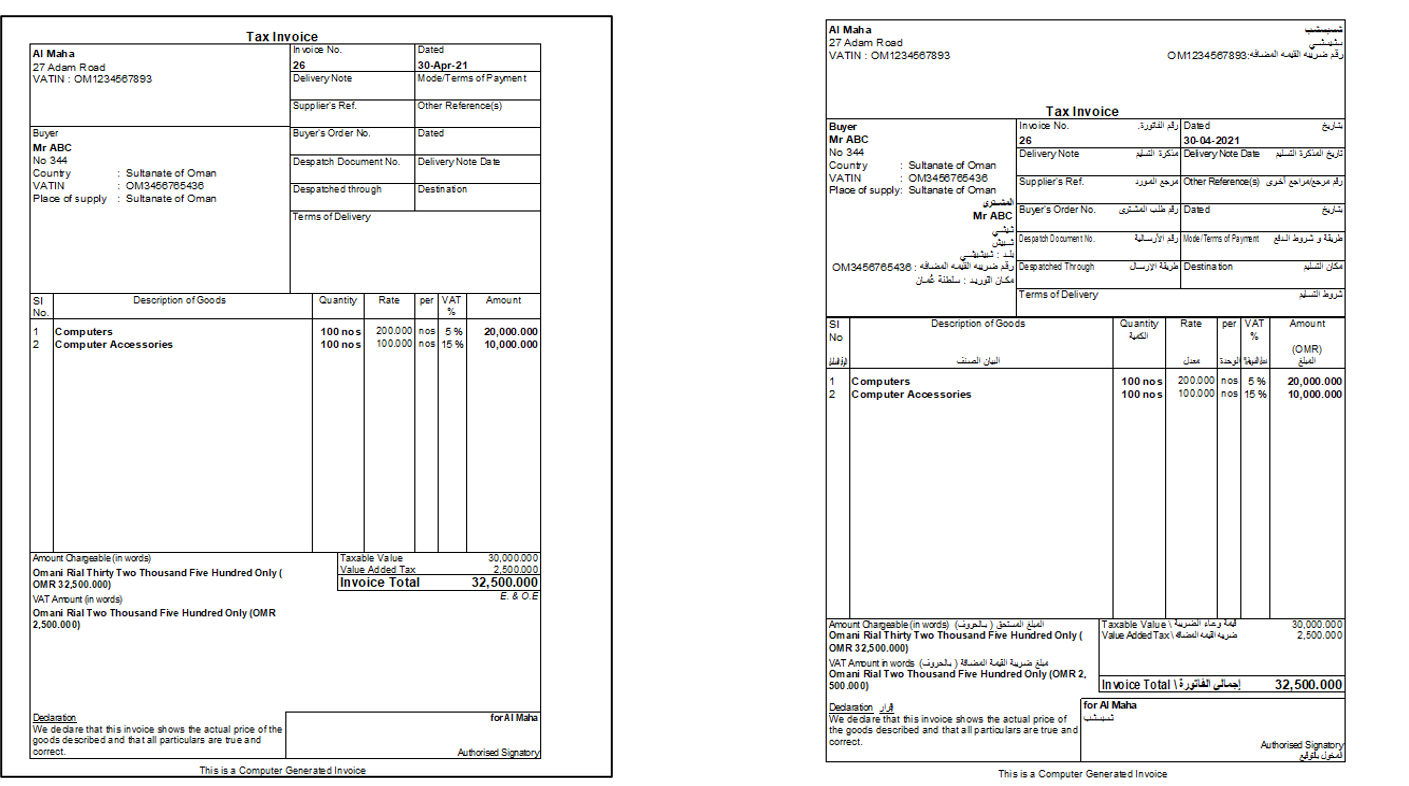

With TallyPrime’s simplified and accurate VAT compliant invoicing, you can adhere to all the mandatory tax laws and bid your worries, goodbye. Let’s look at how easy it is to create and generate VAT invoices with TallyPrime:

Easy and simplified configuration of VAT rate

With easy and one time set up of VAT configuration, you can seamlessly record purchase and sales transactions without having to specify the actionable. You can create various types of invoices with multiple items, multiple tax types and multiple currencies within minutes of installation.

Invoices with multiple currencies can be printed with value breakups of the transactions in terms of different currencies. VAT gets calculated on the base currency (the currency of your country).

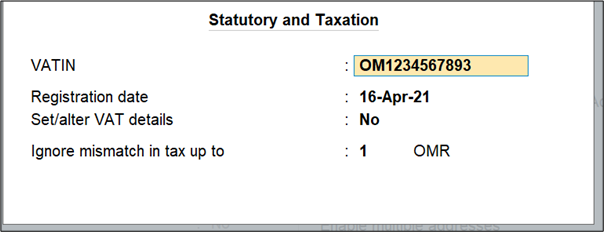

Specify the VATIN for the business. This can be printed in the invoices as required.

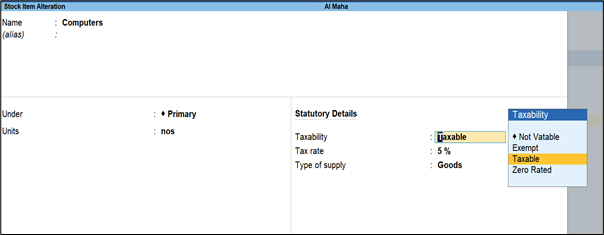

Categorise your stock items based on their taxability: Taxable, Exempt and Zero-Rated

You can also configure taxes and other related details for service ledgers, similar to stock categorization. You can use this ledger to bill the services rendered by your business, in the Accounting Invoice mode.

TallyPrime also lets you define tax rates for stock groups that fall under respective taxable categories, so that you don’t have to enter the tax rates time and again while passing a voucher.

Recording and generating accurate invoices

Based on your inputs configured in your Master set up, TallyPrime automatically detects the VAT rate that has to be calculated for a product or a service.

Generate invoices in Arabic/English or both

TallyPrime now gives you a feature to generate VAT invoices in English or Arabic or both.

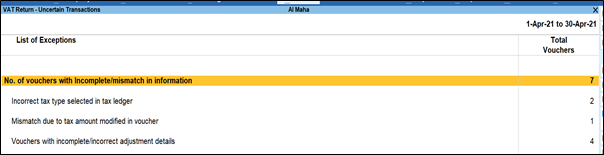

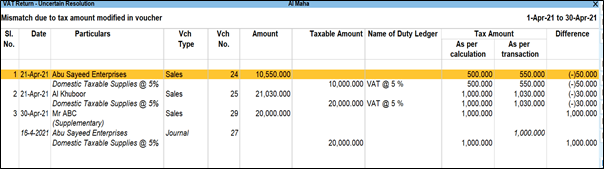

Get exception reports for mismatched transactions

With the unique capability of automatically detecting and aiding in error correction, like incorrect VATIN numbers, inaccurate transaction, etc, TallyPrime will help you stay audit-ready and VAT compliant.

With TallyPrime built in intelligence and exception reports capability, you can easily get view of mismatched transactions to take further actions. Based on your inputs in Masters, TallyPrime’s prevention, detection and correction capability alerts you about the inaccuracies at a flick.

Once these errors get highlighted, you can simply navigate to the concerned voucher/ledger, and make necessary changes and stay VAT complaint, always!

You can manage all types of VAT transactions in TallyPrime

With TallyPrime’s VAT capability, you can seamlessly manage transactions such as discounts, freight charges, self-account for reverse charges, input tax credit and advanced receipts, and drill down further to see how VAT is calculated.

What should you look for in software for accurate VAT compliance?

Information technology plays the most challenging, time consuming and complex role in the VAT implementation journey. Thus, it is of prime importance that your ERP system helps you automate VAT calculation. The key changes required in an ERP system for VAT implementation include the creation of various types of invoices with multiple items, multiple tax types and multiple currencies, customised tax reports, and the generation of tax invoices/credit notes.

System reports with tax identifiers will be required during VAT return fillings and the VAT audit to gather and maintain accurate and complete data. Hence, these customised system reports should be developed in advance to avoid any VAT return filling and audit hassles.

As the saying goes: “He who is well prepared has won half the battle”. Thus, implementing an automated system for VAT compliance will make you win half the battle in business efficiency. Take a free demo of TallyPrime today and prepare and manage VAT implementation in a better way, ensuring VAT compliance and business continuity.

Read more on Oman VAT

Oman VAT, VAT Invoice in Oman, Best VAT Software in Oman, Input VAT Deduction in Oman, Exempt Supplies in Oman VAT, How to Calculate VAT in Oman, What is VAT and How does it work, What are the Benefits of Applying VAT in Oman, How is Introduction of VAT going to Affect Oman Economy, VAT Payment on Import of Goods and Services in Oman, What are the Taxable Goods and Services Under VAT in Oman

VAT Rate

VAT Rate in Oman, Zero-Rated supplies in Oman VAT, Food Items Subject to Zero-rate VAT in Oman

VAT Registration

VAT Registration Guide in Oman, VAT Registration Deadline in Oman, Who Should Register Under Oman VAT, Business Benefits of Voluntary VAT Registration, Oman VAT Registration Guide for Persons with CRN, What is Tax Group Registration in Oman VAT

VAT Return

VAT Return in Oman, Oman VAT Return Format, FAQs on Oman VAT Return, How to File Oman VAT Return