- Oman VAT registration guide

- Who is required to register for VAT?

- VAT registration timeline

- How to apply for VAT registration?

- Frequently-asked-questions

Oman VAT is expected to get implemented across Oman on April 16th, 2021. Oman would be the fourth of six Arab Gulf states to introduce VAT as part of a 2016 VAT union agreement. The six states had agreed to implement a harmonised 5% regime. So far, only Saudi Arabia, UAE and Bahrain have done so.

The mandatory Oman VAT registration threshold is OMR 38,500. However, it is possible to apply for a voluntary registration above OMR 19,250. Non-resident businesses will be required to VAT register if they provide taxable supplies, irrespective of registration threshold limit.

Key highlights of the Oman VAT registration guide

The Oman tax authorities have recently released ‘VAT Registration Guide (Transitional Period)', that explains the registration requirements for businesses and individuals. It covers different aspects such as liability to register for VAT and the registration requirements in the period before the VAT law is effective (i.e., the Transition period).

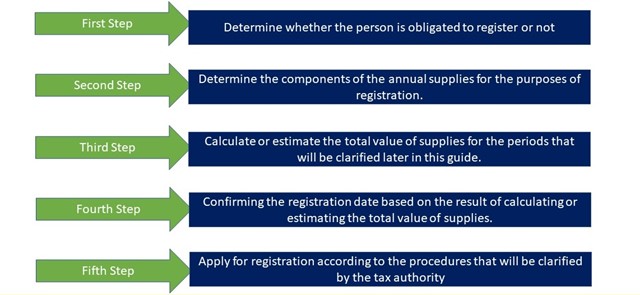

The guide has clarified that the below-mentioned steps should be followed in case any business/individual wants to register for VAT.

Who is required to register for VAT?

- Every person with a place of residence in the Sultanate that exceeds or is expected to exceed the annual revenue generated in the Sultanate from a commercial, industrial, or insignificant activity or exceeds the mandatory registration threshold

- Every person who does not have a place of residence in the Sultanate and is obligated to pay tax, regardless of his income.

- For registration purposes the value of supplies includes the following

- Calculating the total value of supplies for the purpose of registration

- Calculating the total value of supplies after the VAT Law comes into effect

Read more on: Who is required to register for VAT

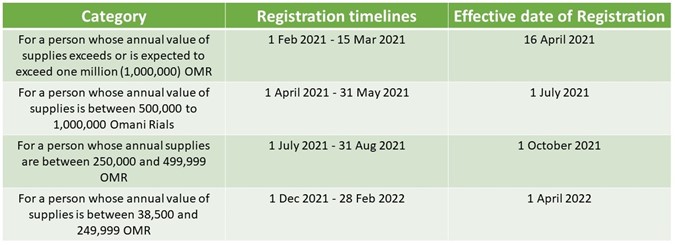

VAT registration timeline

After calculating the annual supplies, the person required to register must submit an application for registration with the tax authority within the dates specified by Decision of the Head of the Tax Authority.

The date of registration is the date on which the registration becomes effective, and the registered person must comply with all provisions of the law as of this date, such as issuing tax invoices, keeping accounting records, submitting tax declarations and other tax obligations.

Voluntary registration

- Any person who has a place of residence in the Sultanate that exceeds or is expected to exceed the annual revenues generated by him from a commercial, industrial, professional or other activity the voluntary registration limit (19,250 OMR)

- Any person who has a residence in the Sultanate that exceeds or is expected to exceed his annual expenses that he spends in the Sultanate related to a commercial, industrial, professional or other activity, voluntary registration limit (19,250 OMR).

Note: A person who may voluntarily register may apply for his registration to the tax authority at any time starting February 1, 2021.

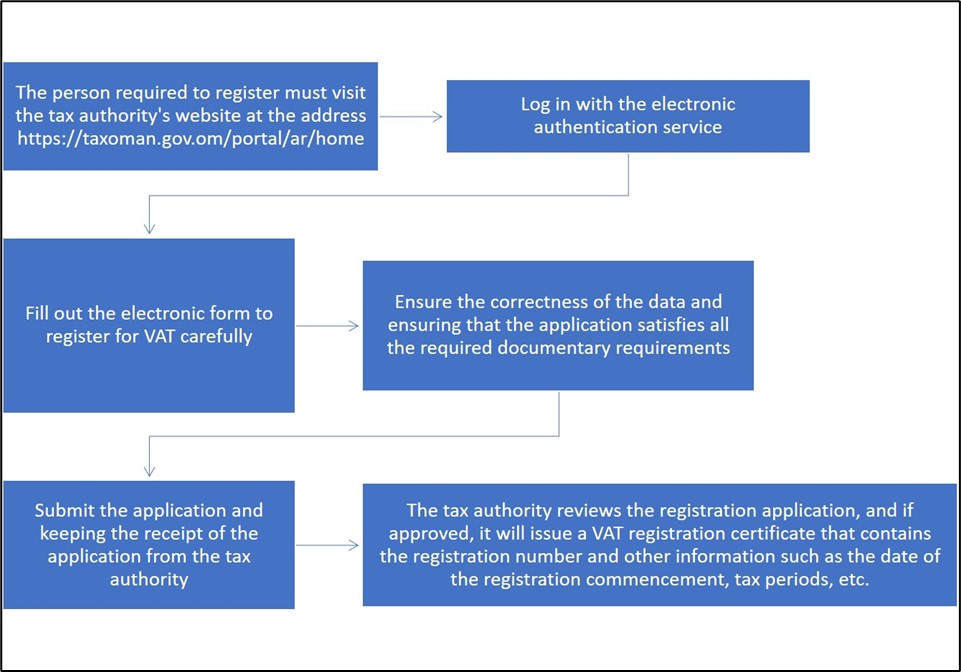

How to apply for VAT registration?

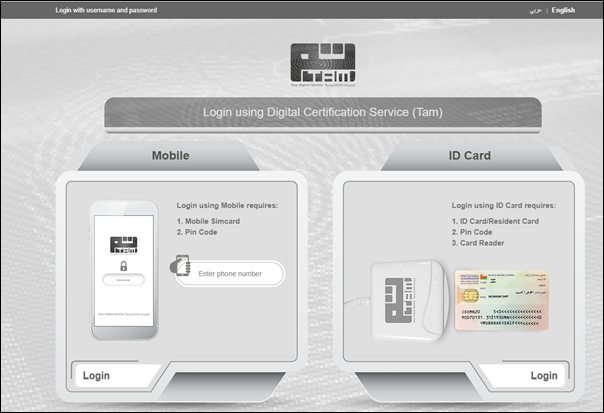

Businesses that meet the above criteria can start enrolling for VAT by logging in to the online VAT registration portal provided by Oman tax authorities. VAT registration is a simple process, just follow the below steps:

- Open https://taxoman.gov.om/portal/ar/home and click on login using Digital Certification Service (Tam)

- While registering your business, you have to enter all the relevant details in the form carefully. Some of the most crucial fields that should be thoroughly checked before submitting are:

- Legal Name

- Trade Name

- Commercial Registration number

- Tax identification number

- Excise tax identification number

- Customs identification number

- Legal form of business

- Business address

- Phone number

- Email id

- Special zones registration

- Customs suspension situations

- Once you ensure the correctness in your forms, submit the application and ensure to keep the receipt for future reference. You will be issued a VAT registration certificate once TA approves your application.

Here are the steps to register your business for VAT in a gist!

Once the VAT registration certificate is obtained, the following actions would be required –

- The VAT registration certificate must be clearly displayed at every location in which the activity is conducted

- The VAT identification number must be included in all documents issued, such as tax invoices, communications, and all other documents issued by the taxable person.

Being tax compliance is extremely crucial for business owners. TallyPrime ensures that the software is always prepared for any latest statutory changes for smooth functioning of your business. Take a free-demo and stay on top of your tax game, always.

Frequently asked questions

How do I get a VAT registration certificate?

Businesses that meet the above criteria can start enrolling for VAT by logging in to the online VAT registration portal provided by Oman tax authorities.

What documents do I need to register for VAT?

- Legal Name

- Trade Name

- Commercial Registration number

- Tax identification number

- Excise tax identification number

- Customs identification number

- Legal form of business

- Business address

- Phone number

- Email id

- Special zones registration

- Customs suspension situations

Read more on Oman VAT

Oman VAT, VAT Invoice in Oman, Best VAT Software in Oman, Input VAT Deduction in Oman, How to Calculate VAT in Oman, What is VAT and How does it work, What are the Benefits of Applying VAT in Oman, How is Introduction of VAT going to Affect Oman Economy, Value of Supply in Oman VAT, How does VAT affect Omani businesses, Time of Supply in Oman VAT

VAT Rate

VAT Rate in Oman, Zero-Rated supplies in Oman VAT, Food Items Subject to Zero-rate VAT in Oman

VAT Registration

VAT Registration Deadline in Oman, Who Should Register Under Oman VAT, Business Benefits of Voluntary VAT Registration, Oman VAT Registration Guide for Persons with CRN, What is Tax Group Registration in Oman VAT

VAT Return

VAT Return in Oman, Oman VAT Return Format, FAQs on Oman VAT Return, How to File Oman VAT Return