- VAT payment on import of goods

- VAT payment on import of services

- Managing exports and imports in TallyPrime

Under Oman VAT, the import of goods and services into the Sultanate is taxable at 5% VAT. Barring few types of supplies such as zero-rated, exempt and few notified supplies, all the goods or services imported into the state of Oman is taxable. The responsibility of VAT payment on import of goods and services is on the importer. There are different procedures for VAT payment on goods import and import of services.

In the blog, let us understand the options or procedures for payment of vat on import of goods as well as the import of services. Let us start with the import of goods.

VAT payment on import of goods

The importer is provided with 2 options to pay vat on import of goods. The first option is to pay on the date of import of goods or the date of the entry of goods at the first point of entry. The second option is a deferred payment of VAT.

AT the time of import of goods

As stipulated in the law, the importer is liable to pay the VAT on the date of import of goods or the date of entry of goods at the first point of entry. To simplify, the importer needs to pay VAT on the date goods enter the Sultanate.

For example, if you have imported goods directly from Malaysia, the tax becomes due as soon as the goods enter Oman and you are required to pay VAT along with other duties to customs authorities before clearing goods from the customs.

Deferment or postponement of VAT on imports

Unlike the first option that requires you to pay VAT at customs, deferment or postponement options allow you to defer the VAT on the import of goods at a later date i.e., at the time of filing VAT returns. Those who wish to avail this option are required to file an application in the prescribed form to the authority who will verify the request and grant permission for deferred payment of VAT on goods import.

Let’s say, if you have imported goods directly from India, you need not pay vat at customs, instead, you can pay VAT on the date of VAT return filing.

To get permission for deferred payment of VAT on import of goods, the business needs to submit the necessary details, documents and meet the conditions prescribed in the VAT regulation. Deferred VAT payment will be highly beneficial for businesses that have a high frequency of imports.

VAT payment on import of services

On import of services from outside the GCC States, the business needs to treat such supplies as if it has been supplied by you for self. In simple words, when you import the services, you need to pay the VAT on a ‘Reverse charge Mechanism (RCM)’ basis.

Under the reverse charge mechanism, the recipient or the buyer of goods or services is responsible to pay the tax to the authorities, unlike in the forward charge, where the supplier is liable to pay the tax. The key change is the shift in the responsibility of paying tax, which is moved from the supplier to the buyer.

For example, if you have received a technical service from a service provider located in India, you need not pay VAT to the service provider. Instead, you need to pay the VAT directly to the authorities. Usually, the VAT on the import of services is paid at the time of VAT return filing.

Managing exports and imports in TallyPrime

Using TallyPrime, a business management software, you can easily manage various types of supplies including imports. Whether you have opted for paying VAT on imports of goods on a deferred or reverse charge mechanism (RCM) basis or pay VAT at customs, TallyPrime helps you record and manage both types of supplies. Also, it supports booking and payment of VAT on imports of services under reverse charge mechanism (RCM).

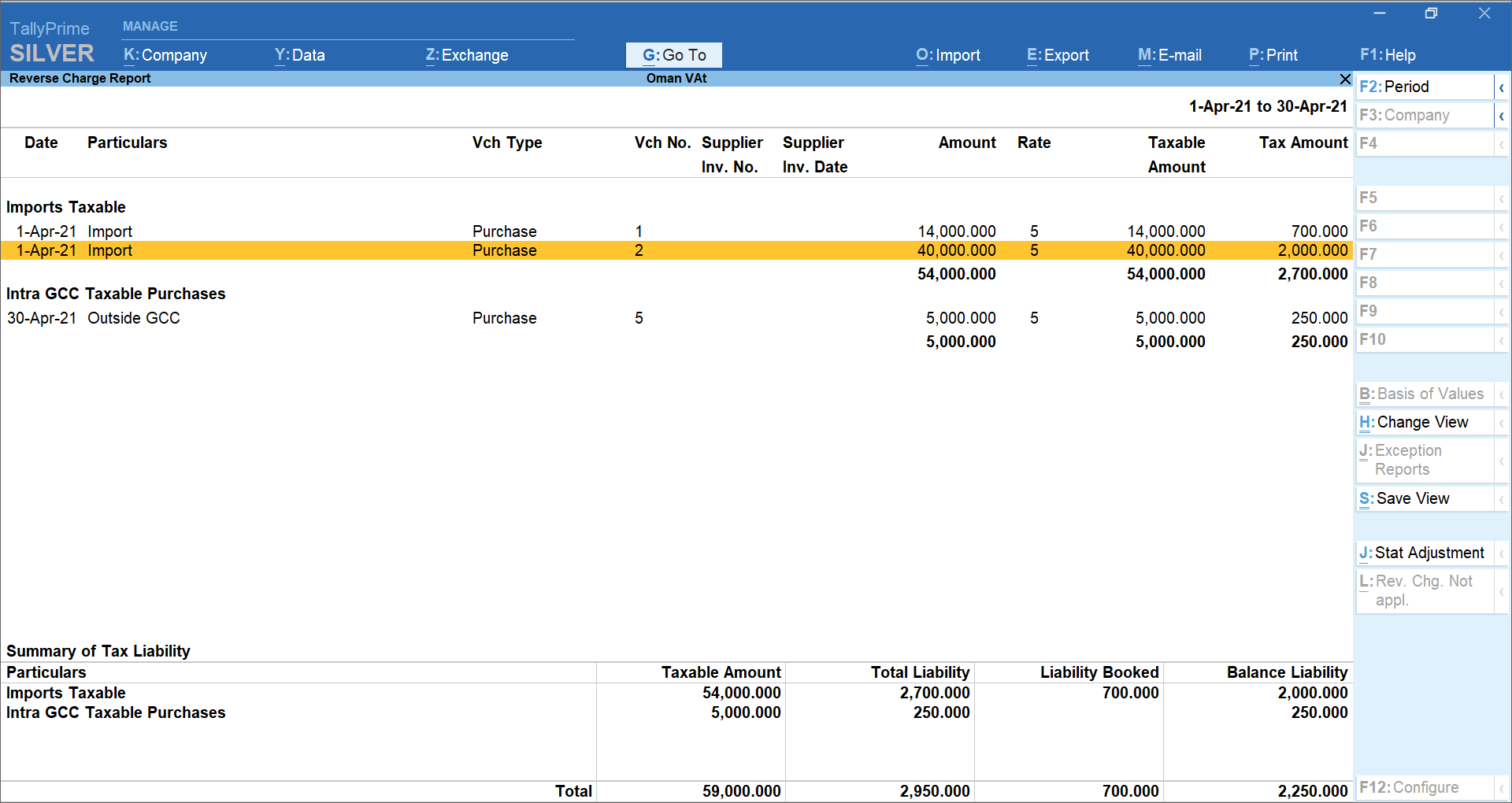

VAT report on deferred payment of VAT on import of goods using reverse charge mechanism in TallyPrime

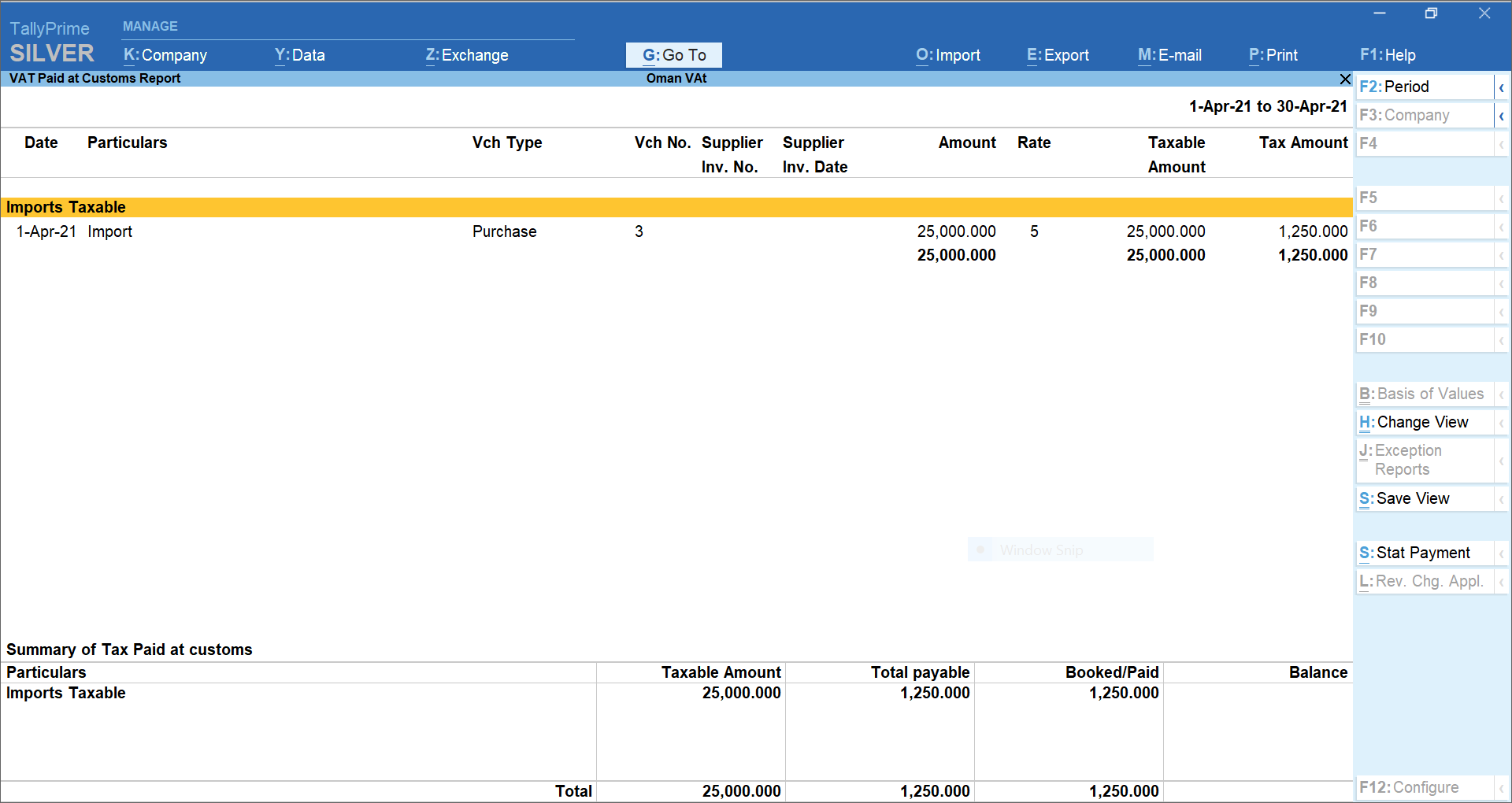

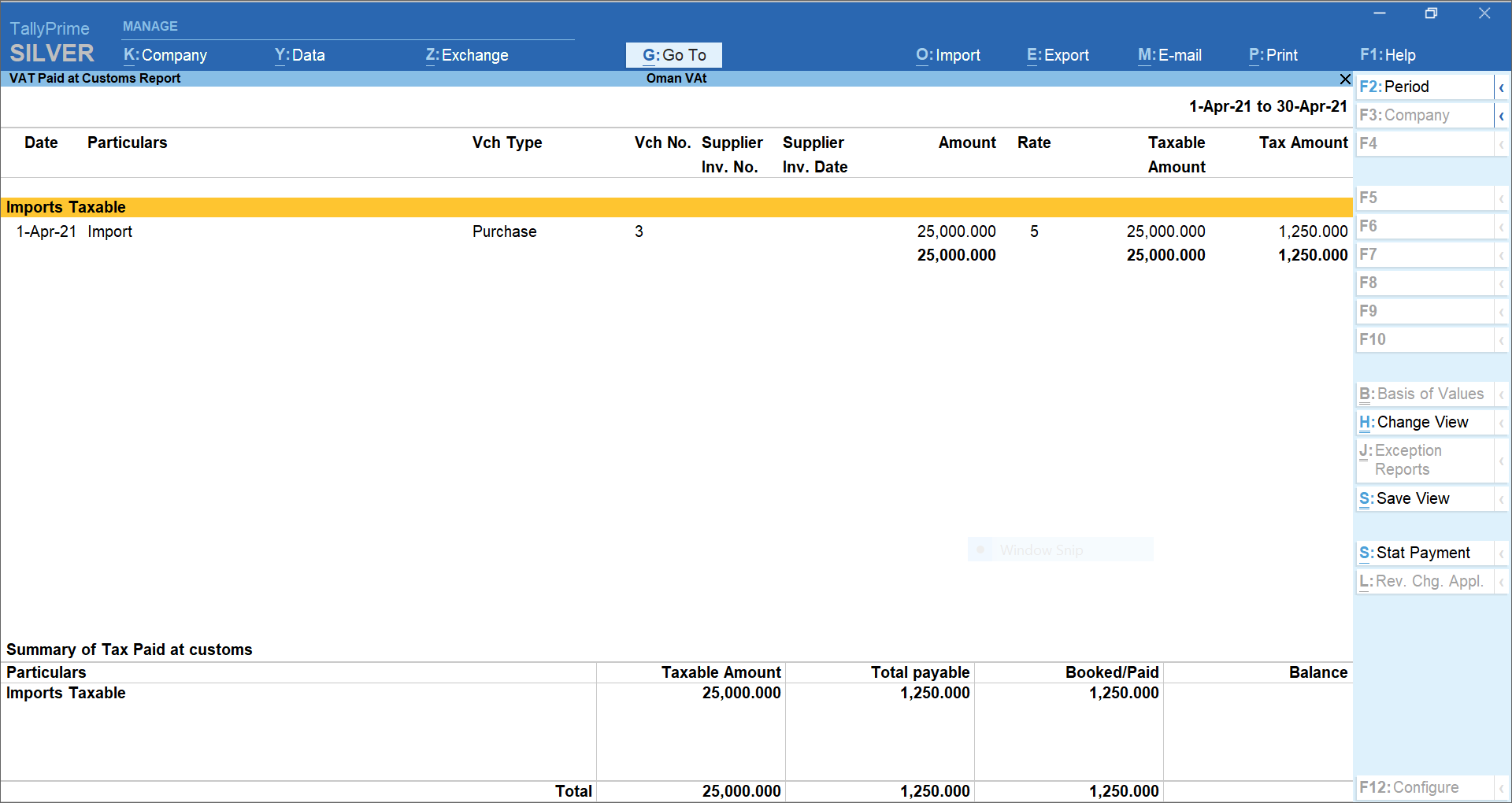

VAT report to track payment of VAT on import of goods at customs

VAT return summary giving you break up tax as well as different nature of supplies made during the period

Read more on Oman VAT

Oman VAT, VAT Invoice in Oman, Best VAT Software in Oman, Input VAT Deduction in Oman, How to Calculate VAT in Oman, What is VAT and How does it work, What are the Benefits of Applying VAT in Oman, How is Introduction of VAT going to Affect Oman Economy, Purchases/Expenses Eligible for Input VAT Deduction, VAT on Free Zones and Special Economic in Oman, What are the Taxable Goods and Services Under VAT in Oman

VAT Rate

VAT Rate in Oman, Zero-Rated supplies in Oman VAT, Food Items Subject to Zero-rate VAT in Oman

VAT Registration

VAT Registration Guide in Oman, VAT Registration Deadline in Oman, Who Should Register Under Oman VAT, Business Benefits of Voluntary VAT Registration, Oman VAT Registration Guide for Persons with CRN, What is Tax Group Registration in Oman VAT

VAT Return

VAT Return in Oman, Oman VAT Return Format, FAQs on Oman VAT Return, How to File Oman VAT Return