- What is a tax invoice?

- When should you issue a tax invoice?

- Components of tax invoice

- Format of tax invoice

- Currency in which it should be issued

Invoices serve an important purpose for both - the business sending the invoice and the client receiving it. For small businesses, an invoice helps expedite the payment process by giving clients a notification of the payment that's due. Not just that, an invoice also helps you track your company’s sales and revenue and keep your books of accounts updated. With VAT in Oman, the invoice issuance took more prominence. This is because the VAT law mandates all the businesses registered under VAT to issue an invoice on making a taxable supply.

What is tax invoice?

Tax Invoice in Oman simply refers to a written or electronic document which the taxable person must issue, and it should contain the details of supply and all other details in accordance with the provisions of law.

Business who are registered under VAT, must now issue a tax invoice for supply of taxable goods and services. The VAT and regulations prescribes the requirements of Tax invoice and It is one of the compliance responsibility that business must adhere .

When should you issue a tax invoice?

Under Oman VAT, on making a taxable supply of goods and services, a registered business must issue a tax invoice. The taxable person must issue a tax invoice when:

- making a supply of goods or services

- deemed supply

- receiving consideration – in full or part- before the date of supply

- Tax invoices may be issued by third parties on behalf of the taxable person provided the authority’s approval is obtained.

The Regulations will determine the conditions and rules to issue tax invoices, its types, its substitutes, amendments and the data it must include, and cases that are exempt from issuing a tax invoice.

Components of tax invoice

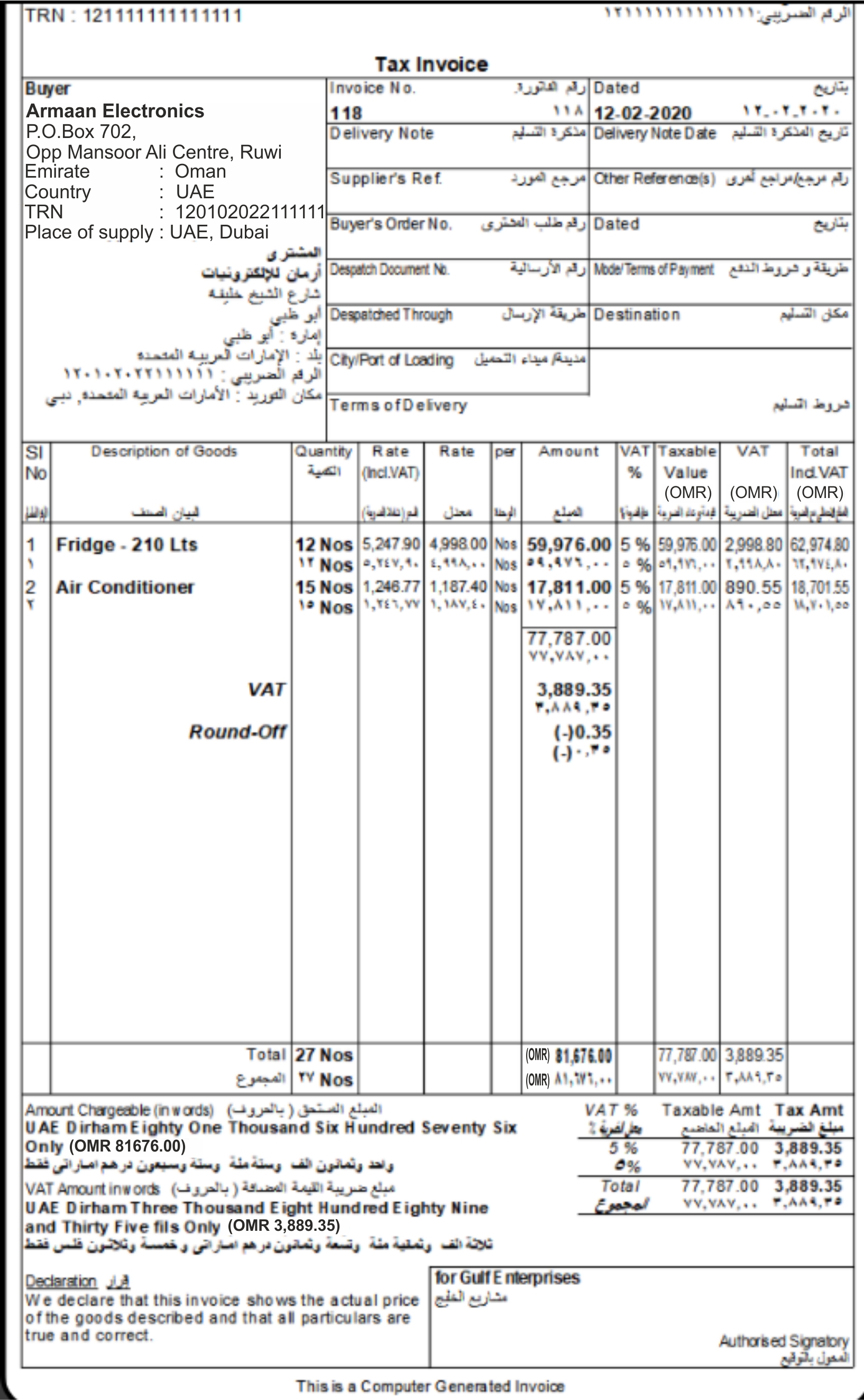

A detailed tax invoice must be issued for all taxable supplies showing, among others, the amount of VAT due and the net value for each line item. A tax invoice is required to include:

- Reference to “tax invoice”

- Supplier name, address and VAT identification number (VATIN)

- Customer name and address

- Sequential invoice number

- Date invoice is issued

- Date supply is made

- Description and quantity of goods or services

- Taxable amount and unit price (in OMR)

- Tax rate

- Amount of VAT charged (in OMR)

A simplified tax invoice, with fewer details, can be issued subject to conditions to be specified in this regard.

Format of Tax invoice

Here is a sample tax invoice that will be generated post the supply of goods.

Currency in which VAT should be issued

The tax invoice is to be issued in Omani Rials or any other currency. In case it is issued in a foreign currency, the tax value is to be calculated in Omani Rial per the average purchase and sale price of the currency published by the Central Bank of Oman at the tax due date.

The taxable person must maintain regular accounting records and books that record in a timely manner the transactions related to the import or export of goods and supplies of goods and services. Businesses need to consider what steps are necessary in order to be adequately prepared for VAT implementation, given that VAT will have significant implications on every facet of business.

Take a free-demo of TallyPrime today and find out how a business management software will help transit to VAT regime.

Read more on Oman VAT

Oman VAT, Best VAT Software in Oman, Input VAT Deduction in Oman, Exempt Supplies in Oman VAT, How to Calculate VAT in Oman, Reverse Charge Mechanism in Oman VAT, What is VAT and How does it work, What are the Benefits of Applying VAT in Oman, How is Introduction of VAT going to Affect Oman Economy

VAT Rate

VAT Rate in Oman, Zero-Rated supplies in Oman VAT, Food Items Subject to Zero-rate VAT in Oman

VAT Registration

VAT Registration Guide in Oman, VAT Registration Deadline in Oman, Who Should Register Under Oman VAT, Business Benefits of Voluntary VAT Registration, Oman VAT Registration Guide for Persons with CRN, What is Tax Group Registration in Oman VAT,

VAT Return

VAT Return in Oman, Oman VAT Return Format, FAQs on Oman VAT Return, How to File Oman VAT Return