- Time of Supply of goods or services in Oman

- Time of supply in case of imports of goods

- Time of supply in case of Continuous Supplies or Progressive Billing

- Time of supply in case of assembly or installation

Time of supply refers to the point in time when businesses become liable to report and pay tax to the authorities. This concept determines the time when the tax liability will arise on supply of goods or services. In simple words, it is the date on which VAT becomes due.

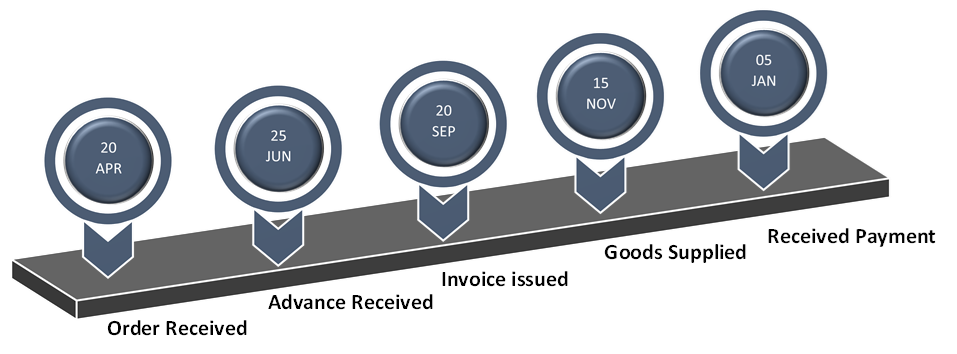

Time of supply, referred to as tax due date, is a crucial concept determining the period in which the taxable transactions must be reported and paid. It can become a little tricky given the number of events involved in completing a supply. Let’s understand the importance of time of supply with an example.

- 20th April: Receipt of sales order from a customer to supply goods

- 25th June: Received advance amount (10% of supply value)

- 20th Sept: Issued invoice to the customer with VAT

- 15th Nov: Delivered goods to the customer

- 5th Jan: Received remaining payment (90%) including VAT from the customer

Let us assume that you are required to file quarterly VAT returns, i.e. APR-Jun, Jul-Sep, OctT-Dec and so on...

If you look at the above illustration, a single transaction of supply consists of multiple dates spread across three VAT return periods. Now, considering the above scenario, in which VAT period you would report the VAT amount?

The Oman VAT law and regulations specify guidelines that remove the ambiguity of determining the date on which tax becomes due. This concept is known as a time of supply or tax due date.

| Value of Supply in Oman VAT | Input VAT Deduction in Oman |

Time of Supply of goods or services in Oman

The time of supply of goods and services will be on any of the following dates, which is ever is earlier:

- Date of the supply

- Date of issuance of the tax invoice

- Date of partial or full receipt of the consideration and to the extent of the received amount

Let us understand this with an example

|

Date of Supply |

Date of Invoice |

Date of Receipt of Payment |

Time of Supply of Goods |

|

25th June |

30th June |

10th July |

25th June |

In the above scenario, the time of supply will be 25th June. The reason being the time of supply will be the earliest of:

- Date of supply

- Date of invoice

- Date receipt of payment

In this case, the date of supply is earlier than the date of receipt of payment.

The next question is, will the date of supply be the date on which goods reach the customers' place or when it starts? How to treat those supplies of goods without transportation. Let’s answer this with a table.

|

Supply of goods with transportation |

Date of placing the Goods at the disposal of the customer |

|

Supply of goods without transportation |

Date of starting the transport or dispatch of Goods |

Time of supply in case of imports of goods

|

Date of import of goods

|

Whichever is earlier |

|

Date of the entry of goods at the first point of entry

|

|

|

Date of release of the imported goods at the end of the suspension of the tax payment (goods subject to any suspension)

|

Time of supply in case of Continuous Supplies or Progressive Billing

|

Date of payment specified in the invoice |

Whichever is earlier |

|

Date of payment |

Note: This is applicable only if periodic payments does not exceed one year from the date of the provision of such goods and services.

Time of supply in case of assembly or installation

|

Date on completion of assembly or installation |

Determining the time of supply is an important concept, and businesses need to be accurate about it. The reason is that wrong determination will lead to a delay in paying the tax, which will attract a penalty or end up in the early payment of tax, which will impact your cash outflow. Here is why VAT software helps you automate reporting of VAT liability to a correct tax period.

VAT return report in TallyPrime

TallyPrime, a business management software, comes with complete support for VAT in Oman. It helps you generate accurate tax invoices, automated reporting of tax, and file VAT returns. Why wait? Book a free demo and give it a try.

Read more on Oman VAT

Oman VAT, VAT Invoice in Oman, Best VAT Software in Oman, Input VAT Deduction in Oman, Exempt Supplies in Oman VAT, How to Calculate VAT in Oman, What is VAT and How does it work, What are the Benefits of Applying VAT in Oman, Place of Supply of Services under Oman VAT, Place of Supply of Goods under Oman VAT, Value of Supply in Oman VAT

VAT Rate

VAT Rate in Oman, Zero-Rated supplies in Oman VAT, Food Items Subject to Zero-rate VAT in Oman

VAT Registration

VAT Registration Guide in Oman, VAT Registration Deadline in Oman, Who Should Register Under Oman VAT, Business Benefits of Voluntary VAT Registration, Oman VAT Registration Guide for Persons with CRN, What is Tax Group Registration in Oman VAT

VAT Return

VAT Return in Oman, Oman VAT Return Format, FAQs on Oman VAT Return, How to File Oman VAT Return