1st January,2019, Bahrain will be third GCC Member state to implement VAT after UAE and Saudi Arabia. You must have read our previous article’ Important terms under VAT in Bahrain’, which talks about the common terms frequently used in dealing with VAT. In this article, let us understand what is VAT and how does VAT system work?

What is VAT?

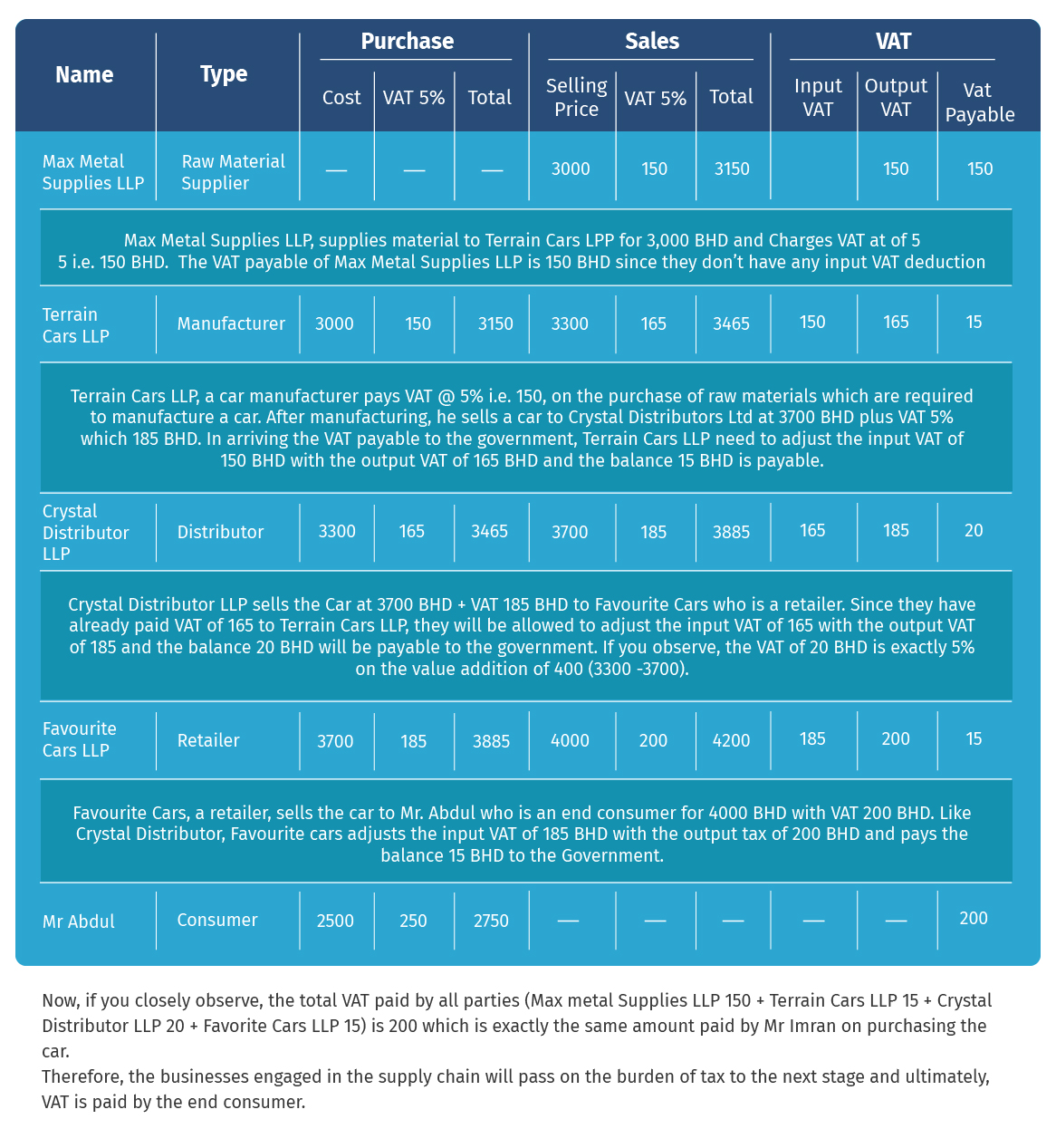

Value Added Tax known as VAT is an indirect tax charged on the supply of goods and services as well on imports. In general, it is consumption tax levied on value addition in each stage of the supply chain. This is achieved through the concept of input VAT deduction which allows the business to set off the VAT paid on purchases (Input VAT) with the Vat collected on the sales (Output VAT).

To know What is input VAT and Output VAT, please read our article ‘Important terms under VAT in Bahrain’

How does Value Added Tax System work in Bahrain?

The businesses registered under VAT act as an appointed agent of the government to collect and remit VAT and the entire burden of paying 5% VAT is on the final consumer. To make it clearer, we need to understand the mechanism of the VAT system.

Let us understand how VAT System works with the example.

Read more on Bahrain VAT

VAT in Bahrain, VAT Invoice in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, VAT Rates in Bahrain, Tax Invoice Format in Bahrain, Simplified Tax Invoice Format Under VAT in Bahrain, VAT Return Filing Period, Checklist for Tax Invoice in Bahrain, What types of records need to be maintained for Bahrain VAT

Read more on Reverse Charge under Bahrain VAT

Domestic Reverse Charge under Bahrain VAT, Reverse Charge Mechanism Under Bahrain VAT