The first VAT return under Bahrain VAT is due on 30th April,2019 for tax period January- March’19. This is applicable for business who have registered in the first phase of Bahrain VAT registration. Click here to know more about VAT return filing period and due date. While the due date is still a few weeks away, it is critical for businesses to understand the VAT Return format and accordingly prepare the VAT return on-time.

In this article, we will understand the VAT return format in detail and the details to be furnished.

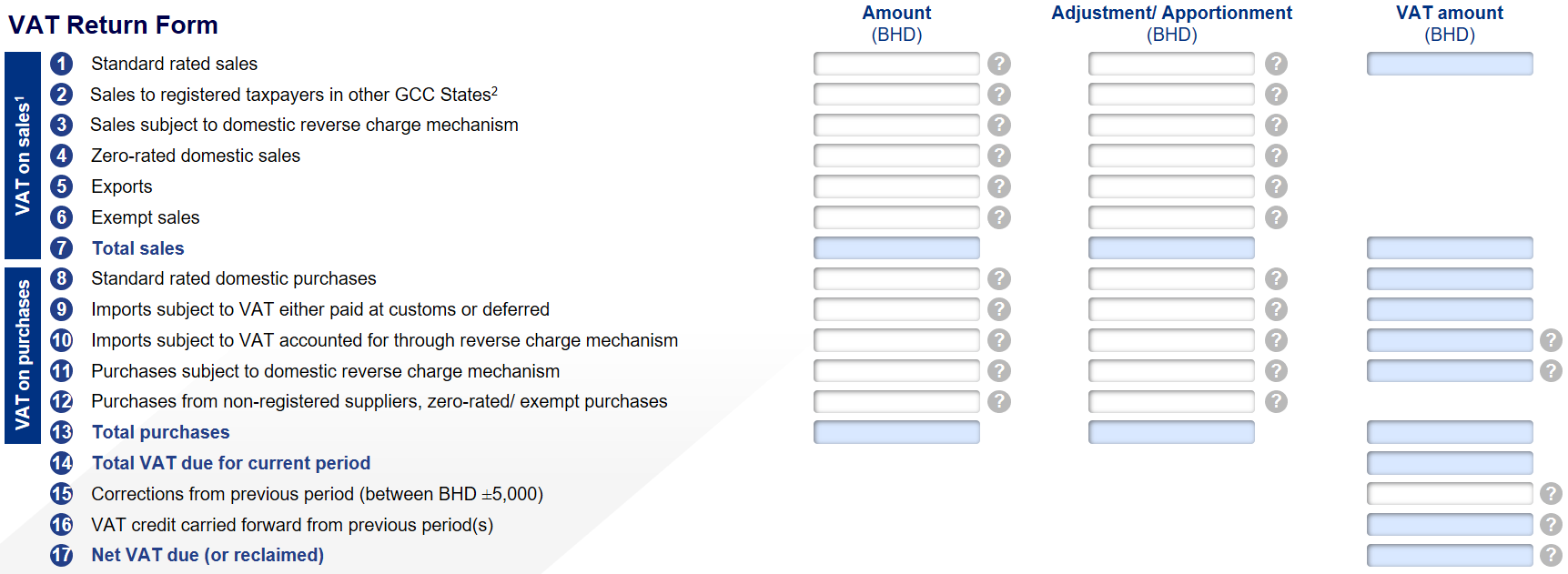

VAT Return Format

The taxpayer needs to furnish the details in the return format as prescribed by the National Bureau for Revenue (NBR). Below is the VAT return format for filing return.

The VAT Return format is broadly categorized into ‘VAT on sales’ and ‘VAT on Purchases’. This is further categorized into different rows in which details of supplies need to be captured along with VAT. In total, there are 17 rows in VAT return form and let us understand each of these in detail.

VAT on Sales

In this section, you need to mention the details of sales, output VAT and adjustment, if any. This consist of 7 sub-section from 1 to 7.

- Standard rated sales:Here, you need to report the total amount of standard-rated goods and services (attracting 5% VAT) sold during the current period in Bahrain. The value to considered here is excluding VAT and should be reported in column ‘Amount (BHD)’. The VAT collected on these supplies needs to be reported in separate column ‘VAT amount (BHD). If there are any adjustments of similar sales made in the previous reporting periods can also be reported under this.

- Sales to registered taxpayers in other GCC states:Total amount of sales to GCC states and all adjustments to sales to registered customers in GCC states will be treated as exports until integrated GCC customs system goes live. Thus, for the time being, this field will be “display only” and not editable.

- Sales subject to domestic reverse charge mechanism:All the sales made under the Domestic reverse charge mechanism should be reported here. Click here to know the supplies on which Domestic Reverse charge mechanism is applicable.

- Zero-rated domestic sales:Total value of all goods and services sold during the current period that are zero-rated in Bahrain.

- Exports:Value of taxable (standard-rated and zero-rated) and exempt supplies made during the current period to the countries outside Bahrain.

- Exempt Sales:The value of exempt supplies made during the tax period should be reported here.

- Total Sales:The Aggregated value of supplies declared above will be automatically calculated.

VAT on Purchase

Here, you need to furnish the details of purchases and recoverable input VAT. This consists of 5 sub-sections from 8 to 13. Please note, the value of input tax credit which is restricted or which you are not eligible to claim Input VAT should be reduced from the total and only the net value needs to be mentioned in the following sections.

- Standard rated domestic purchases:You need to declare the value of purchases on which you are eligible to recover Input Tax and the amount of Recoverable Input Tax in the VAT return period.

- Imports subject to VAT either paid at customs or deferred:Value of import of goods on which VAT is paid at customs or deferred should be reported here.

- Imports subject to VAT accounted for reverse charge mechanism:Services imported should be accounted on reverse charge mechanism and the value of all such supplies along with recoverable input tax need to be reported.

- Purchases subject to domestic reverse charge mechanism:All the purchases made under the Domestic reverse charge mechanism should be reported here along with recoverable input VAT. Click hereto know the supplies on which Domestic Reverse charge mechanism is applicable.

- Purchases from non-registered suppliers, zero-rated/exempt purchases:Total amount of goods and services purchased during the current period that were either:

- Zero-rated and purchased in Bahrain

- zero-rated and imported from a country outside of Bahrain

- Purchased from a non-registered supplier

- Exempt and either bought in Bahrain or imported from a country outside of Bahrain

- Total purchases:The Aggregated value of goods and services purchased (as declared in the above sections) during the tax period will be auto-calculated.

Other Sections

The details in these sections are auto-calculated to arrive the Net Vat which will either results in VAT payable or refund. The following are details of section 14 to 17.

- Total VAT due for current period (automatically calculated): Net VAT calculated from aggregated VAT collected on sales and recoverable VAT paid on purchases.

- Corrections from previous period (between ±5000BHD):If corrections to the previous return entail a VAT liability adjustment less than BHD 5,000 or greater than BHD -5,000 (reduction), then the taxpayer must specify the VAT adjustment (and not sales or purchases amount) in this field. For any other VAT adjustments, the taxpayer has to submit a self-amendment form.

- VAT credit carried forward from previous period(s) (automatically calculated) :Total amount of credit in your VAT account from previous returns that has not been used to offset any subsequent liabilities or not been refunded will be captured automatically here. This amount will be used to offset the VAT liability (if any) of current return.

- Net VAT due (or refund) (automatically calculated):The total amount of VAT liability or credit for the current return. A negative amount is VAT creditthat can either be refunded or carried forward to offset VAT liability for the subsequent periods.

Conclusions

The VAT returns are required to be filed electronically i.e. the businesses are required to prepare the return in the prescribed format and manually keen the values in NBR portal. It is a must for businesses to have a software which will not only help the business to account for VAT but also helps the businesses to generate the valid VAT return forms in the format which is accepted by NBR.

Read more on Bahrain VAT

VAT in Bahrain, VAT Invoice in Bahrain, Vat Return in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, Tax Invoice Format in Bahrain, Simplified Tax Invoice Format Under VAT in Bahrain, VAT Return Filing Period, Checklist for Tax Invoice in Bahrain, Tax Identification Number (TIN)

Read More on Bahrain VAT Registration

VAT Registration Deadline in Bahrain, VAT Registration in Bahrain