Stock or inventories, however you call it, are physical goods held by the businesses to facilitate future consumption, either through sale or production. If you are into manufacturing or trading, you know how important it is for your business. Even, few service-related businesses like products services deal with inventories.

While the necessity to hold inventories is straightforward, on any given day, you will always have stock which is unsold and lying in your business. This portion of stock is called closing stock.

You can’t just plan not to have a closing stock. As a business, you need to keep sufficient stock to aid in future sale or consumption. This leaves with you a little more stock which is unsold.

Let’s deep dive to understand closing stock with example and how should you calculate closing stock.

What is closing stock?

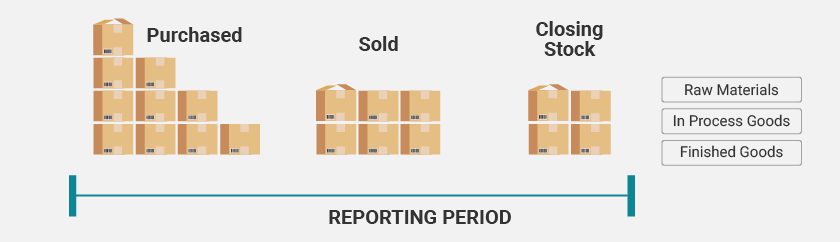

Closing Stock is an amount of unsold stock lying in your business on a given date. In simple words, it’s the inventory which is still in your business waiting to be sold for a given period. The closing stock can be in various forms such as raw materials, in-process goods (WIP) or finished goods.

Here, the reporting period for a closing stock is usually the period for which the financial statements like Balance Sheet, Profit & Loss A/c are prepared.

Example and formula of closing stock

Max Enterprises, a mobile dealer purchased 50 Nos of Ace A1 Plus-Smartphone in the month of April. As on 30th April, 28 mobiles were sold.

|

Details |

Qty |

|

Purchase |

50 Nos |

|

Sales |

28 Nos |

|

Closing stock as on 30th April |

22 |

Here, the closing stock on a given date is 22 Nos. This will be carried forwarded to the next period or the next day as an opening balance.

With this understanding, you can arrive at the closing stock formula as below:

Closing stock = (Opening Stock + Inward)- Outward

- Opening stock is the unsold stock brought forwarded previous period

- Inwards are new additions which include purchases and goods produced

- Outward is the sale or consumption of goods in production.

How to calculate the closing stock value?

Now that you know how to determine the closing stock using the above formula, the next crucial thing for you is to arrive the value of the closing stock. The reason why you should calculate the closing value is to represent it in Profit and loss A/C and the Balance Sheet.

Want to know why it is shown in both the statements? Read why is closing Stock value is shown in Profit and Loss A/c and Balance Sheet?

Arriving at the closing stock value is a little tricky. Let’s understand this with the same example of Max Enterprises. The Purchase and sales of Max Enterprises are given below:

Purchases in the month of April

|

Date |

Particulars |

Qty |

Rate |

Value |

|

01/04/2019 |

Purchase |

30 |

3,500 |

1,05,000 |

|

10/04/2019 |

Purchase |

20 |

3,300 |

66,000 |

Sales in the month of April

|

Date |

Particulars |

Qty |

Rate |

Value |

|

3/04/2019 |

Sales |

15 |

4,700 |

70,500 |

|

10/4/2019 |

Sales |

10 |

4,600 |

46,000 |

|

25/04/2019 |

Sales |

3 |

4,500 |

13,500 |

Now, if you look at the example, the purchases are made at different rates (3,500 and 3,300) and this leaves us with a question as to which rate to be considered in calculating the closing stock?

Should I consider 3,500 which is the highest rate paid during the month?

The answer is ‘No’. This will inflate the profit. Similarly considering the least, will increase your cost and lowering the profit. Both are incorrect.

Her is why Stock Valuation methods are used by the businesses.

To define Stock valuation, it is a process of calculating the value of the closing stock for a given period using the prescribed methods. Stock valuation prescribes different methods in line with accounting standards using which the closing stock is valued.

Closing stock valuation methods

Based on the company’s requirement and nature of stock, any of the valuation methods can be used in determining the closing stock value. These are popularly known as inventory valuation methods.

- Average costing method

- Weighted Average costing method

- Moving Average costing method

- FIFO costing method

- LIFO costing method

- Last purchase cost

- Costing method

- At zero Cost

The way and methods used to calculate closing stock differs from each other and it has a direct impact on the profitability of the business. As a result, it is crucial for businesses to choose a method which is more relevant to the products they deal with.

Interested to know more on each of the stock valuation methods and how these works with examples? Read Inventory Valuation – Definition, Methods, Examples and Calculations