- What is an ending inventory formula?

- What is the significance of the ending inventory formula?

- How to calculate the ending inventory formula?

- Steps to calculate the ending inventory formula

- What are the factors that affect the ending inventory formula?

- Why should you calculate the ending inventory formula?

- How TallyPrime can help you in optimum inventory management?

Inventory in a company may change every day. In a retail or manufacturing company, the amount of money that is spent on inventory and the amount of inventory turnover are both considerable. Since inventory must be shown on the balance sheet as an asset, it is essential that the exact value of inventory at the time of compiling the balance sheet or any other financial report be accurately determined. The ending inventory formula is used for this calculation.

|

7 Must-Have Features & Functions for Inventory Management Software |

What is an ending inventory formula? (closing inventory formula)

We can define ending inventory as the total value of the physical goods that are on hand at that point in time. Retail or wholesale companies base their daily operations on the inflow and resale of inventory. Manufacturing companies stock inventory of raw materials and then use them to manufacture their products or goods. This inventory inflow and outflow is a daily operation. There will be a stock of goods or raw materials in inventory at any point in time. They may be the unsold goods or the raw materials yet to be used. The value of ending inventory is dependent on the level of sales and the pricing at that point in time.

An end-of-month inventory closing formula is used to determine the inventory status at the month-end. It can be used to tweak the inventory policies to ensure that there is ideal stock level through the month and to track the fluctuations in demand through the month.

What is the significance of the ending inventory formula?

A good inventory assessment provides insights on exactly how much inventory stock is being sold and left unsold. The closing inventory formula lets you know exactly where you stand with inventory stock. In addition to the financial figures, ending inventory helps you keep track of the inventory value fluctuations.

- Match the reported value with the actual stock

The number must be recorded on the balance sheet as the inventory value matches the actual inventory stock. The ending inventory formula is a verifiable number that helps accurately judge the ending stock on hand at the end of the accounting period. It may also help find and plug malpractices or leaks that are affecting the inventory such as damage, theft or loss.

- Calculates the net income

The income that your accounting books show must correlate with the inventory flow. The ending inventory formula tells you the book value of the inventory on hand. If the numbers do not match up it may show that you are paying too much for the purchase of inventory or selling it too low.

- Report accuracy

The ending inventory is calculated based on the opening inventory of a period. So, the ending inventory calculation that you use at the close of the accounting period on hand will be the opening inventory for the next accounting period. So, the accurate calculation of ending inventory is vital to the accuracy of future reports.

How to calculate the ending inventory formula?

The Inventory Ending Formula is meant to tell you the difference in inventory from the opening status to the closing time. So, the beginning inventory is the previous value of goods at the start of the accounting period. The closing inventory formula is the current value of the goods in stock on the date of closing of the accounting period.

The most straightforward ending inventory formula is:

Ending inventory = Beginning Inventory + Purchases - Sales

We sometimes would like to project the expected closing inventory for a time period. For this, we need to factor in the average of the monthly sales and profit.

The formula would be

Ending inventory = Beginning Inventory + Monthly Sales/12-Month Average Monthly Sales + Profit/12-Month Average Profit

Or

Ending inventory = Beginning Inventory + Monthly Sales/2 × Average Monthly Sales - Profit/2 × Average Profit

You can work with these formulae and tweak the variables to reduce the closing inventory value.

Steps to calculate the ending inventory formula

Maintaining just enough inventory is a business goal that is meant to ensure that the stock levels are optimal without locking in too much money. Stocking too little should also be avoided. You can calculate ending inventory for any period of time. It is usually a monthly activity in retail businesses.

Here are the steps to calculate the ending inventory formula:

- Find the total cost of goods available for sale: Add the cost of all the inventory stock items, including those on order. Subtract the value of returns or discounts availed. Add the markup for items that were bought on markdown offers. Add 10% to the value as it is not possible to be completely accurate.

- Calculate how many days of stock are in inventory: Divide the result of step 1 by the average daily sales for the period (month, two months, three months, or a year).

- Use the following formula:

COGS = Opening Inventory + Purchases – Ending Inventory

COGS is the Cost Of Goods Sold and is essential to determine the gross profit margin and make critical financial decisions.

What are the factors that affect the ending inventory formula?

The factors that are used in the formula for ending inventory are the ones that influence it.

Ending Inventory = Beginning Inventory + Purchases - Sales

Beginning Inventory: The inventory that is held at the start of the period is called beginning inventory. This would be recorded under the asset section in long-term assets on a balance sheet.

Purchases: The cost of the goods that were bought in the time period. This may be determined from the income statement under expenses and includes both the direct and indirect costs

Sales: The money received through sales as recorded on the income statement (not inclusive of returns, discounts, or other deductions

Why should you calculate the ending inventory formula?

The ending inventory formula helps you determine the asset value of the stock in hand to put on important financial documents such as the balance sheet. It also helps the business keep track of whether they are stocking optimally or overstocking inventory. While standard inventory reports will show you the quantities of the items in inventory, the ending inventory formula is used to determine the value of the inventory being held.

How TallyPrime can help you in optimum inventory management?

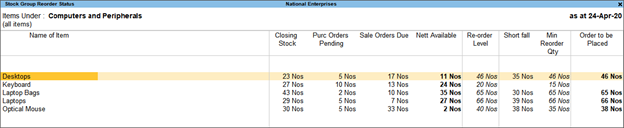

TallyPrime is an intelligent solution to help you optimally manage your inventory management software solution. Use TallyPrime’s reorder quantity feature that allows you to define the stock level beyond which an order has to be placed for the item. You can monitor all the items in inventory that have reached low levels and that need to be reordered by generating the reorder status report. By automating this process, you can always maintain healthy stock levels and prevent stockouts.

Reorder Status Report - TallyPrime

Reorder Status Report - TallyPrime

Read More: