About GST Portal India

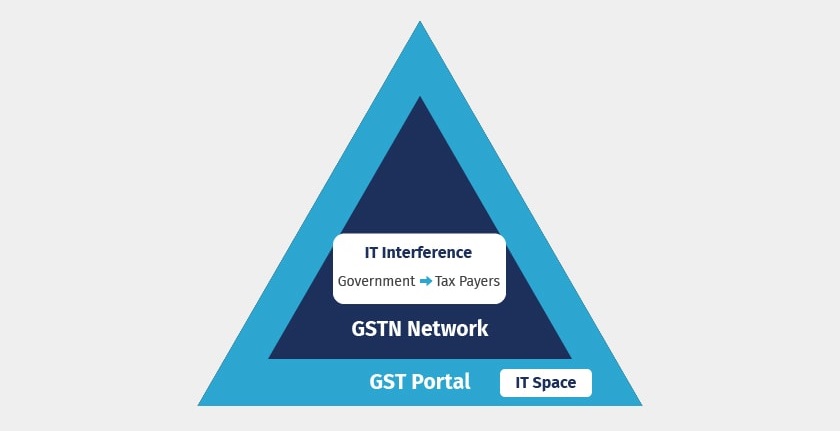

GST Portal is a platform or usage space for taxpayers to perform various tax-based activities. Goods and Service Tax Network (GSTN) is the backbone of the GST Portal which acts as a medium of interaction between the taxpayers and the government.

The entire process of GST is online starting from registration to the filing of returns. And all these are carried out with the help of IT structure of GSTN inside the bigger space called GST Portal India. The domain for GST Portal login is www.gst.gov.in

Relationship Between GSTN and GST Portal

Role of GSTN at GST Portal

- Helps in managing the entire IT system of the GST Portal

- Plays the role of mother data base for each of the data exchanged at the GST Portal

- GSTN helps in creating the user interface at the GST Portal which provides the taxpayers with all services – from registration to filing of taxes

List of Services Available at GST Common Portal India

|

Application for Registration

|

Opting out of Composition Scheme (GST CMP-04) |

Claim refund of excess GST paid (RFD-01) |

|

Application for GST Practitioner |

Filing GST Returns |

Furnish Letter of Undertaking (LUT) (RFD-11) |

|

Opting for composition scheme (GST CMP- 02) |

Payment of GST

|

Transition Forms

|

|

Stock intimation for Composition dealers (GST CMP-03) |

Filing Table 6A GSTR-1 (Export Refund) |

Viewing E- Ledgers

|

GST Portal Login: New Registrants

|

Step 1 |

Make access to GST common Portal India at www.gst.gov.in |

|

Step 2 |

Under Services tile select Registration – then select New Registration |

|

Step 3 |

Fill up all the details and submit all the documents in the GST Registration process |

|

Step 4 |

An ARN Number will be allotted at the end of the GST Registration process. The applicant shall use this number to login to GST portal. Note: The applicant at this stage can only view or track the status of his application or he can only view the Application form filled by him and he shall not be able to use the other services on the GST Portal |

Once the application is approved by the concerned officer in charge, the applicant will be then allotted a 15 digit Unique identification number called GSTIN.

Now the applicant can use the GSTIN to attempt GST portal login with the help of the password issued by GSTN network to his registered mail id. After which the user can change the GST Portal login ID and password of his choice and can use all the features that GSTN offers.

GST Portal India Registration: Migrated Tax Payers

The entire process for creating GST portal login for migrated taxpayers is same, except for the ARN number generation which in this case is allotted to migrating tax payers vis a vis to their registered mail-id which can then be used to create access to GST portal and then followed up by registration process on the GST Portal.