Proforma Invoice is a preliminary invoice that is sent to buyer before the sell is confirmed. It's not a legal invoice but, it's type of quote or estimate outlines the term of sale.

Let’s understand this better with an example.

Company X received an order of 10,000 boxes of automobile gear from Company Y. However, without proceeding with a negotiation or discussing the terms, Company X starts manufacturing the gear. After 2 months when all the gears are manufactured, Company X sends an invoice to Company Y, which seems displeasing to the buyer because:

- The price is on the higher end, and they require a negotiation.

- They expected an early delivery date.

- They wanted a longer payment term.

Given the situation, Company X can consider making amends by creating a new invoice with reduced pricing and an early delivery date. Nevertheless, rushing the orders to meet the new deadline and that too with reduced prices is very chaotic, inefficient, and unhealthy for a business.

This use case can be easily avoided with a Proforma Invoice.

What is proforma invoice?

Proforma Invoice is the primary quotation that contains all the details about the goods/service to be provided, quantity, rate, the total payable amount, and other terms of the agreement. It is designed specially to establish an understanding between the seller and buyer and reach an agreement before the delivery process begins.

The Proforma invoice allows the buyer to know what to expect ahead of time such as---estimated costs, fees, and the date of delivery, instead of creating any last-minute surprises or added rush for anyone.

| What are the Different Types of Invoices for Small Businesses | Fast, Reliable, and Fully Connected E-invoicing Software for Your Business |

Why do businesses issue proforma invoices?

Among many other reasons, here are a few reasons why you would need to propose a proforma invoice to your buyers:

- To inform the buyer about the deliverables and what to expect ahead of time

- To propose the rate and the total payable amount and invite negotiation if required

- To validate the credibility and show the willingness of the supplier to offer the goods/service at the promised date and price

- To get an acknowledgment from the buyers with an intent to pay

- To ensure visibility and save time and costs

- For international trade, declare the value of the goods/services to the customs agencies for smooth delivery

- To initiate the internal purchasing approval process

What is the format of the proforma invoice?

As liquid and flexible as the format of a proforma invoice can be, certain fields should be added to the invoice to ensure a streamlined and hassle-free process.

- Document title as Proforma Invoice

- Billing and shipping address of the buyer

- Company name and address of the seller

- Transaction terms and payment details

- Invoice creation and expiration dates

- Description of the goods/services to be provided.

- Price and quantity of the goods/services

- Discounts and taxes

- Total payable amount

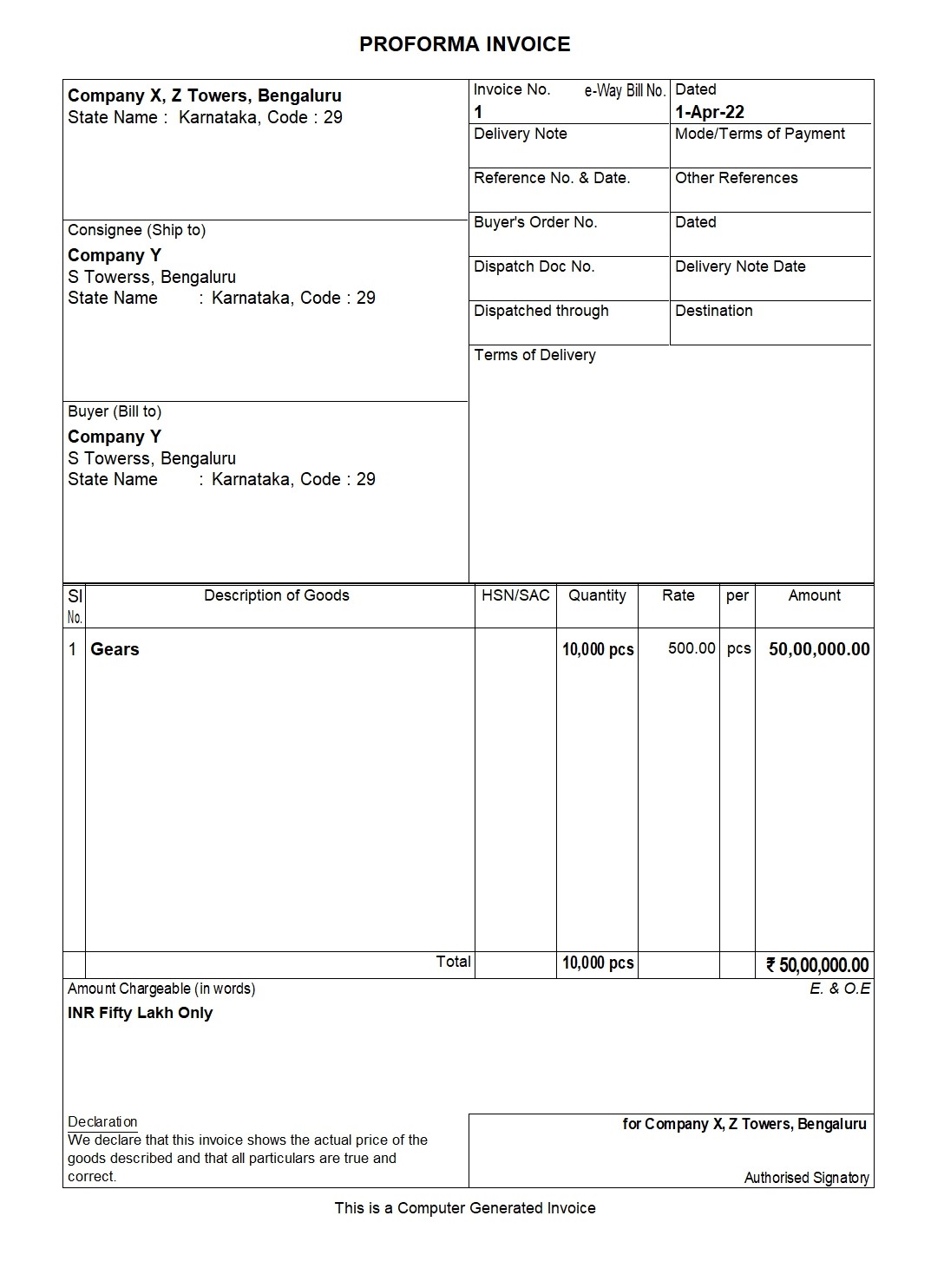

Sample formats

Here is an example of proforma invoice generated in TallyPrime.

Although proforma invoices and regular conventional invoices contain many similarities, there are a few key differences that can affect the invoicing process. Let's find out.

Proforma Invoice Vs. Commercial Invoice

While Proforma invoice is just a quotation of your services or order, Commercial invoice is the final, legally binding invoice issued after the sale is confirmed.

|

Aspect |

Proforma Invoice |

Commercial Invoice |

|

Purpose |

Estimate/quotation |

Final billing document |

|

Issued When |

Before delivery or shipment |

After delivery/shipment |

|

Legal Status |

Not legally binding |

Legally binding |

|

Editable? |

Yes, can be modified |

No, finalized document |

|

Used For |

Buyer review, internal approval, customs preparation |

Payment, bookkeeping, and customs clearance |

|

Includes |

Estimated price, items, terms of delivery/payment |

Final price, tax, shipping info, invoice number |

Proforma Invoice Vs. Quotes

Quote is typically an informal piece estimate provided at the initial stage of buyer interest, but proforma is formal, detailed and structure document issued once you express genuine interest.

|

Aspect |

Quote |

Proforma Invoice |

|

Purpose |

Provides a price estimate based on buyer inquiry |

Offers a formal summary of the intended sale |

|

Formality |

Informal or semi-formal |

Formal document with standardized layout |

|

Issued When |

At the initial stage of discussion |

When the buyer shows serious intent to proceed |

|

Contents |

Item description, unit price, total estimate |

Detailed item list, quantity, pricing, taxes, terms & conditions |

|

Legal Standing |

Not legally binding |

Not legally binding, but more official in trade transactions |

|

Buyer’s Use |

To compare suppliers or consider feasibility |

To approve purchase, obtain internal approvals, or arrange financing |

|

Usage in International Trade |

Limited or not used |

Commonly used, especially for customs and cross-border transactions |

Proforma Invoice Vs. Bill of Landing

Bill of Landing is receipt and transport document during shipment. It usually used as proof of shipment. Let's understand the key differences.

|

Aspect |

Proforma Invoice |

Bill of Landing |

|

Purpose |

Serves as a quotation or sales agreement before shipment |

Acts as a receipt and transport document during shipment |

|

Issued By |

Seller or exporter |

Carrier or freight forwarder |

|

Issued When |

Before shipment, during negotiation or purchase approval stage |

After goods are shipped |

|

Legal Status |

Not legally binding |

Legally binding transport document |

|

Main Contents |

Product details, pricing, terms, estimated costs |

Shipping details, consignee, shipper, cargo description |

|

Used For |

Internal approval, customs pre-clearance, buyer confirmation |

Proof of shipment, title of goods, customs clearance |

|

Transfer of Ownership |

No |

Yes – can serve as title to the goods |

How to generate proforma invoice with TallyPrime?

In TallyPrime a proforma invoice is created as a printout of an optional sales voucher. Once the voucher is marked as ‘Optional’, it will no longer impact your accounts books. To generate a Proforma Invoice,

- Create a sales voucher and enter all the details required.

- Mark it optional using ctrl+L and Click ctrl+I for preview.

- Once done, press ctrl+P to print or ctrl+E to export into your desired file format.

Frequently asked questions

Is proforma invoice a legally binding document?

A Proforma Invoice is not a legally binding document. It is similar to a quotation document and if the deal stands canceled and the sales don’t go through, there is no need to cancel the proforma invoice. i.e., the buyer can still choose to cancel the order despite agreeing to the proposed proforma invoice.

Can we use proforma invoice to gain advance payments?

No, a payment cannot be made on a proforma invoice. If an advance payment is required to ensure secure capital before the manufacturing process begins, a proforma invoice can be used to propose the terms and details of the upcoming transactions.

Can proforma invoice be used for international imports and trades?

Yes. For international trading businesses must provide a detailed description of the goods, as most customs agencies require the item value and other details such as item weight, packaging, shipping costs and so on. Attaching a proforma invoice with the shipment, can streamline your international imports and trades.

Who issues proforma invoice?

A Proforma invoice is issues by the supplier to the seller before the actual sales happen. It is generally issues to make the buyer aware of the future sale and invite any negotiation if necessary.

What’s the difference between proforma invoice and commercial invoice?

A proforma invoice is a non-taxable document used to declare the estimated amount and delivery date before the actual sale of goods or services happen. A commercial invoice is a legal-binding document that is sent to the buyer after the sale of goods or services has been made and requesting the payment for the same.

Is GST applicable on proforma invoice?

No. A proforma invoice is a courtesy document extended for the sake of clarity between the buyer and seller before the actual sale happens. Thus, there are no VAT or GST added in the document as it is not a legal-binding contract.

Read more:

Explore More Products