Proforma Invoice is a preliminary invoice that is sent to buyer before the sell is confirmed. It's not a legal invoice but, it's type of quote or estimate outlines the term of sale.

Let’s understand this better with an example.

Company X received an order of 10,000 boxes of automobile gear from Company Y. However, without proceeding with a negotiation or discussing the terms, Company X starts manufacturing the gear. After 2 months when all the gears are manufactured, Company X sends an invoice to Company Y, which seems displeasing to the buyer because:

- The price is on the higher end, and they require a negotiation.

- They expected an early delivery date.

- They wanted a longer payment term.

Given the situation, Company X can consider making amends by creating a new invoice with reduced pricing and an early delivery date. Nevertheless, rushing the orders to meet the new deadline and that too with reduced prices is very chaotic, inefficient, and unhealthy for a business.

This use case can be easily avoided with a Proforma Invoice.

What is proforma invoice?

Proforma Invoice is the primary quotation that contains all the details about the goods/service to be provided, quantity, rate, the total payable amount, and other terms of the agreement. It is designed specially to establish an understanding between the seller and buyer and reach an agreement before the delivery process begins.

The Proforma invoice allows the buyer to know what to expect ahead of time such as---estimated costs, fees, and the date of delivery, instead of creating any last-minute surprises or added rush for anyone.

| What are the Different Types of Invoices for Small Businesses | Fast, Reliable, and Fully Connected E-invoicing Software for Your Business |

What are the different types of proforma invoices?

Proforma invoices come in various types based on the nature of transactions they cover. A standard proforma invoice is typically used for one-time sales of goods, detailing items, quantities, prices, taxes, and shipping costs. Common practical types are based on the nature of the transaction rather than strict law:

- Standard proforma invoice: For one‑time sale of goods, listing items, quantity, unit price, taxes, shipping, and estimated total.

- Service proforma invoice: For services (consulting, design, maintenance, etc.), usually showing scope of work, hourly rate or project fee, milestones, and estimate.

- Recurring/subscription proforma invoice: For SaaS or retainers, summarising periodic charges (monthly/annual), number of seats/users, billing period, and renewal terms.

- Export/Import proforma invoice: For international trade, including HS code, currency, Incoterms, country of origin, packing details, and indicative shipping terms to help with customs pre‑clearance.

- Project/contract proforma invoice: Used in long‑term projects to outline stage‑wise billing (mobilisation advance, milestone billing) before issuing formal tax invoices.

Why do businesses issue proforma invoices?

Among many other reasons, here are a few reasons why you would need to propose a proforma invoice to your buyers:

- To inform the buyer about the deliverables and what to expect ahead of time

- To propose the rate and the total payable amount and invite negotiation if required

- To validate the credibility and show the willingness of the supplier to offer the goods/service at the promised date and price

- To get an acknowledgment from the buyers with an intent to pay

- To ensure visibility and save time and costs

- For international trade, declare the value of the goods/services to the customs agencies for smooth delivery

- To initiate the internal purchasing approval process

What are the benefits of a proforma invoice?

The benefits of proforma invoices are numerous. They set clear expectations by providing buyers with detailed estimates before order confirmation, which helps reduce disputes.

- Sets clear expectations: Gives the buyer a detailed cost estimate (price, taxes, freight, terms) before confirming the order, reducing disputes later.

- Aids approvals and budgeting: Helps the buyer get internal approvals and arrange funds since they know the approximate outflow in advance.

- Speeds up negotiation: Price, scope, and delivery terms can be negotiated on the proforma instead of cancelling or revising final invoices repeatedly.

- Supports trade documentation: In exports, it helps with import licences, bank approvals, and customs planning even before shipment.

- Improves cash flow planning: When used as “pre‑invoices”, they help sellers forecast revenue and production requirements more accurately.

What is the format of the proforma invoice?

As liquid and flexible as the format of a proforma invoice can be, certain fields should be added to the invoice to ensure a streamlined and hassle-free process.

- Document title as Proforma Invoice

- Billing and shipping address of the buyer

- Company name and address of the seller

- Transaction terms and payment details

- Invoice creation and expiration dates

- Description of the goods/services to be provided.

- Price and quantity of the goods/services

- Discounts and taxes

- Total payable amount

Sample formats

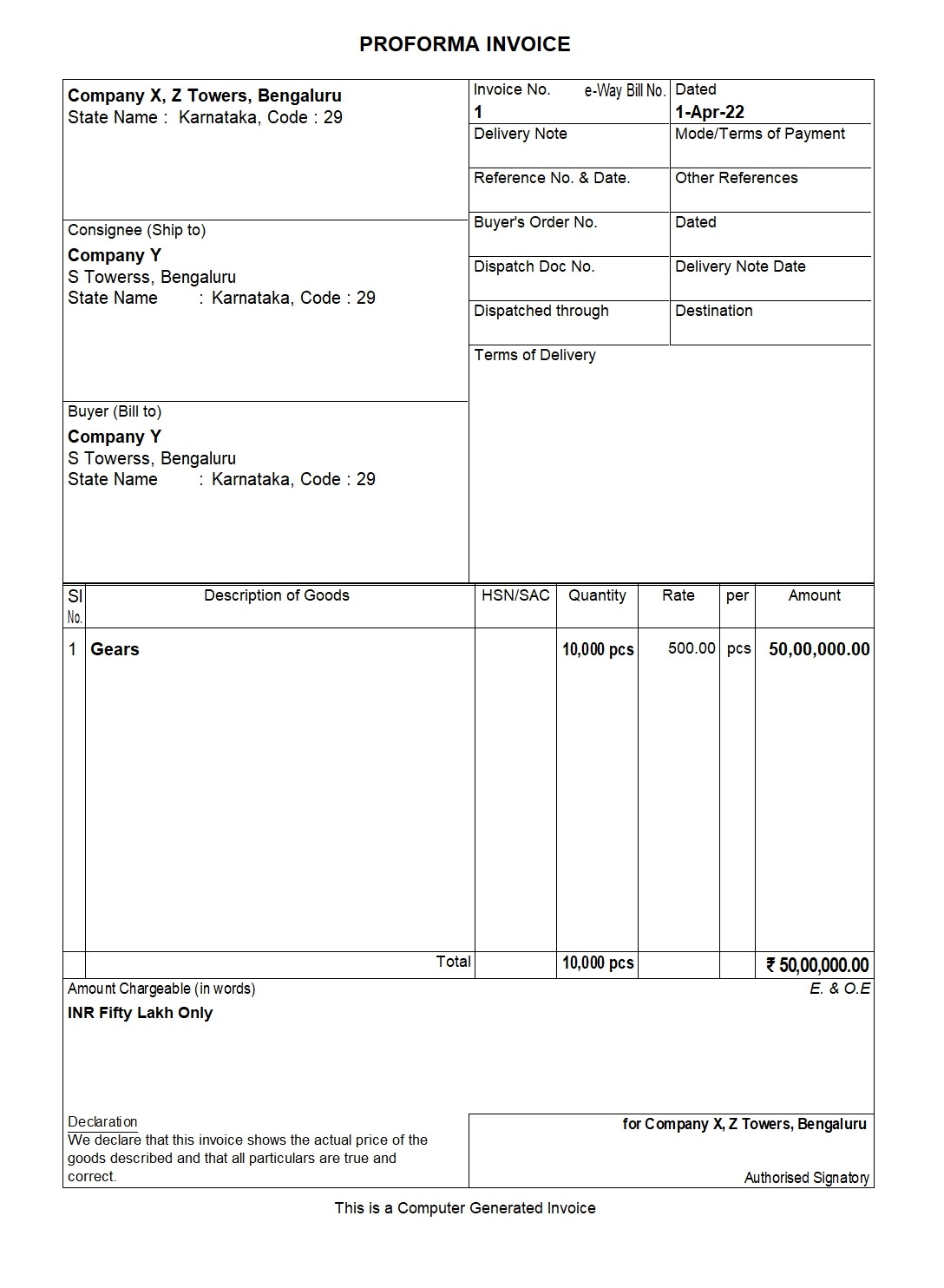

Here is an example of proforma invoice generated in TallyPrime.

Although proforma invoices and regular conventional invoices contain many similarities, there are a few key differences that can affect the invoicing process. Let's find out.

Proforma Invoice Vs. Commercial Invoice

While Proforma invoice is just a quotation of your services or order, Commercial invoice is the final, legally binding invoice issued after the sale is confirmed.

|

Aspect |

Proforma Invoice |

Commercial Invoice |

|

Purpose |

Estimate/quotation |

Final billing document |

|

Issued When |

Before delivery or shipment |

After delivery/shipment |

|

Legal Status |

Not legally binding |

Legally binding |

|

Editable? |

Yes, can be modified |

No, finalized document |

|

Used For |

Buyer review, internal approval, customs preparation |

Payment, bookkeeping, and customs clearance |

|

Includes |

Estimated price, items, terms of delivery/payment |

Final price, tax, shipping info, invoice number |

Proforma Invoice Vs. Quotes

Quote is typically an informal piece estimate provided at the initial stage of buyer interest, but proforma is formal, detailed and structure document issued once you express genuine interest.

|

Aspect |

Quote |

Proforma Invoice |

|

Purpose |

Provides a price estimate based on buyer inquiry |

Offers a formal summary of the intended sale |

|

Formality |

Informal or semi-formal |

Formal document with standardized layout |

|

Issued When |

At the initial stage of discussion |

When the buyer shows serious intent to proceed |

|

Contents |

Item description, unit price, total estimate |

Detailed item list, quantity, pricing, taxes, terms & conditions |

|

Legal Standing |

Not legally binding |

Not legally binding, but more official in trade transactions |

|

Buyer’s Use |

To compare suppliers or consider feasibility |

To approve purchase, obtain internal approvals, or arrange financing |

|

Usage in International Trade |

Limited or not used |

Commonly used, especially for customs and cross-border transactions |

Proforma Invoice Vs. Bill of Landing

Bill of Landing is receipt and transport document during shipment. It usually used as proof of shipment. Let's understand the key differences.

|

Aspect |

Proforma Invoice |

Bill of Landing |

|

Purpose |

Serves as a quotation or sales agreement before shipment |

Acts as a receipt and transport document during shipment |

|

Issued By |

Seller or exporter |

Carrier or freight forwarder |

|

Issued When |

Before shipment, during negotiation or purchase approval stage |

After goods are shipped |

|

Legal Status |

Not legally binding |

Legally binding transport document |

|

Main Contents |

Product details, pricing, terms, estimated costs |

Shipping details, consignee, shipper, cargo description |

|

Used For |

Internal approval, customs pre-clearance, buyer confirmation |

Proof of shipment, title of goods, customs clearance |

|

Transfer of Ownership |

No |

Yes – can serve as title to the goods |

What are the best practices for using proforma invoices?

Best practices for using proforma invoices include clearly labeling them as “Proforma Invoice” to avoid confusion with tax invoices. It is essential to include all commercial terms such as item details, prices, taxes, delivery and payment terms, and validity periods. Businesses should use proforma invoices only as estimates and issue official tax invoices upon order confirmation. Aligning final invoices with the proforma terms prevents disputes. Using standardized templates in invoicing software ensures consistency, and maintaining an audit trail helps demonstrate agreed terms. Finally, clear communication about the proforma’s purpose prevents misunderstandings in accounting or payment processes.

How to generate proforma invoice with TallyPrime?

In TallyPrime a proforma invoice is created as a printout of an optional sales voucher. Once the voucher is marked as ‘Optional’, it will no longer impact your accounts books. To generate a Proforma Invoice,

- Create a sales voucher and enter all the details required.

- Mark it optional using ctrl+L and Click ctrl+I for preview.

- Once done, press ctrl+P to print or ctrl+E to export into your desired file format.

Read more:

Explore More Products