- Understanding Debit and Credit just got Easier

- Golden Rules of Accounting

- Example of the Golden Rules of Accounting

Understanding Debit and Credit Just Got Easier When You Apply the Golden Rules of Accounts

Got stuck in figuring what to Debit and Credit? Yes, like some of you, even I used to get puzzled as well in my early days. By the time I would settle my understanding on golden rules of accounting: debit and credit, one or the other scenarios would again lead me back to zero and start my understanding afresh.

After following some of logics below, I settled my understanding on debit and credit and after that, I got it right every time. Let’s clear the confusion once and for all!

Instead of beginning with golden rules of accounting, let me register debit and credit as shown in the table.

|

Debit |

Credit |

|

Positive (+) |

Negative (-) |

|

Come |

Go |

|

Receive |

Give |

|

Receiver |

Giver |

|

Deposit |

Withdraw |

|

Increasing |

Decreasing |

From the above table, it’s clear that it is neither a theory nor a puzzling topic anymore - it’s just logic and reasoning. To summarize - Debit is all about incoming/deposits and Credit is all about outgoing/withdrawal.

For example, you purchased a computer by paying 25,000 by cash. Here, you are receiving a computer so it should be debited, and cash should be credited since it is going out.

Voila! You just recorded an accounting transaction even without looking at the golden rules of accounting.

Golden Rules of Accounting

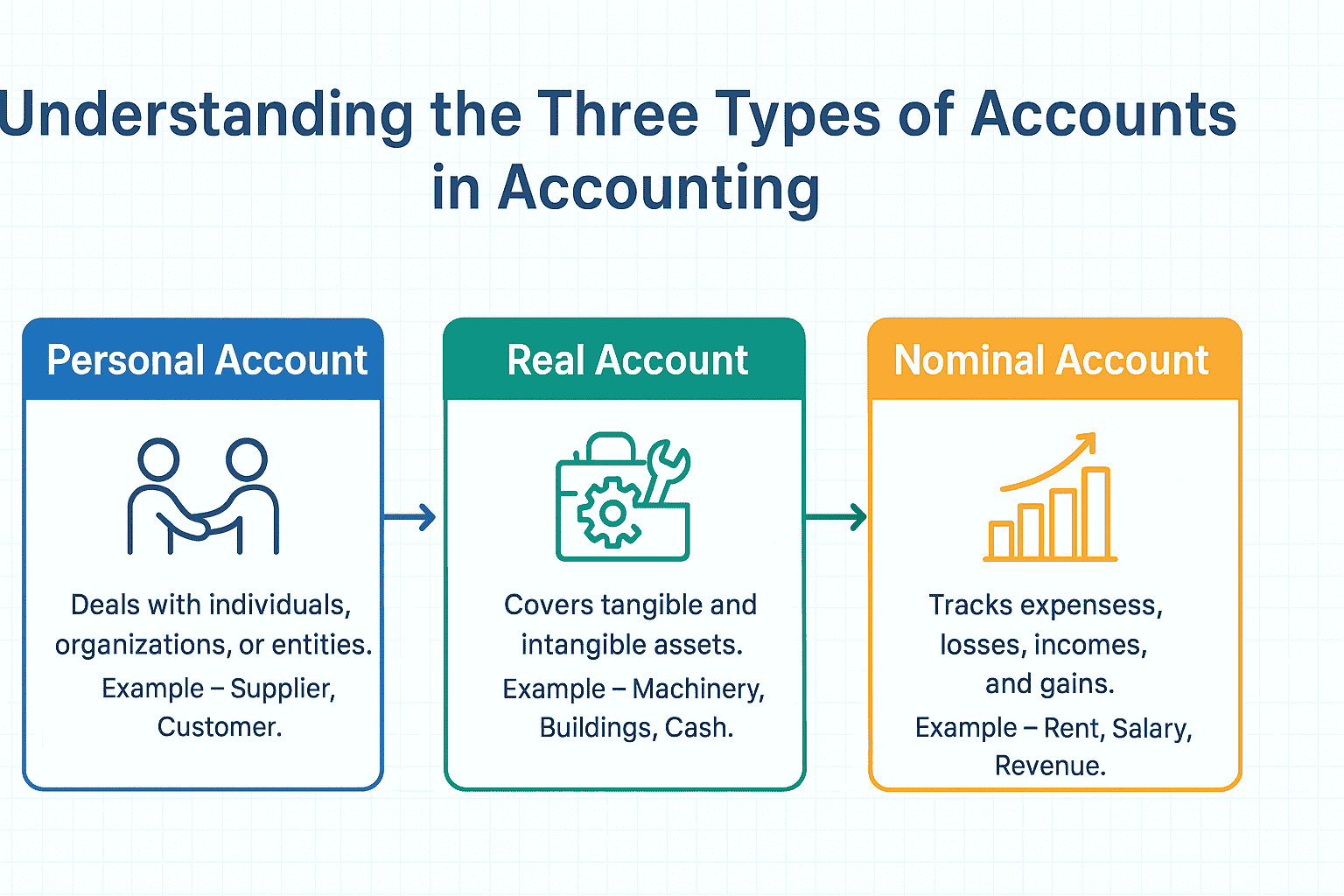

With the above understanding, let us introduce the golden rules of accounting. Golden rules of accounting refer to a set of pre-defined principles which guides the sequential way of recording the transactions using double entry system of bookkeeping. In this system, every transaction involves both a debit and a credit entry, and the rules are categorized based on the three types of accounts: Personal Account, Real Account, and Nominal Account.

Types of Accounts

For all those who are still curious to know the definition of a real account, personal account and nominal account, here is the brief about it.

Real Account

Rule: Debit the receiver, Credit the giver

Real accounts are those accounts which are related to assets or properties or possessions. It includes both tangible and intangible. When dealing with individuals, organizations, or entities, the person or entity receiving something is debited, and the person or entity giving something is credited.

Personal Account

Rule: Debit what comes in, Credit what goes out

Real accounts deal with tangible and intangible assets (e.g., cash, machinery, buildings, patents). When an asset comes into the business, it is debited, and when an asset goes out, it is credited. This includes all accounts related persons consist of natural, artificial and representative accounts.

Nominal Account

Rule: Debit all expenses and losses, Credit all incomes and gains

Nominal accounts deal with expenses, incomes, losses, and gains. Expenses and losses are debited, while incomes and gains are credited.

let's have a look how these rules will help businesses in smooth transaction.

What are the three golden accounting rules?

The three golden rules of accounting apply to different types of accounts, let's understand them with examples

Debit the receiver and credit the giver

This golden rule applies to the personal account. When the business receives something, then the account must be debited and when the business gives something then the account must be credited as per this rule of accounting.

Suppose you pay ₹41,500 to a supplier. The supplier is the receiver (they are getting paid), and cash is going out from your business (giver).

| Date | Particulars | Debit (₹) | Credit (₹) |

|---|---|---|---|

| 01-012025 | Supplier’s Account | 41,500 | - |

| To Cash Account | - | 41,500 | |

| (Being payment made to supplier) |

Debit what comes in and credit what goes out

This golden rule applies to real accounts (also known as permanent accounts). Examples of real accounts include equity, asset, and liability accounts. When the business is acquiring something such as an asset, then the account of the business has to be debited. On the other hand, when the business is giving something out then the account will be credited.

You purchase machinery worth ₹8,30,000 in cash. Machinery is what comes in, and cash is what goes out.

| Date | Particulars | Debit (₹) | Credit (₹) |

|---|---|---|---|

| 10-01-2025 | Machinery Account | 8,30,000 | - |

| To Cash Account | - | 8,30,000 | |

| (Being machinery purchased for cash) |

Debit expenses and losses, credit income and gains

This golden rule applies to nominal accounts (also known as temporary accounts). Examples of nominal accounts include expense, gain, loss, and revenue accounts. As per the rule, when the business incurs a loss or has an expense then you need to debit the account. If the business has a gain or earns an income then the account should have a credit.

Now you earn revenue of ₹83,000 in cash. Cash is coming in (asset increase), and revenue is income being credited.

| Date | Particulars | Debit (₹) | Credit (₹) |

|---|---|---|---|

| 20-01-2025 | Cash Account | 83,000 | - |

| To Revenue Account | - | 83,000 | |

| (Being revenue earned in cash) |

What are modern rules of accounting?

The modern rules of accounting have six types of accounts rather than the three types of accounts in the traditional rules of accounting. As per the modern rules, the six accounts are an asset, capital, drawings, revenue, liability, and expense.

You have to debit the increase while you credit the decrease for the asset account. For liability, you credit the increase and debit the decrease. You debit the decrease and credit the increase for a capital account. For the revenue account, you debit the decrease and credit the increase. For the drawings account, you debit the increase and you credit the decrease. You debit the increase and you credit the decrease for the expense account.

Why the Golden Rules of Accounting Matter – Key Benefits Explained

The golden rules of accounting aren’t just textbook definitions—they’re the backbone of trustworthy financial management. By following these simple but powerful rules—debit the receiver, credit the giver; debit what comes in, credit what goes out; and debit all expenses and losses, credit all incomes and gains—businesses can keep their financial records accurate, transparent, and easy to manage.

Here’s why these rules are so essential and the major benefits they bring:

1. Spotting Errors Becomes Easier

The double-entry system, guided by the golden rules, makes it hard to overlook mistakes. Every debit entry has a matching credit entry, so the books always need to balance. If they don’t, it’s a clear sign something’s off. This helps businesses quickly identify and fix errors like missing transactions, number typos, or wrong entries—making financial reports more reliable.

2. Audit-Ready Records with Less Hassle

A well-maintained accounting system is easier to audit. Whether it’s an internal review or an external audit, following the golden rules ensures that records are structured, consistent, and easy to trace. Auditors can quickly follow the money, reducing the time and effort needed to verify transactions. Plus, clear books reflect strong financial discipline, which builds trust and can even lower audit costs.

3. Aligns with GAAP Standards

The golden rules form the practical steps for applying Generally Accepted Accounting Principles (GAAP), the global standard for financial reporting. By categorizing transactions correctly and following debit/credit guidelines, businesses ensure their records meet GAAP’s expectations for recognizing income, tracking expenses, and showing financial health. This makes reports more credible to investors, banks, and regulatory bodies.

4. Creates Consistency and Easier Comparisons

Accounting works best when it’s consistent. These rules give businesses a uniform approach to recording transactions, which helps track progress over time. It’s also easier to compare performance across companies because everyone’s following the same method. Whether you’re an investor or a financial analyst, this consistency provides clarity and confidence in the data.

Conclusion

Understanding and applying the golden rules of accounting—debit the receiver and credit the giver, debit what comes in and credit what goes out, and debit all expenses and losses while crediting all incomes and gains—simplifies the process of recording financial transactions accurately. These rules provide a logical framework that supports the double-entry bookkeeping system, ensuring all transactions are balanced and traceable. Adopting these principles not only reduces errors but also facilitates clear, consistent financial records aligned with accounting standards, making audits smoother and financial management more reliable. Ultimately, the golden rules form the foundation of trustworthy accounting practices essential for any business.

Read More on Accounting

Accounting Software, Accounting Equation, Accounting Principle, Accounting Methods, Accounting Rate of Return, Cash Accounting, Accrual Basis of Accounting, Financial Accounting, Cost Accounting, Accounting Standard, Cash Accounting vs Accrual Accounting, Cost vs Management Accounting