- What is cash flow and why does business cash flow matter?

- Why maintain positive cash flow in your business?

- How to calculate cash flow?

- Cash inflow vs cash outflow

- How can you enhance your business cash flow?

What is cash flow and why does business cash flow matter?

Cash flow is the net amount that flows into your business and out of your business during a period. This period is usually a month, quarter, or year. Cash flows occur from three major sources; operating activities, financing activities, and investing activities. That is, cash flow, whether it flows into the business or out of the business, occurs when either of the three activities is performed by your business. Cash flow can be positive or negative and it depends on which amount is higher; the cash inflow or cash outflow. Cash flow statements must be monitored regularly by businesses to ensure the cash flow is positive.

Cash flow does not include what is there in the bank and the credit from suppliers. Neither does it include the money other entities owe your business. Cash flow is simply a measure of the cash that is entering your business or leaving your business during a certain period. Business cash flow is important to understand because important people such as investors and bank lenders use it to analyze the financial health of your business. Businesses must look into cash flow constantly because it shows whether you can purchase the inventory you require, pay taxes, pay salaries and wages, and pay operational costs.

What is cash inflow?

Cash inflow is the amount of cash coming into your business. In the case where the cash inflow is greater than cash outflow, the cash flow is positive. Cash inflow includes gains you receive from an investment you made. It includes the cash your customers pay immediately for the products or services you sell. This is generally the largest portion of cash inflow. Cash inflow is necessary because it ensures your business operations can run smoothly and you have sufficient balance to do things necessary for business growth. Cash inflow ensures your business doesn’t go bankrupt and can stay afloat. A good cash inflow doesn’t necessarily mean you have higher profits.

What is cash outflow?

Cash outflow is when cash is moving out of your business. In the case of operations, cash outflow occurs when you are paying salaries to your employees and when you pay for rent. Cash outflow includes how much you spent on fixed assets as well as the interest payments your business is required to pay for a loan you took. When cash outflow is higher than cash inflow, it leads to negative cash flow which isn’t an ideal situation to be in. Startups can experience negative cash flows in the beginning before the customers start to buy from them. The sooner your cash outflow becomes lesser than cash inflow, the better for your business.

Why maintain positive cash flow in your business?

Businesses must maintain a positive cash flow in the business because you should have enough cash to run and operate your business. A positive cash flow is when cash inflow is higher than cash outflow. You can invest in your business when you have a positive cash flow. You can settle debts when you have a positive cash flow and you can also pay dividends to investors. A positive cash flow means you have extra cash that you can use in case of an emergency purchase that can sometimes be necessary. It can take some time for new businesses to have positive cash flow.

However, there are a few things to keep in mind. You can have a positive cash flow when you take a loan. When you do so, there is a high cash inflow but it doesn’t mean that is a good thing because you will eventually need to pay off the debt with interest. Moreover, you might have a negative cash flow because you have invested a large amount of cash recently in a machine that can eventually cut costs. But that isn’t necessarily a bad thing immediately because you will get a return on investment soon. Hence, while you should know whether the cash flow is negative or positive, you should also consider the activities that resulted in the cash flow and how they will affect your business in the long run.

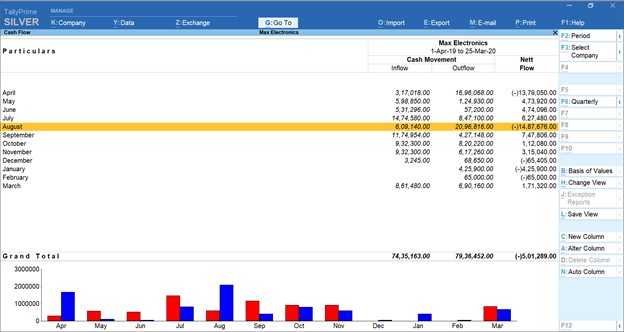

Monthly cash flow report in TallyPrime showing positive and negative cash flow

How to calculate cash flow?

You can calculate cash flow with the following formula:

Net cash flow = Net cash flow from operating activities + Net cash flow from investing activities + Net cash flow from financial activities

Or

Net cash flow = Total cash inflows – Total cash outflows

It will be clear with a simple example. Let us say that a company called SunRays has calculated a net cash flow of $350,000 from operating activities, $50,000 from financial activities, and $5,000 from investment activities. The net cash flow would be as follows:

Net cash flow = $350,000 + $50,000 + $5,000

Net cash flow = $405,000

Note that if your business lost money due to an investment, then the investment amount will be written as a negative. For instance, if in the above example, SunRays lost $5,000 then the net cash flow would be $350,000 + $50,000 - $5000 which would equate to a net cash flow value of $400,000. In real life, cash flow calculations are much more complex because adjustments need to be made. For instance, income statement calculations are prepared on an accrual basis and so the amounts cannot be directly used to calculate cash flow.

What is a financial report?

Financial reports and financial statements are often thought to be the same but they aren’t. Financial statements include the statement of cash flows, income statement, and balance sheet. Financial statements fall under financial reports. A financial report can be described as an umbrella term and is used to make decisions as it shows your business performance. Financial reports help to determine the cash flow scenario in the future along with how investments can be optimally planned. A financial report is often used by lenders, investors, and government agencies to see how your business decisions have panned out.

Cash inflow vs cash outflow

|

Cash Inflow |

Cash Outflow |

|

Cash inflow is the net cash amount coming into your business that you have available for a period of time. |

Cash outflow is the net cash amount that is going out of your business because you are paying someone else or another entity. |

|

Examples of cash inflow include customer payments, return on investments, and interest you receive on loans you have given to another entity. |

Examples of cash outflow include money spent on fixed assets, salaries, payment made to suppliers, loans taken and interest paid on them, wages, transport costs, and insurance dividends that require you to pay. |

How can you enhance your business cash flow?

You can improve your business cash flow in numerous ways. You can offer incentives to customers so they pay instantly as this can improve your business cash flow. For example, you can offer discounts on future purchases if they continuously pay on time. You want to take a good look at your inventory. Improper inventory management can lead to high costs and poor cash flow. Instead, focus on inventory management to ensure you have sufficient amounts so your customers are satisfied and minimal is going to waste. Leasing instead of buying can improve your cash flow in certain cases especially if you don’t plan to use that particular item for a long time.

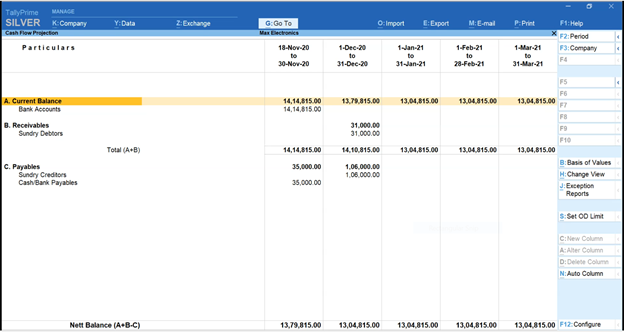

Cash flow projection report in TallyPrime

Business cash flow can be improved by negotiating with your suppliers. Are your suppliers willing to offer a discount if you pay on time or before time? If so, then trying to save with the help of discounts can help. Ordering materials in bulk can also help in managing cash flow. You should re-evaluate your expenses and see if you can cut expenses in certain places. This can help you manage your cash flow better as you will have more cash in hand. Opening a business savings account can help with cash flow as it generates interest. Setting up an emergency fund in this account can help for future unexpected expenses.

TallyPrime is a business management software that can be used to generate cash flow statements and cash flow projections. Cash flow statements accurately put together how much cash inflow and cash outflow has occurred during a particular time period so you can understand thoroughly what happened to the cash. The cash flow projection enables you, the business owner, to get an overview of how the future might look like. That is, it helps you understand how much cash might be generated and spent. TallyPrime is a complete business management tool that can generate powerful insights so your small business is always aware of what is happening and can make changes immediately when required.