- What is financial reporting?

- Why is financial reporting important for your business?

- How TallyPrime helps with financial reporting

What is financial reporting?

Financial reporting is a means by which internal and external stakeholders understand your business’s financial health. It involves generating financial statements periodically and other financial reports that relay financial information to the concerned parties. It is useful and applicable to all businesses, regardless of their size and revenue.

Generally, large businesses must follow a set of rules and regulations pertaining to financial reports as they must follow the Securities and Exchange Commission (SEC) obligations. The other businesses must also follow a set of standards when reporting their finances.

Why is financial reporting important for your business?

Financial reporting reveals your company’s financial health. In the U.S., every business needs to conform to the U.S. Generally Accepted Accounting Principles (GAAP) or the International Financial Reporting Standards (IFRS). Financial reporting provides you with data to analyze your business and aids in the management of your internal operations. Analysis cannot be done without data, and financial reports help you evaluate various aspects of your business in an easy-to-understand manner.

How TallyPrime helps with financial reporting

TallyPrime is a robust business management software that aids in financial reporting for better business insights, visibility, and analysis.

Accounting and financial reports

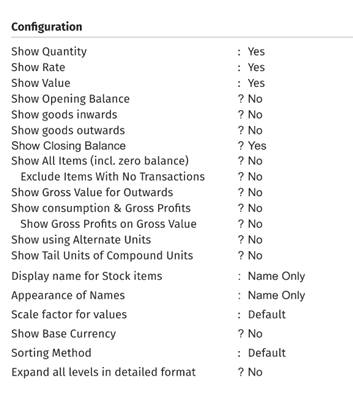

TallyPrime is a software for financial reporting as it can generate over 400+ reports for your business. You can generate any report you wish right after you make a transaction making it a swift software that generates reports in a blink. The reports can be customized, as you can exclude certain details and include others for a better understanding of a certain portion of your business.

This allows personalization and better comprehension, thereby, better decision-making for your business. You can perform comparative analysis monthly or weekly or as you wish, depending on the multiple companies you own, for better judgment of operations.

TallyPrime supports personalization and customization

You can view another report as you view the current report and later get back to the previous one with a single click. This ease of operation promotes multi-tasking and allows you to get answers as soon as you have questions.

TallyPrime can generate inventory reports, accounting reports, financial reports, management control reports, and many more for an in-depth understanding of your business. TallyPrime gives you the freedom to custom-create a report view and save it by any name you choose. This allows you to show others or use it to make key decisions.

Balance sheet

TallyPrime generates your business’s balance sheet to determine your current position financially. The balance sheet provides information about your assets, liabilities, and equity whereby your assets are equal to your liabilities and equity.

The balance sheet is among the most vital financial statements as it shows you whether your business can withstand the current scenario and afford growth shortly. It also shows the current net worth. It also shows the current net worth. It gives you a thorough understanding of your resources and how well you are utilizing them currently.

Trial balance

TallyPrime’s trial balance is a vital financial report. A trial balance ensures that the entries in the business’s general ledger are balanced correctly. Ideally, the balances of both the credits and the debits must match, and if not, it indicates that one or more financial transactions were not balanced. When you use a software tool like TallyPrime, the balances will match.

The trial balance is used by auditors who check the account balances and apply their audit procedure to test if these balances are correct. A trial balance is of more value to manual bookkeeping, where errors can occur. Trial balances are used by bookkeepers to ensure the entries are reliable.

Ratio analysis

Ratio analysis in TallyPrime is used for comparison between different accounts in your books. Many types of financial ratios exist, such as the debt-to-equity ratio, quick ratio, current ratio, and gross profit percentage. All of these are used for analysis purposes, such as the liquidity of a business, and they can be used to compare companies in the same industry to see which one is doing better.

It helps you know the financial position of your business from different viewpoints, thereby providing you with better clarity and understanding. It also lets you understand which business areas are doing better and which areas need to be worked on.

Profit and loss account

The profit and loss statement or the income statement shows your net income or net loss, your revenue, and your expenses over a period. It is regarded as the most vital financial statement as it shows how good your business is at creating profits and how well your business can manage various expenses.

TallyPrime generates a range of reports including profit and loss report

The income statement generated by TallyPrime also shows how well your business is able to generate sales. It is often used for comparison with how your business performed in earlier periods. This shows whether any improvements have been made or if the business is worse than before.

Bills payable

TallyPrime’s outstanding payable report is how much you owe to others, such as vendors. Let us say you purchased in bulk from a vendor, but you will pay them next month due to a cash shortage. This will be in your outstanding payable report as you have not made the payment yet.

Generating this report allows you to make payments on time and avoid paying the extra fee for late payments where it applies. It also ensures your cash flow is maintained and you have a clear idea of how much cash you have at hand rather than an unrealistic number.

Cash/bank books

TallyPrime has cash books that record every transaction that affects the cash in your business. That is, it records all cash payments done by your bank and all the receipts associated with cash. Similarly, TallyPrime generates a bank book report that records every receipt that was generated through the bank used by your business and all the payments that you made using your bank.

TallyPrime has a cash/bank book feature that allows you to get the information of the two in a single report. Despite being saved in separate ledgers, you can view the information on the two categories in one report.

Purchase/sales register

A purchase register lets you see what purchases from made by your business during a period. A sales register report in TallyPrime enables you to see the sales transactions of your business for a particular period. Let us say you want to view the sales that occurred in the last six months.

You can simply generate a sales register report to see what sales occurred and when. It will give you details of the value and other important details about the particular sales giving you an in-depth view of your company’s sales. Apart from these, you also have a payment register and journal-register report that enable you to understand your business more thoroughly.

Bills receivable

TallyPrime generates a receivables report which means how much other people owe you. Let us say that a customer purchases products in bulk but will pay the next month. This will be listed in the receivables report as you are yet to receive payment.

You must keep track of these amounts to ensure you receive payments on time or remind them to pay you if they forget. These are known as outstanding receivables because they owe you and haven’t paid your business yet. Dues recovery is crucial, especially when maintaining the right cash flow in your business.

Read More:

- How to Easily Build Great Estimates for Your Projects

- What Is Cash Management, And How Can It Benefit My Business?

Explore More Products