- What is financial reporting?

- Benefits of financial reporting

- Types of financial reporting

- Objectives of financial reporting

- How Tally lets you keep track of your financial statements, seamlessly

What is financial reporting?

Being financially independent is one of the primary objectives when starting a business. Business owners must take into consideration the probable consequences of their management decisions, as they could have a direct impact on profits, cash flow and on the overall financial condition of the company.

Financial reporting helps track the financial performance of a company on a regular basis with the help of various financial reports. This information is vital for the management to take key decisions about the company’s future. It also generates information to capital providers like creditors and investors about the profitability and financial stability of the company.

Benefits of financial reporting

Statutory purposes

The government is always around to collect taxes and keeps changing tax regimes to make the process simpler. To adhere to tax reforms and laws, financial management must plan to pay its taxes on a timely basis. Financial management is an important skill of every small business owner or manager. Every decision that an owner makes has a financial impact on the company, and he has to make these decisions within the total context of the company's operations.

Financial management in normal operations

Usually, a company provides a product or service, sells to its customer, collects the money and the process is repeated again. Financial management is moving cash efficiently through this cycle. This means that managing the turnover ratios of raw materials and finished goods inventories, selling to customers and collecting the receivables on a timely basis and starting over by purchasing more raw materials. While this is happening, the business must also ensure that it pays suppliers and employees, regularly. All of this must be done with cash, and it takes astute financial management to make sure that these funds flow efficiently. Even though economies have a long-term history of going up, occasionally they will also experience sharp declines. Businesses must plan to have enough liquidity to weather these economic downturns, otherwise they may need to close their doors for lack of cash.

Operation evaluation

When a business starts its operations, it comes with an upfront cost. And as the business grows, these costs go up for obvious reasons. Setting up a sound structure for financial management helps business owners evaluate the operational changes that impacted the overall financial health of the business. Financial reporting which is done on an income statement generates results about sales, expenses and profit or losses. Using the

Decision-making, planning and forecasting

When key decisions are to be taken by a business owner, careful analysis of financial statements is imperative. One simple look at the value of the assets that a business currently holds and managers can instantly decide, if they can afford to purchase more or not. Conversely, when the value of assets is severely depreciated, managers can decide if they need to be sold off. Financial management also help is creating various strategies for optimum use of stock-at-hand and resources that will ultimately result in better cash flow.

Mitigate errors

Accurate financial reporting can help businesses catch grave mistakes and inter errors early in the process that could cost the business a hefty amount. There is no better way to detect illegal financial activities than catch discrepancies in financial statements. Through a reconciliation process, errors that have been made can be found. Companies spend a lot of time reconciling their books of accounts and verifying each journal entry, so they can find if an accounting error has occurred or if anyone has tampered with any part of the business.

Types of financial reporting

Below are the financial reports that help business owners a great deal in running their company seamlessly:

- external financial statements (income statement, statement of comprehensive income, balance sheet, statement of cash flows, and statement of stockholders’ equity)

- notes to the financial statements

- communication regarding quarterly earnings and related information through press releases and conference calls

- quarterly and annual reports to stockholders

- financial information posted on a business’s website

- financial reports to governmental agencies including quarterly and annual reports to the Securities and Exchange Commission (SEC)

- documentation pertaining to the issuance of common stock and other securities

Objectives of financial reporting

The primary objective of financial reporting is to track, analyse and report your business' income. These reports are then used to examine the resource usage, cash flow, business performance which help assess the financial health of the business. Financial reporting is a way of following standard accounting practices to give an accurate depiction of a company’s finances, including:

- Revenues

- Expenses

- Profits

- Capital

- Cashflow

How Tally lets you keep track of your financial statements, seamlessly

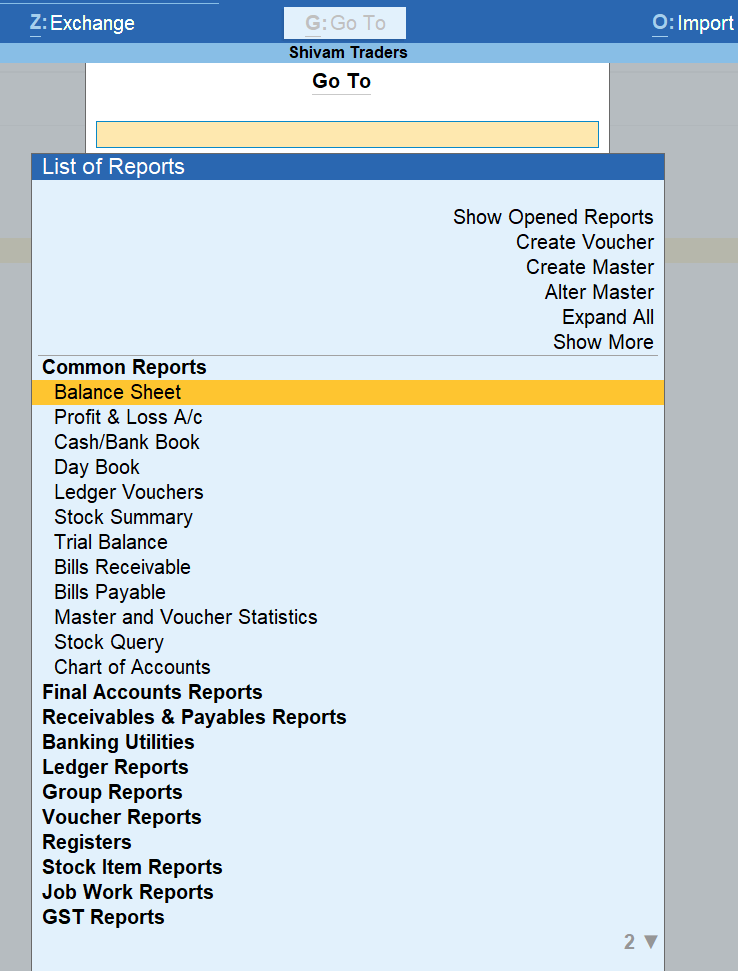

Financial independence lets your business grow at a steady rate. Keeping a close track on your expenses, will not only give you a strong sense of where your money is going, but also enable you to take smarter business decisions that will boost your company’s productivity and efficiency. Financial reporting with Tally is as easy as it can be. Be it finance, stock, or taxes, the reports available in Tally will help you manage all these aspects better. With our ‘Go To’ feature, you can easily track all your crucial business reports, without having to learn any specific path to navigate.

As you can see in the above screen, from the balance sheet to the master voucher stats, everything you need is right there for you! The new Go-To capability helps you discover and get more out of TallyPrime. It will help you discover new insights to run your business better. Also, helps you multitask better, navigating from one report to another without the worry of quitting the task you were on it and much more.

Watch Video on Insightful Financial Reports

FAQ:

What is the main purpose of financial reporting?

Financial reporting is vital for many reasons. Firstly, it enables you to compare the actual result with the business’s budget to see how far off you were in your predictions. This throws light on what needs to be improved and changed. Financial reporting is helpful in monitoring compliance such as taxation, regulations, and legal compliance. The primary goal of financial reporting is to monitor the performance of the business to make future predictions based on how it has performed now in terms of expenses and revenues. It can be used for comparison purposes by using particular ratios.

What is financial reporting with example?

Financial reporting includes the following elements - income statement, comprehensive income statement, balance sheet, cash flow statement, and more.

What are the benefits of financial reporting?

Here are some of the key benefits of financial reporting:

- Helps in real-time analyses

- Helps in better debt management

- Optimizes financial performance and compliance

- Seamless cash flow management