Are you a regular dealer who is into trading, manufacturing, reselling or providing services? Then, GSTR-1 Reconciliation is undoubtedly something that you and your business should never overlook and here’s how your business would benefit from GSTR-1 Reconciliation.

Reconciliation of return data is always a healthy habit, especially if your data is being filed by an employee in a different branch office or any third party such as an auditor or chartered accountant. This will help you in verifying the data on the portal with the data in your company books and identify any differences between the data.

Considering the sheer number and variety of transactions, it might sound daunting to track all the differences in GST details. By downloading TallyPrime's latest version, you don't have to worry about reconciliation at all.

You only have to import your GSTR-1 data in TallyPrime, and the relevant details from the portal will appear seamlessly in the GSTR-1 reconciliation report, along with the details in your company books. After that, you can verify the details and easily make the necessary changes.

| Ease of GSTR-2B and GSTR-2A Reconciliation with TallyPrime |

What is GSTR-1 Reconciliation?

We all know GSTR-1 is a statement of all outward supplies that should be filed by all normal and casual registered taxpayers on a monthly or quarterly basis (depending on the turnover of the business).

GSTR-1 reconciliation is the matching of the data in your GSTR-1 return form and your book of accounts, performed at regular intervals to ensure that your returns are in sync with your books.

Seamless GSTR-1 Reconciliation with TallyPrime's latest version

GSTR-1 Reconciliation can get overwhelming with the huge volume of sales transactions of business on a day-to-day basis. However, with TallyPrime’s hassle-free GSTR-1 Reconciliation capabilities, businesses can now stay compliant without stress.

Here’s how your reconciliation journey can get simpler with TallyPrime:

Reliable and guaranteed compliance

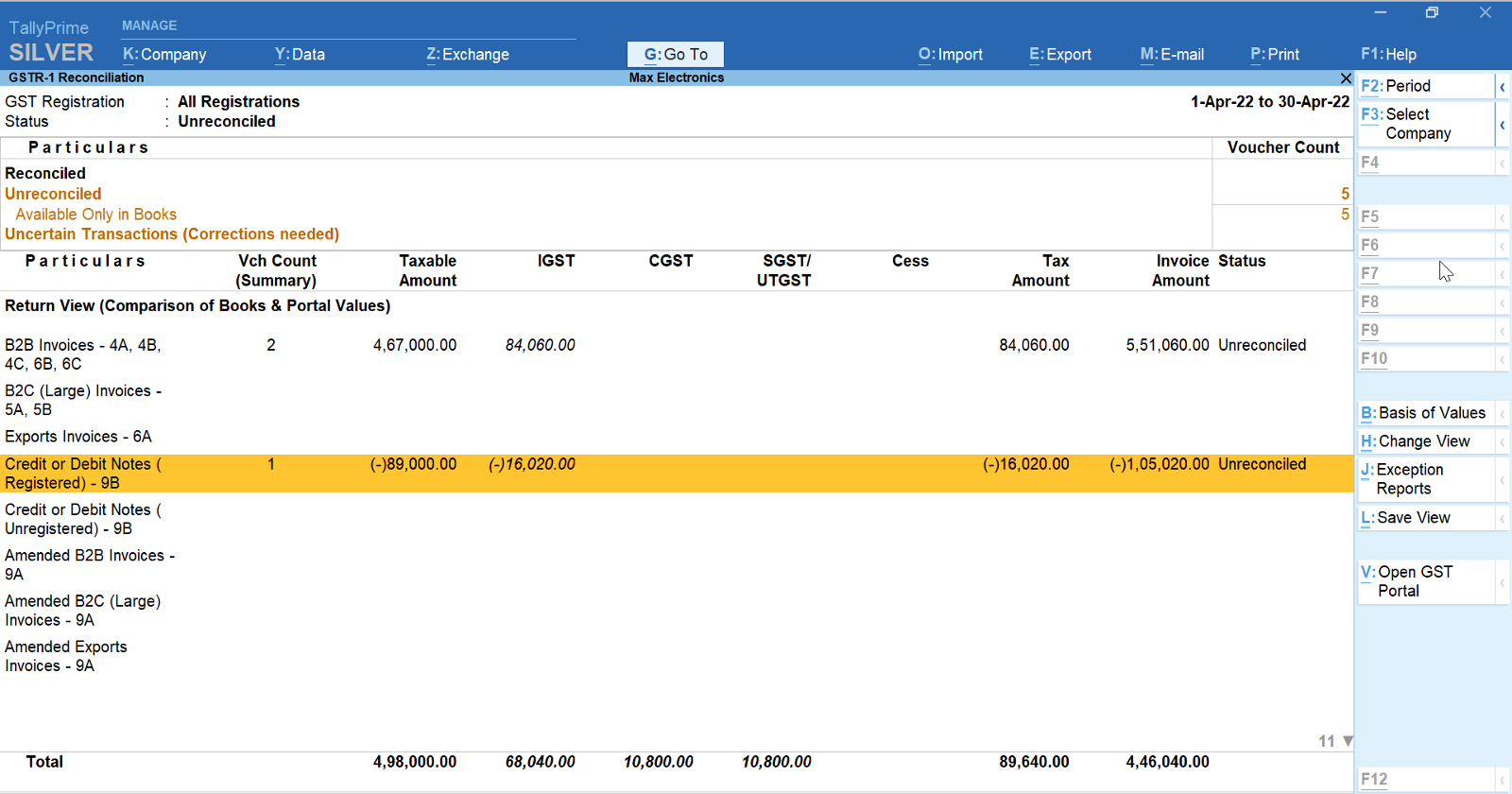

The various sections and tables of Form GSTR-1 can seem challenging and confusing. The good news is the with TallyPrime, businesses need not sort GST data separately. Moreover, the GSTR-1 Reconciliation is accurately mapped to the GSTR-1 form tables, automatically assigning all the GST onward supplies to the relevant tables. Once the details of the business are imported, the same will be reflected in the concerned sections.

User-friendly and intuitive design

With umpteen transactions and amendments, finding the transactions that require your attention can be tricky. The latest version of TallyPrime makes this easier by a color-coding mechanism that facilitates easier identification – all the sections that require attention will be highlighted in amber color and the values from the portal will be in blue color.

The flexibility of TallyPrime enables easier identification of reconciled and unreconciled transactions. From the imported data, all data that is available only on the portal goes to a whole new section by the name ‘Available Only on Portal.’

TallyPrime comes with the option to configure the GST Return Effective Date for a transaction. For some reason, you might not have been able to upload a transaction on GST portal in the same month, or you might have agreed with your counterparty to upload the transaction in the subsequent month. For such transactions, you can easily update the GST Return Effective Date, as needed. Such transactions will automatically appear under Mismatch in Return Period.

Unmatched performance

When it comes to GST transactions, there is often a lot of data involved, which can make it overwhelming to manage. However, with TallyPrime, you do not have to worry about the size of your data. The GSTR-1 Reconciliation report will always be instantly available, that is, as soon as you import your GSTR-1 file, the return information will be reflected in the reports in real-time. Even when you have thousands of GST transactions, GSTR-1 Reconciliation will load the details in a jiffy. Additionally, TallyPrime allows you to move between reports and drill down to transactions quickly, making the entire reconciliation process faster and more efficient.

Multi-GSTIN support

If your business consists of multiple GST registrations/GSTINs, then the GSTR-1 Reconciliation report provides you with an amazing view of your combined GST details and activities across registrations. You also have the flexibility to view GSTR-1 Reconciliation for only one registration, from any of your companies. You can view and resolve your uncertain transactions or export your return, for all GSTINs combined or for one GSTIN at a time, based on your business practice.

Additional flexibilities

What's more, GSTR-1 Reconciliation report provides you with a host of flexibilities. For example, after importing the GSTR-1 data, you can either compare the values in your books and in the portal side by side, or you can view the difference between the values, depending on your convenience. You also have other options such as viewing the report for all your transactions, or for specific transactions such as Available only in Books or Excluded, but available on Portal. You can also choose to ignore minor differences in values between your company books and portal, which might arise use to factors such as rounding off.

How to reconcile GSTR-1 in TallyPrime?

GSTR-1 Reconciliation with the latest TallyPrime version is as simple as it can get! The below steps gives an overview of the reconciliation process:

Here are quick steps to reconcile GSTR-1 in TallyPrime

- Import GSTR-1 statement in TallyPrime

- TallyPrime will automatically reconcile the books with the statement

- Invoices that match will be reconciled, and the rest will be marked as unreconciled with the reason.

- A quick summary is available to see the status (reconciled, mismatched, etc.)

- Drill down to see the unreconciled invoices with reasons and take suitable action.

There is more for you in TallyPrime's latest version

Apart from the above-mentioned features, the latest version of TallyPrime is packed with numerous more features to manage your compliance and business needs.

- GSTR-2B and GSTR-2A reconciliation

- Multiple GSTIN support in a single company

- All new powerful report filter

- Flexible voucher numbering and voucher series

- Integration with payment gateways

Videos to check out

GSTR 2A and GSTR 2B Reconciliation | TallyPrime Walkthrough

Simplified & Powerful Report Filters | TallyPrime Walkthrough

Payment Gateway Integration | TallyPrime Walkthrough

How to Use Multiple GST Registrations Feature in TallyPrime

Voucher Numbering Behaviour in TallyPrime