- Implication of GCC VAT on invoices

- Is Tax Credit Note?

- Tax Credit Note format

- Impact of Tax Credit Note

- Electronic Tax Credit Note

In our previous articles on invoicing under VAT in UAE, we have learned about Tax invoices and Simplified Tax invoices. These are the documents to be issued by registrants when taxable supplies of goods or services are made. In this article, let us learn about another important document to be issued under VAT- Tax Credit Note.

Implication of GCC VAT on invoices

In the VAT regime, all sales and purchase transactions need to be tax compliant. This means that invoices, debit notes, credit notes, and other documents have to be printed as per the formats prescribed by the Federal Trade Authority (for UAE) and General Authority of Zakat & Tax (for Saudi Arabia), depending on where your business is located.

What is Tax Credit Note?

A Tax Credit Note is a written or electronic document to be recorded and issued by a registered supplier of goods or services to record the following occurrences:

- Supplies are returned or found to be deficient by the recipient

- Decrease in value of supply

- Decrease in value of tax

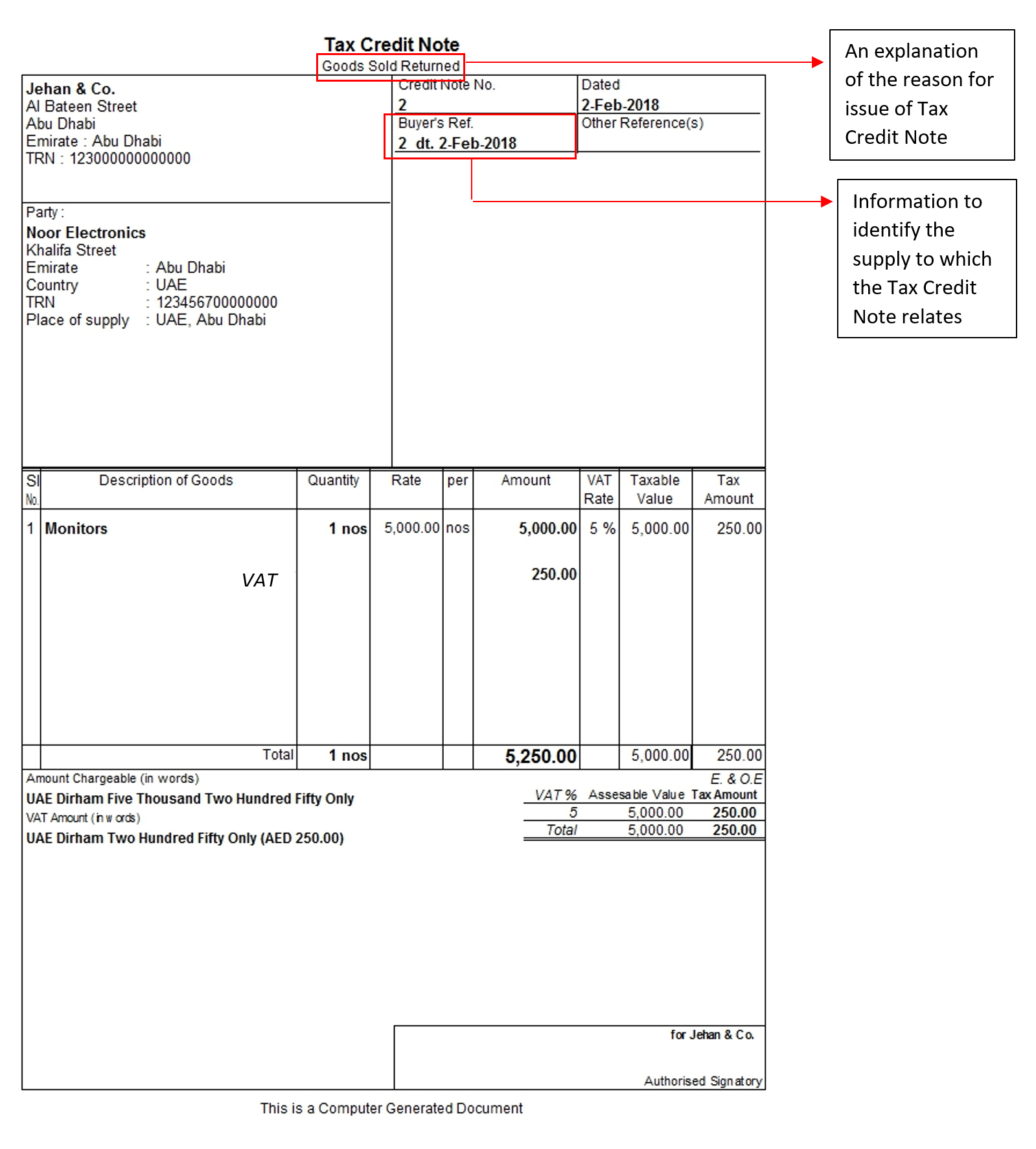

Example: On 2nd Feb, '18, Jehan & Co., a registrant in Abu Dhabi, supplies 10 Monitors @ AED 5,000 each, to Noor Electronics, a registrant in Abu Dhabi. VAT charged on the supply is AED 2,500. On the same day, Noor Electronics returns 1 monitor to Jehan & Co., as it was found to be damaged in transit. In this case, Jehan & Co, should issue a credit note to Noor Electronics for the monitor returned and reverse the VAT charged on the monitor. The Tax Credit Note to be issued by Jehan & Co. is shown below.

Tax Credit Note format

A sample format of a Tax Credit Note under VAT in UAE is given below:

Impact of Tax Credit Note

A Tax Credit Note issued by a registered supplier will have 2 impacts:

- Reduction in tax payable by the supplier on the supply

- Reduction in input tax recoverable by the recipient on the supply

Electronic Tax Credit Note

A Taxable Person can issue a Tax Credit Note using electronic means, provided:

- The Taxable Person must be capable of securely storing a copy of the electronic Tax Credit Note as per the record keeping requirements

- The authenticity of origin and integrity of the content of the electronic Tax Credit Note should be guaranteed.

Hence, persons registered under VAT in UAE should take note of the Tax Credit Note, which is the document to be issued in the above mentioned scenarios. Registered suppliers should ensure that Tax Credit Notes issued are complete and contain all the mandatory details required. If the Tax Credit Notes are issued using electronic means, it is important that the required conditions for the issue of Electronic Tax Credit Notes are fulfilled. Tax Credit Notes are also of great importance to recipients of supply who are registered, as a Tax Credit Note results in a corresponding reduction in their input tax recoverable on the supply.

Read more about UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Payment

VAT Payment in UAE, How to Make VAT Payment using GIBAN, How to make VAT Payment to FTA in UAE, VAT Payment on Import of Goods in UAE, VAT Payment through e-guarantee in UAE, VAT payment on commercial property in FTA Portal, VAT payment on import in FTA portal

Reverse Charge

Reverse Charge Supplies in VAT Form 201, VAT Reverse Charge Mechanism, Conditions for applying reverse charge VAT in Gold and Diamond Business

VAT Calculator

VAT Calculator, How to calculate VAT under Profit Margin Scheme