A Designated Zone will be treated as being outside the State and outside the Implementing States for the purpose of UAE VAT. As a result, this requires a differential VAT computation on making a supply from the Designated Zone. In this article, we will understand the VAT treatment of goods supplied from the Designated Zone under following scenarios:

- Goods supplied from Designated Zone to another Designated Zone

- Goods supplied from Designated Zone to Mainland

- Goods supplied from Designated Zone to outside the UAE State

To know more about Designated Zones, please read VAT on Designated Zone and VAT on Free Zones in UAE.

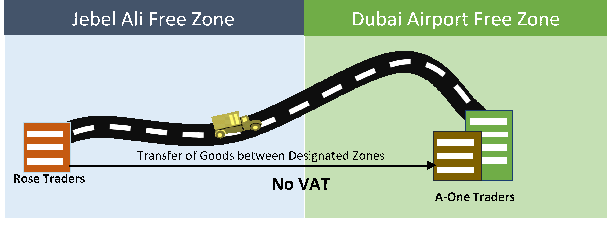

Goods supplied from Designated Zone to another Designated Zone

Supply of goods between Designated Zones will not attract VAT. For example, Rose Traders located in Jebel Ali Free Zone supplied goods to A-One Traders, Dubai Airport Free Zone.

In the above illustration, Jebel Ali Free Zone and Dubai Airport Free Zone are Designated Zones. The supply of goods from Rose Traders to A-one Traders will be VAT free since the supply is between Designated Zones.

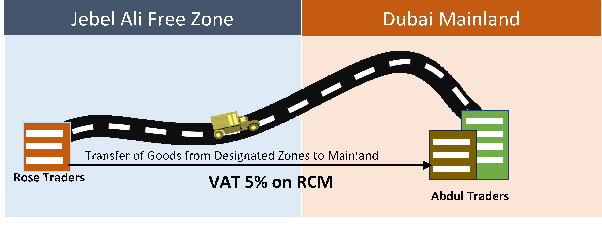

Goods supplied from Designated Zone to Mainland

For the purpose of the VAT, a Designated Zone will be treated as being outside the State. As the result, the supply of goods from the Designated Zone to the supplier located in the mainland (inside the UAE State) will be considered as import. The supplier who is buying goods from the Designated Zone will have to pay VAT on a reverse charge basis, similar to import of goods from other countries.

For example, Rose Traders located in Jebel Ali Free Zone supplied goods to Abdul Traders, located in Dubai mainland.

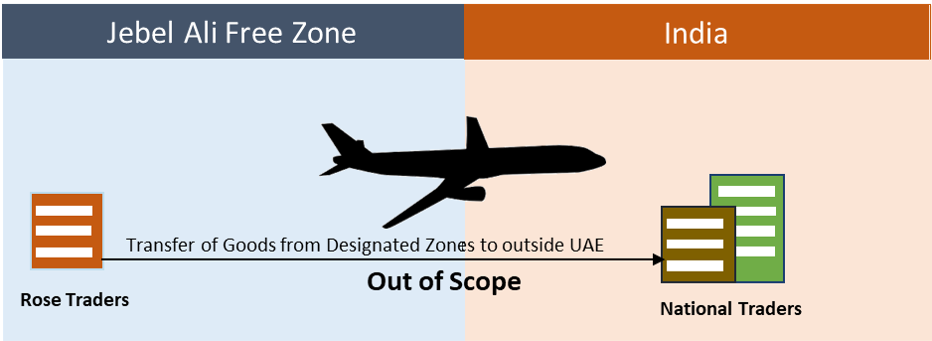

Goods supplied from Designated Zone to outside the UAE State

Goods supplied from the Designated Zone to outside the UAE State will be considered as out of scope for the purpose of VAT. For example, Rose Traders located in Jebel Ali Free Zone supplied goods to National Traders, located in India.

In the above illustration, goods are supplied from Jebel Ali Free Zone (Designated Zone) to India. The supply of goods from Rose Traders to National Traders will be considered as out of scope and VAT will not be applied.

Conclusion

The above-discussed scenarios are only applicable for the supply of goods. In the case of a supply of services, the treatment of VAT is different. To know more about the supply of services from designated zones, please read 'Treatment of services supplied from Designated Zone'.

Read more about UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Payment

VAT Payment in UAE, How to Make VAT Payment using GIBAN, How to make VAT Payment to FTA in UAE, VAT Payment on Import of Goods in UAE, VAT Payment through e-guarantee in UAE, VAT payment on commercial property in FTA Portal, VAT payment on import in FTA portal

Reverse Charge

Reverse Charge Supplies in VAT Form 201, VAT Reverse Charge Mechanism, Conditions for applying reverse charge VAT in Gold and Diamond Business