- What is Free Zone in UAE?

- Free Trade Zone in VAT Regime

- What is a Designated Zone?

- What are the conditions for Designated Zone?

- List of Designated Zone in UAE

Ever since the GCC VAT framework was designed, for that matter even when UAE VAT Law was released, one question which created a buzz among most businesses, was about 'VAT on Free Zones'. The businesses wanted to know the treatment of existing Free Zones in VAT and what will be the VAT Treatment on supplies from or to Free Zone?

Before understanding the treatment of VAT on Free Zones, let us understand what is a Free Zone in UAE?

What is Free Zone in UAE?

Free Zone, also known as Free Trade Zone, is an area designed to promote the international business in UAE by providing 100% foreign enterprise ownership. Free Zones offer attractive incentives such as no requirement for a UAE national as a local partner/shareholder, tax exemptions on duties and taxes such as Corporate, Personal Income Tax, all import and export duties etc. The businesses in Free Zones are required to obtain the necessary licenses from the respective Free Zone authorities and comply with their guidelines when operating the business in this region.

Each emirate in UAE has a designated area as a Free Zone. There are more than 35 Free Zones operating in UAE such as Jebel Ali Free Zone, Dubai Internet City Free Zone, Dubai Airport Free Zone etc.

Free Trade Zone in VAT Regime

First and foremost point which businesses need to take note is that 'All Free Zone' may not be a 'VAT Free Zone'. This is evident from the definition and provisions defined in the UAE VAT Law and Executive Regulations. In UAE VAT law, VAT Free Zones are called 'Designated Zones' and the executive regulation prescribes the conditions which a Designated Zone needs to fulfil.

What is a Designated Zone?

Designated Zone refers to an area specified by a cabinet decision and that meets the conditions specified in the Executive Regulation. For the purpose of VAT, a Designated Zone will be treated as being outside the state and any supplies between Designated Zones will not attract VAT at 5%.

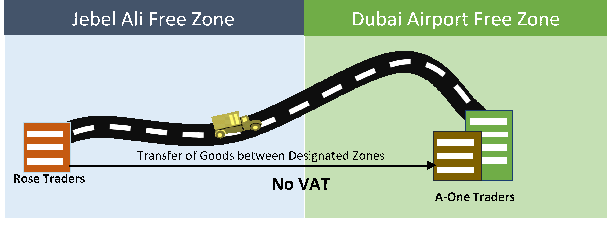

For example, Rose Traders located in Jebel Ali Free Zone supplied goods to A-One Traders, Dubai Airport Free Zone.

In the above illustration, Jebel Ali Free Zone and Dubai Airport Free Zone are assumed to be Designated Zones. The actual list of Designated Zones will be made available after the cabinet decision. The supply of goods from Rose Traders to A-one Traders will be VAT free since the supply is between Designated Zones.

What are the conditions for Designated Zone?

The Designated Zone specified by the cabinet decision should meet the following conditions in order to be considered as being outside the State and as well as implementation States:

- Designated Zone Should be within a specific fenced geographical area

- It should have security measures and customs controls in place to monitor the entry and exit of individuals and the movement of goods to and from the area

- It should have internal procedures regarding the method of keeping, storing and processing of Goods with the Designated Zone

- The operator of the Designated Zone should comply with the procedures set by the Authority

The above are conditions which a Designated Zone has to compulsorily comply. If there are any changes in the manner of operating or if businesses located in these areas no longer meet any of the conditions required to qualify as a Designated Zone, it shall be treated as being inside the State, and will be treated at par with the businesses located outside the Designated Zone.

List of Designated Zone in UAE

| Emirate | Designated Zone |

| Abu Dhabi | Free Trade Zone of Khalifa Port |

| Abu Dhabi Airport Free Zone | |

| Khalifa Industrial Zone | |

| Dubai | Jebel Ali Free Zone (North-South) |

| Dubai Cars and Automotive Zone (DUCAMZ) | |

| Dubai Textile City | |

| Free Zone Area in Al Quoz | |

| Free Zone Area in Al Qusais | |

| Dubai Aviation City | |

| Dubai Airport Free Zone | |

| Sharjah | Hamriyah Free Zone |

| Sharjah Airport International Free Zone | |

| Ajman | Ajman Free Zone |

| Umm Al Quwain | Umm Al Quwain Free Trade Zone in Ahmed Bin Rashid Port |

| Umm Al Quwain Free Trade Zone on Sheikh Mohammed Bin Zayed Road | |

| Ras Al Khaimah | RAK Free Trade Zone |

| RAK Maritime City Free Zone | |

| RAK Airport Free Zone | |

| Fujairah | Fujairah Free Zone |

| FOIZ (Fujairah Oil Industry Zone) |