In KSA VAT, the supply of goods and services are broadly categorized into taxable supply, zero-rated supplies and exempt supplies. Each of these supplies has different VAT treatment and subsequently, have a different impact on the business. With the implementation of VAT in KSA, it is very critical for businesses to understand the VAT structure, identify the supplies made by them and accordingly apply the required VAT treatment.

In this article, let us understand what is taxable supply in KSA VAT.

What is Taxable Supply in Saudi VAT?

Taxable supply refers to the supply of goods and services on which standard rate of VAT @ 5% is levied. In KSA VAT, all the goods and services bought or sold in the Kingdom or imported into the Kingdom are under scope of 5% VAT, unless it is specified as exempt.

For businesses, it is clear that on the supply of goods and services which are taxable, they should charge 5% VAT and remit it to the government. Also, businesses are allowed to recover the Input VAT paid on the taxable purchases or expenses. This implies, that if you, as a business, have paid 5% VAT on taxable purchases, you are allowed to recover it by way of reduction in your output VAT (5% collected on the taxable supply).

Now, it is clear that taxable supply is a supply on which 5% VAT is levied but how will you determine whether the goods or services which you are supplying is a taxable supply or not?

Identifying whether you are making a taxable supply or not, is very simple. You can do it by following the steps mentioned below:

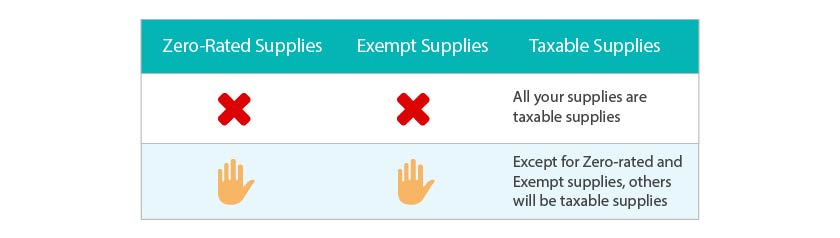

- Determine whether any of your supplies are under zero-rated or exempt supplies list

- If none of your supplies are under zero-rated list and exempt list, it is understood that all your supplies are taxable supplies and you need to charge VAT at 5%

- If few of your supplies are under zero-rated list or exempt list, except those, all others goods or services will be taxable supplies and you need to charge VAT at 5%

The implementing regulations of KSA VAT provide the list of supplies which are zero-rated and exempted. Generally, all exports are zero-rated and notified financial services, residential building, etc. are exempt supplies. To know more, please read Zero-rated supplies and Exempt supplies.

Supplying of goods or services is not new for the businesses but classifying them into different brackets (Taxable, Zero-rated and Exempt supplies) under VAT is something new which businesses need to deal with it. This is very critical because, it helps in identifying the transactions on which VAT @ 5% should be levied and also from the point of Input VAT recovery on the taxable supplies. An early determination will help you to prepare well in advance and avoid the consequences of non-compliance.

Read more on Saudi Arabia VAT

Introduction to VAT in Saudi Arabia, What is Time of Supply under VAT Saudi Arabia, Saudi VAT for Export of Services Outside GCC, Export of goods to Non-GCC countries from Saudi Arabia, VAT rates in Saudi Arabia, Zero-Rated Supplies under VAT in Saudi Arabia, Difference between zero rated & exempt VAT in Saudi Arabia, VAT Exempt Supplies/Items in Saudi Arabia

VAT Invoice

VAT invoice in Saudi Arabia, VAT invoice format in Saudi Arabia, Types of invoices under VAT in Saudi Arabia, Simplified Tax Invoice in Saudi Arabia, Checklist for VAT invoice in Saudi Arabia

VAT Registration

VAT Registration Process in Saudi Arabia, VAT Registration Deadline in Saudi Arabia, VAT Registration Threshold Calculation in Saudi Arabia, Who should register for VAT in Saudi Arabia?, 5 Key Benefits of VAT Registration in Saudi Arabia

VAT Payment

VAT payment in Saudi Arabia, VAT Payment on Import of Goods under Saudi VAT, FAQ on VAT Payment in Saudi Arabia

Input VAT Deductions

Input VAT deductions in Saudi Arabia, Checklist for Input VAT Deduction, Eligibility for Input Tax Deduction under Saudi VAT