- Maintaining Records and Accounting books in Oman

- Period of retaining records and books

- Manner of maintaining records and books

- Language of maintaining records and accounting books

- Currency of records and accounting books of accounts

- How TallyPrime will help you in maintaining accounting books and records

Does issuing VAT invoices and filing VAT returns sufficient to stay compliant in Oman? The answer is No. Alongside generating invoices and filing VAT returns, businesses registered under VAT need to comply with several bookkeeping requirements. The Oman VAT law and regulation prescribe different types of records to be maintained and the period for retaining such records. This article will detail accounting book, and record-keeping requirements that registered businesses should adhere to.

Maintaining Records and Accounting books in Oman

The Oman VAT law mandates the regular maintenance of accounting records and books on time. You should keep the translation records related to imports, exports, and any other documents related to supply.

| Expenses on which Input VAT Deduction is Blocked | How to File Oman VAT Return? |

The following are the list of records and statements that businesses should maintain:

- Daily record in which the day-to-day transactions related to the business activity in their chronological and sequential manner. Also, keep all the documents that enable the control of the validity of these activities.

- The Master record monitors the opening of accounts and the transactions based on this account, provided a separate account for each type of supplies (taxable or exempt) exits.

- The inventory record, where the inventory items and the total count are recorded

- Records and documents related to the import and export of goods and services

- Records and documents related to intra-GCC supplies of goods and services

- Records and documents related to all customs transactions

- All documents proving taxable supplies at zero (0%) rate in accordance with articles (51) and (54) of VAT law

- Record of all tax invoices and other documents issued by the registered business.

- A complete record of all tax invoices and other documents received by the VAT registered business

- Records that include information necessary to determine the correct tax treatment

- Any other records determined by the authority

Period of retaining records and books

Businesses should retain tax Invoices, accounting records and books, and customs documents related to the import and export of goods and any other documents for 10 years following the end of the tax year in which the VAT Return is filed.

In the case of real estate, books and all other records are to be retained for 15 years.

|

All VAT registered business except real estate |

10 years |

|

Real estate business |

15 years |

Manner of maintaining records and books

Accounting records, books and all other documents can be maintained electronically using automated accounting systems. However, the accounting transactions and all other documents must be issued on paper when requested by the authorities.

Following are the conditions to maintain the records electronically:

- The systems used for such purposes do not allow any adjusting entries, changes, deletions or additions to the accounting records and books, invoices and documents after the recorded date of the transactions.

- The electronic copy should be a clear copy and a true copy of the original paper records

- The system should have an operating manual when requested by the authority

Language of maintaining records and accounting books

The registered businesses can maintain accounting records, books, invoices and all other documents in any language as long as they are made available to authorities in the Arabic language, upon request.

Currency of records and accounting books of accounts

The accounting records or books must be maintained in local currency unless there is approval from authority to maintain in foreign currency.

How TallyPrime will help you in maintaining accounting books and records

TallyPrime is a business management software that integrates several business functions such as accounting, inventory, and VAT, ensuring your books and compliance are always in sync.

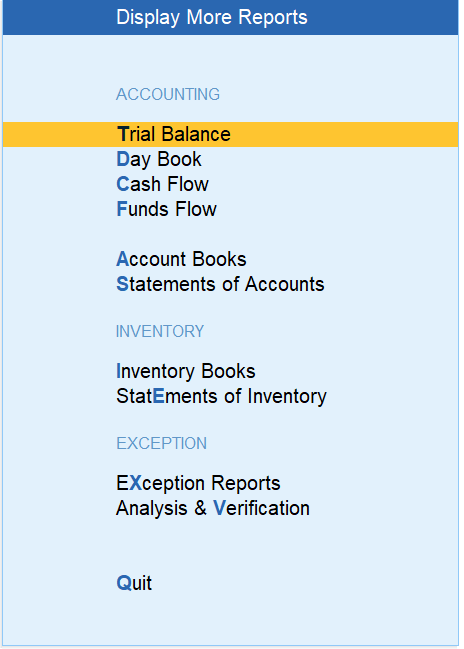

Accounting reports in TallyPrime

Using TallyPrime, the only thing you need to do is record invoices. Based on the invoice details, your accounts are prepared, inventory is updated, and compliance data is ready. When this happens, you can be assured that your financial reports give you a wholesome view of your business alongside maintaining all the records in line with Oman VAT law and regulation.

Read more on Oman VAT:

Oman VAT, VAT Invoice in Oman, Best VAT Software in Oman, Input VAT Deduction in Oman, Exempt Supplies in Oman VAT, How to Calculate VAT in Oman, Reverse Charge Mechanism in Oman VAT, What is VAT and How does it work, What are the Benefits of Applying VAT in Oman

VAT Rate

VAT Rate in Oman, Zero-Rated supplies in Oman VAT, Food Items Subject to Zero-rate VAT in Oman

VAT Registration

VAT Registration Guide in Oman, VAT Registration Deadline in Oman, Who Should Register Under Oman VAT, Business Benefits of Voluntary VAT Registration, Oman VAT Registration Guide for Persons with CRN, What is Tax Group Registration in Oman VAT

VAT Return

VAT Return in Oman, Oman VAT Return Format, FAQs on Oman VAT Return, How to File Oman VAT Return