- What is payroll management?

- What are the existing taxation rules

- The Oman payroll options

- Why do you have to set up your Oman payroll?

The human resources of a company are their most valuable asset. A company has to have an excellent payroll management process to pay its employees. An efficient payroll process will calculate and pay their employees accurately and on time. When there are delays or inaccuracies in payment it causes unhappiness and problems for the company. The entire workforce will be demoralised when they keep facing problems and inconsistencies in payments. Delays in payment also reflect badly on the reputation and image of the company. The local laws also regulate the timely and proper payment of employees.

The rules and regulations in Oman require compliance in the calculation, payment and reporting of payroll. In order for a company to satisfy legal requirements, calculation and payment of payroll according to the laws and rules is necessary. Accurate and prompt payment of your employees in Oman will also motivate and encourage the workforce. So, a payroll management system is essential for a company or business in Oman.

What is payroll management?

Payroll management is the recording, calculation and management of all the details relating to the salary paid to each employee along with the deductions and bonuses. An employer would need to calculate and record this to pay employees accurately. An employer would also have to calculate payroll and maintain records in accordance with the laws of the country or region.

Pre-payroll

Policy

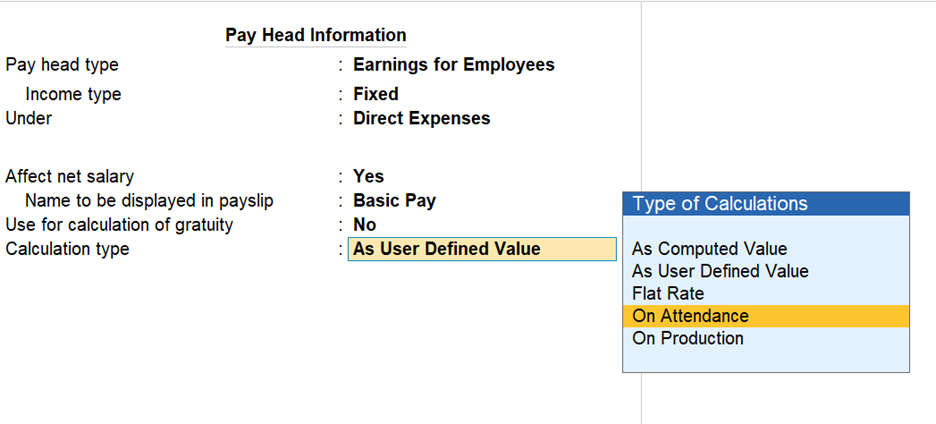

A company would have to define their payroll policy, the levels of pay, additions and deductions, leave, attendance and benefits. Then the company would have to also relate each pay scale to the relevant tax laws.

Attendance types in TallyPrime

Data gathering

The payroll department would have to gather data from other departments in the company. This could include attendance as well as data to calculate benefits and deductions. In older systems, this process was manual. Good business management software with payroll such as Tally, shares the data seamlessly for payroll calculation. This eliminates mistakes that could be made through manual data transfer or entry.

Validation

The data is checked for validity and the list of employees is verified to ensure that no employee is left out and that employees who have left are omitted.

Payroll processing

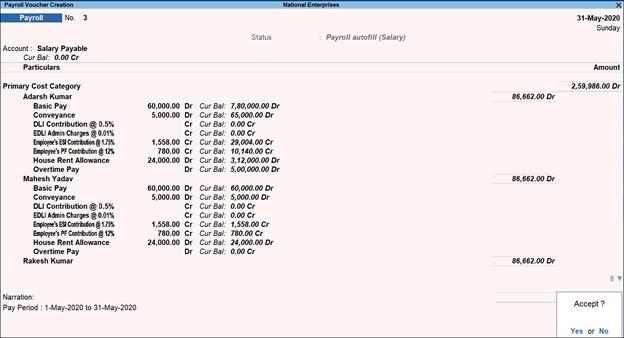

The payroll is calculated based on the data that is gathered and following the payroll policy. The net pay is calculated after factoring in the additions and deductions. The calculations are checked and reconciled to avoid making mistakes. Business management software calculates the payroll accurately with a few clicks. This is a great time saver and ensures accuracy in payroll calculation.

Auto-generated pay calculation in TallyPrime

Post-payroll process

The relevant details of the government-sanctioned taxes and other deductions are submitted to the government agencies in the format required. This may be monthly, quarterly or at the frequency required by the department. The dues to the government are also paid as per the prescribed schedule. Payroll processing software such as Tally generates these reports for easy and accurate filing with government agencies.

Payroll accounting

The payouts to the employees have to be recorded in the books of accounts. The company must maintain scrupulous accounts of the financial details of payroll. Payroll management is fully integrated with financial accounting in Tally, and the books of accounts are updated without the need for re-entering the data.

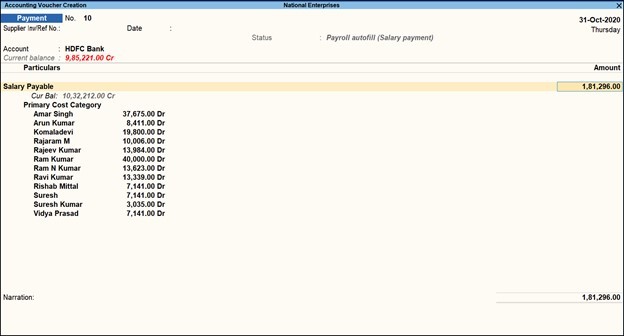

Payroll payments

Employers may pay their employees directly or through transfers to the employee’s bank accounts. The financial accounting department will first ensure that the company has enough cash at hand or in the account. The necessary directions are given to the bankers in the format required to process the payment of salaries. Employees are handed payslips that show them the complete details of all the calculations that went into computing their net pay. Business management software generates payroll instructions, payroll summaries and payslips quickly and speeds up the payroll payment process.

Auto-generated salary payment in TallyPrime

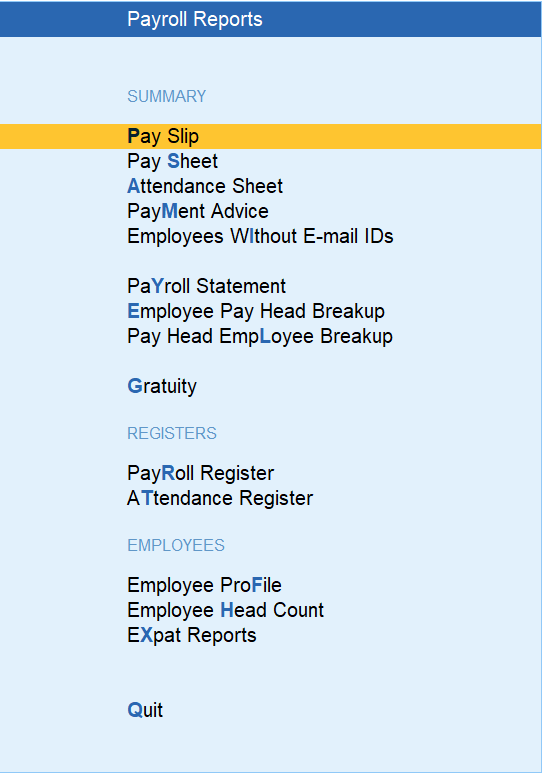

Payroll reporting

Payroll reports are compiled for management to study the different aspects of the company’s payroll. This helps the company better manage their payroll processes.

Payroll reports in TalyPrime

What are the existing taxation rules?

Oman has a taxation system that makes deductions for social security contributions. Employees contribute 7% of their wages towards Oman’s social security program. Employers contribute 10.5% of wages for social security and 1% for industrial illnesses and injuries. There is no payroll tax or sales tax in Oman. Foreign nationals are not subject to social security payments.

Oman’s social security system is under a unified system of insurance protection coverage for Gulf Cooperation Council (GCC) members and covers workers in all GCC countries.

Residency is not the determinant of corporate taxes in Oman. When you are an employer in Oman, you also have to pay corporate taxes. When a business or company provides services for 90 days or less than 12 months, it is a permanent establishment and pays corporate income taxes. All branches, companies and permanent establishments contribute 15% of their taxable income in taxes. Petroleum industries may have a few exclusions and exemptions. A 10% withholding tax is applied at source for royalty payments and management fees for companies without a permanent establishment in Oman.

The Oman payroll options

While payroll calculation is similar in most companies, Oman offers different payroll options to choose from.

Remote

Remote payroll happens when a company that is a foreign company has to pay an employee in Oman. In this case, the parent company adds all its subsidiary employees and processes payroll. However, the regulations may differ based on the actual location of each employee.

Internal

It makes excellent business sense to process payroll internally for a large number of staff. However, this requires that the company have a fully functional HR department with people who know the local laws and regulations. A good business management software with payroll management makes payroll processing easier for HR and accounting. The company may also need legal counsel and an accounting form in Oman to be compliant.

Payroll processing company

Payroll processing including payment and filing could also be outsourced for ease of operations. Payroll would have to be outsourced to an Oman payroll processing company to be compliant. But the employer is still mentioned as the employer of record and held responsible for compliance with tax, immigration, employment and other payroll regulations.

Global employer organisation or partner

Some companies use a Global Employer Organization (GEO) that acts as a local employer and ensures compliance with Oman laws and regulations. They handle payroll management, payroll processing, tax and immigration and are a quick way to employ local and foreign workers in Oman.

Why do you have to set up your Oman payroll?

Oman is attractive to many global companies and businesses who want to set up operations in the country. To do so, they may first have to ensure that they fully understand and comply with the payroll process in Oman. It is general practice to give employees a probation period of three months and also to offer fixed-term contracts. The termination process depends on the type of contract the employer has entered into with the employee, and the employee may be eligible for an indemnity payment.

Payroll management in Oman is easy when you have the right business management software. Tally is well suited to process payroll, financial accounting, and other processes in Oman.

Conclusion

Setting up, calculating and payroll management in Oman is easy when you have the right tools. TallyPrime is a business management software adaptable to Omani Rial (OMR) calculations, payroll calculations and reporting formats. It makes the data gathering and calculation steps of payroll processing efficient and accurate. It saves time and money for the company, whether it uses internal processing or is a payroll outsourcing company. TallyPrime also makes it easy to manage payroll processing for employees in different locations and who attract different types of deductions and taxation.

Explore more Products

Inventory Management Software, Accounting Software, ERP Software, VAT Software

Learn more

What are Financial Statement Notes?, How to Choose a Business Management Software in Saudi Arabia?, How to Choose the Best Free Zone for Your Business in UAE?, Checklist to Register for Trademark in the UAE, Advantages of Renting an Office Space in Dubai, How Expo 2020 will impact the economy of UAE?