Tally Solutions | Updated on: August 25, 2021

VAT Invoice is one of the key document to be issued by a registered supplier on the supply of taxable goods and services. Also, tax invoice acts as an evidence for the customer to claim input VAT deduction. Thus, it is utmost important for a taxable person to issue a VAT compliant Tax invoice in accordance with the provisions of the Bahrain VAT Law.

Non-issuance of Tax invoice in accordance with the provisions of Bahrain VAT law may attract the penalty up to BHD 500. On the other side, it will be difficult for the customer to claim Input VAT deduction.

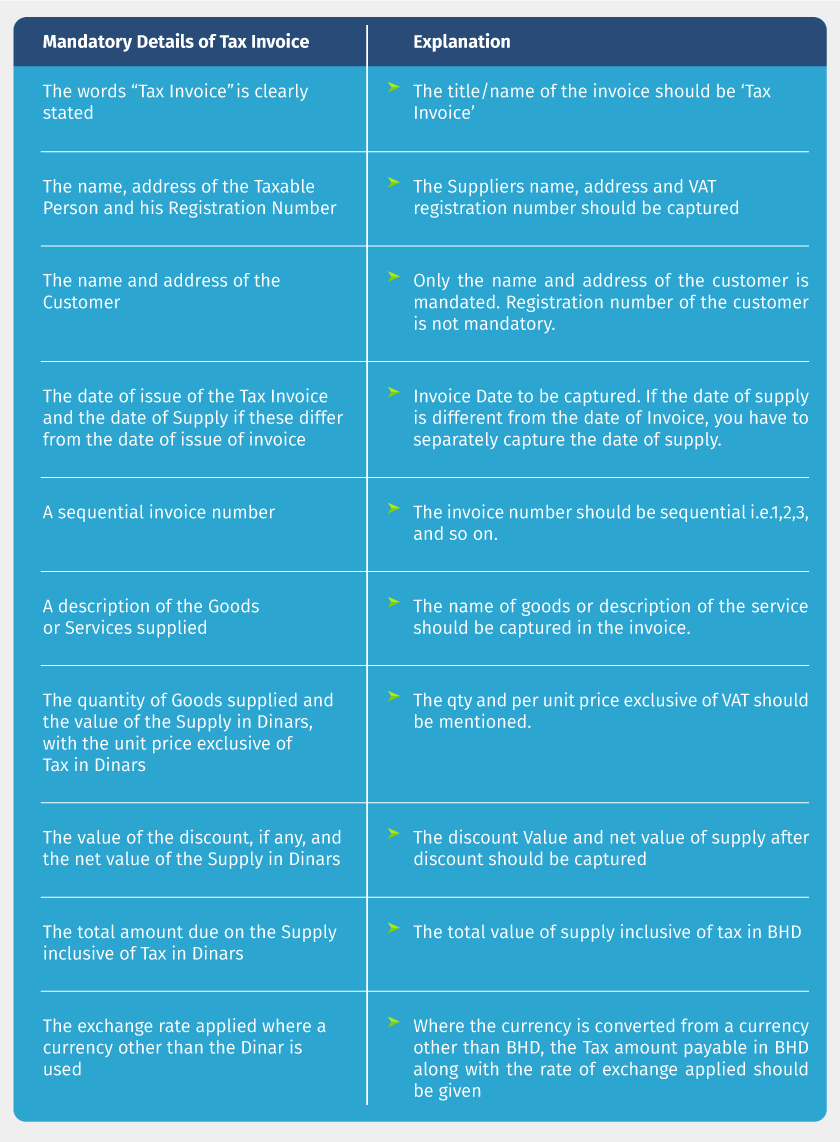

In order to ensure that you issue a VAT compliant invoice, we have prepared a quick checklist with the mandatory details to be captured in the invoice as prescribed by the Bahrain VAT Regulations:

You can download this checklist (pdf file) and start using it right away! Download

Read more on Bahrain VAT

VAT in Bahrain, VAT Invoice in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, Tax Invoice Format in Bahrain, Simplified Tax Invoice Format Under VAT in Bahrain, VAT Return Filing Period

Read more on Bahrain VAT Registration

VAT Registration in Bahrain, VAT Registration Deadline in Bahrain

Latest Blogs

How to prepare for UAE corporate tax filing?

How to Register for Corporate Tax in the UAE