VAT being a transactional tax levied on the taxable supply of goods and services, issuance of a Tax invoice is a key requirement for every VAT registered business. In our earlier article ‘VAT Invoice in Bahrain’, we had a look at different types of VAT invoices and various VAT invoicing requirements of Bahrain VAT Law. In this article, we will discuss the Invoice format and its requirements as prescribed under Bahrain VAT Law and regulations.

Tax Invoice Format

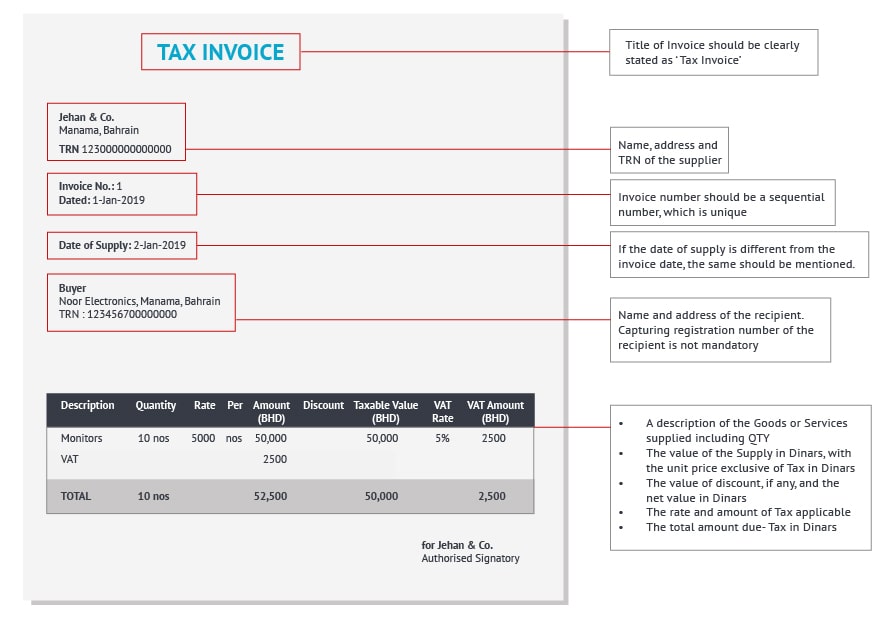

The Bahrain VAT regulation clearly prescribes the various tax invoice requirements which a VAT registered Supplier needs to comply with. Though there is no specific invoice template prescribed, however, there are various mandatory details that need to be captured in a tax invoice in accordance with the provisions of the law.

As per the mandatory details required in a Tax Invoice, a sample Tax Invoice template is shown below:

Key Points to be Noted for Issuing a Tax Invoice

The following are the key points for issuing a Tax Invoice in Bahrain:

- Mentioning VAT Registration number of the customer is not mandatory in the tax invoice. However, as a practice, it is recommended to capture the registration number so that it will be very useful for your customer in claiming Input VAT.

- The fraction of fils can be rounded off to the nearest number by applying the normal rounding off method.

- If you are issuing multiple copies of tax Invoice, in all the extra copies of a tax invoice, you should mention ’Duplicate of the original. Remember, Input Tax shall only be deducted using the original tax invoice.

- If the Invoice is issued in a currency other than BHD, the rate of exchange should be shown

Read more on Bahrain VAT

VAT in Bahrain, Vat Return in Bahrain, VAT Return Format in Bahrain, How to file VAT Return under Bahrain VAT, What is VAT and how does it work in Bahrain, VAT Rates in Bahrain, VAT Return Filing Period, Credit Note under Bahrain VAT

Read more on Bahrain Tax Invoice

VAT Invoice in Bahrain, Simplified Tax Invoice Format Under VAT in Bahrain, Checklist for Tax Invoice in Bahrain

Read More on Bahrain VAT Registration

VAT Registration in Bahrain, VAT Registration Deadline in Bahrain