Have you ever felt overwhelmed juggling so many invoices every month? Now imagine, on top of that, receiving invoices that don’t even belong to you, or ones with the wrong amount. Frustrating, right? If you accept such invoices by mistake, it could affect your Input Tax Credit (ITC) and cause issues during your GST filing.

That’s where the Invoice Management System helps you to easily review and reject invoices that are incorrect, duplicate, or not related to your business. Let’s understand when and why you should reject an invoice, how it affects your Input Tax Credit (ITC), and how to avoid costly mistakes.

Why should you reject an invoice?

Handling invoices every month can be overwhelming. You might think, ‘If an invoice shows up, it must be valid—right?’ Not always. Just because an invoice appears in your system doesn’t automatically mean it’s correct, or it should be accepted.

Let’s understand when to hit “Reject” on an invoice:

- Wrong GSTIN or Business Name: Invoice is issued to a different business. It doesn’t belong to you.

- Duplicate Invoice: You’ve already received and recorded this invoice before. No need to count it twice!

|

IMS Guide This all-in-one guide covers everything you need to know about IMS. Download now to get started. |

TallyPrime IMS hands-on experience Try this interactive demo to see how TallyPrime IMS helps you monitor vendor sales in real time and simplify ITC and GST compliance. |

- Tax Amount Doesn’t Match: The tax charged is different from what you agreed upon in your purchase order.

- Transaction Was Cancelled: The deal never went through, or the goods/services were never delivered.

- Not Eligible for ITC: The invoice doesn’t meet the rules under GST law, so you can’t claim tax credit on it.

When should you reject an invoice?

You need to take timely action when rejecting incorrect invoices. If you fail to do so, the system will treat the invoice as accepted by default, and it will automatically be included in your GSTR-2B.

Key points to remember:

- Reject it before the 14th of the next month – before GSTR-2B is generated. If you reject it before then, it won’t be included.

- If the invoice is rejected after the 14th but before filing GSTR-3B, you can still update and recompute your GSTR-2B to reflect the changes accordingly.

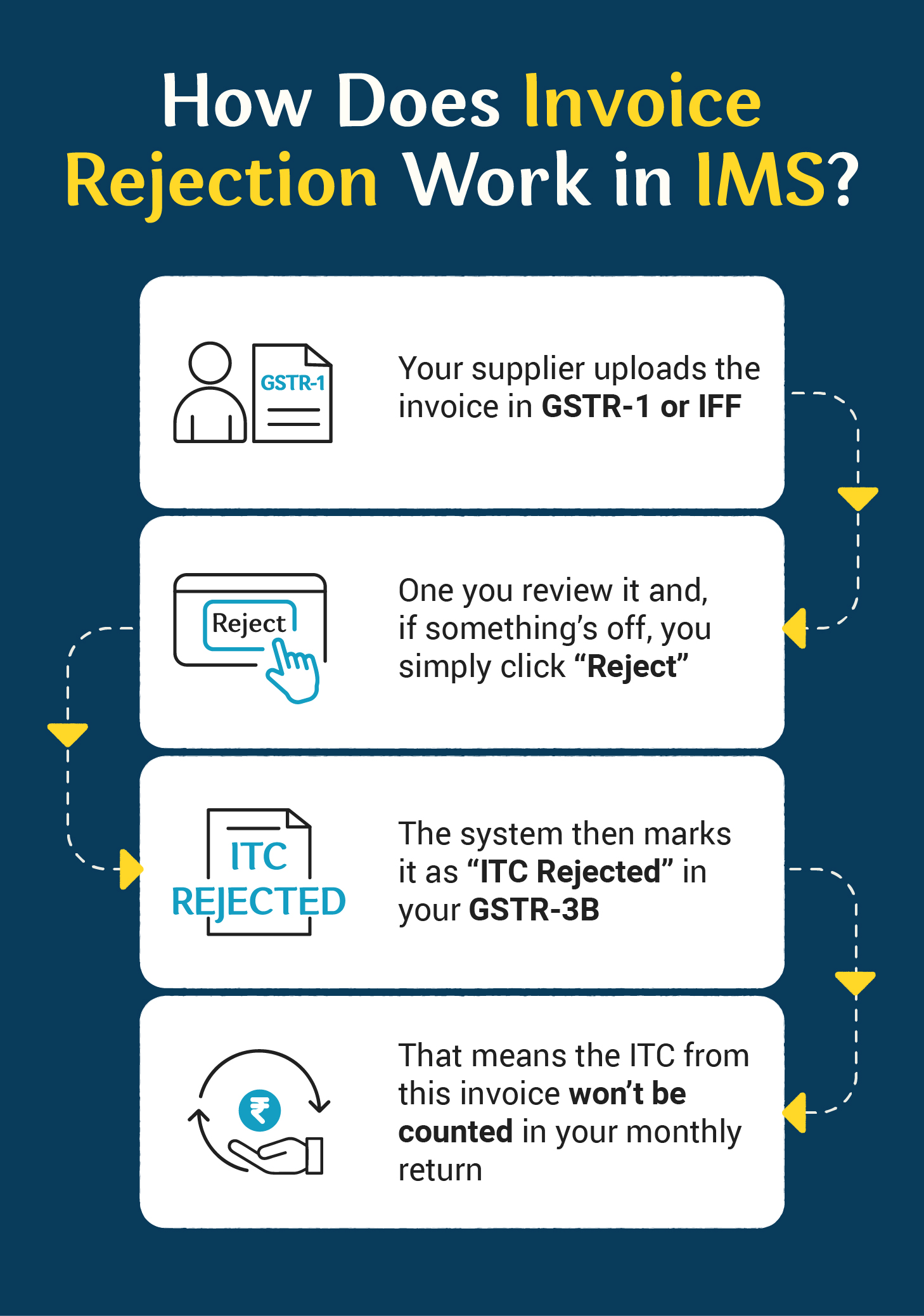

What happens when you reject an invoice?

You might wonder what happens to invoices once they are rejected. When a supplier uploads an invoice in GSTR-1 or IFF, it appears on your IMS dashboard. If the invoice has issue, you have the option to review and reject it. Once rejected, it is marked as “ITC Rejected” in your GSTR-2B, ensuring that the Input Tax Credit (ITC) from that invoice is excluded from your monthly return.

Impact on GSTR-2B and 3B

Even though the invoice appears in GSTR-2B, the system recognizes that it has been rejected and excludes it from the ITC calculation in GSTR-3B.

By marking an invoice as rejected, the ITC claim for that invoice is marked as ineligible for the corresponding month. As a result, such invoices are listed under the ‘ITC Rejected’ section and are not considered for ITC computation in GSTR-3B.

|

Action |

Shows in GSTR-2B? |

Eligible for ITC? |

|

Accepted |

Yes |

Yes |

|

Rejected |

Yes (flagged) |

No |

Impact on Supplier

When you reject an invoice, it also reflects on your supplier’s IMS portal. Based on the timing and reason for rejection, the supplier needs to take the following steps to amend the invoice:

- Rejection before supplier files GSTR-1

If you reject the invoice before the supplier files their GSTR-1, they can easily edit the record and upload a revised version. The updated invoice will then appear in your IMS portal for review.

- Rejection after GSTR-1 is filed by the supplier

If the invoice is rejected after the supplier has filed their GSTR-1, they need to amend or add the invoice in GSTR-1A or in the next GSTR-1/IFF with the necessary corrections. Once amended, the updated invoice will be visible in your IMS portal.