- What is FORM GST ANX-2?

- What are the contents of FORM GST ANX-2?

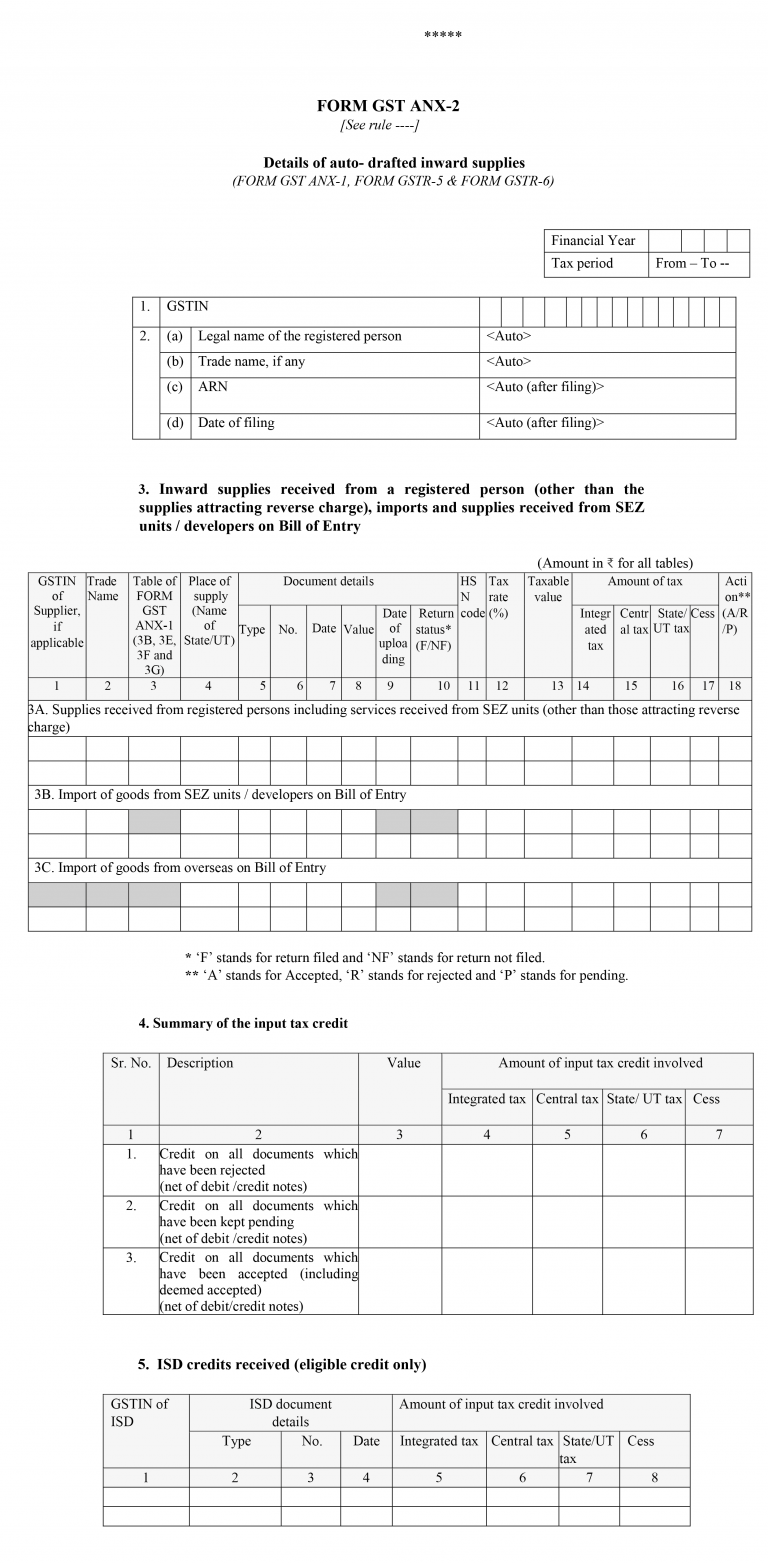

- What is the format of FORM GST ANX-2?

- What should taxpayers keep in mind as they file their FORM GST ANX-2?

Under the New GST Return System, there will be one main return called the FORM GST RET-1 and two annexures i.e. FORM GST ANX-1 and FORM GST ANX-2. The return will have to be filed on a monthly basis, except for small taxpayers (taxpayers with a turnover up to Rs 5 crore) who can opt for the quarterly filing of returns.

What is FORM GST ANX-2?

FORM GST ANX-2 is an annexure to the main return FORM GST RET-1, and will have all the details of inward supplies, for the recipient of supplies to take action by either accepting or rejecting these documents, or marking them as pending, for action to be taken later. If the recipient accepts these documents, it means that the supplies reported in such documents by the suppliers in FORM GST ANX-1 are correct.

What are the contents of FORM GST ANX-2?

GSTIN: A taxpayer needs to input the GSTIN.

Basis details: Basic details such as trade name, legal name, etc. will be auto-populated on the basis of the GSTIN.

Inward supplies received from a registered person (other than the supplies attracting reverse charge), imports and supplies received from SEZ units / developers on Bill of Entry: The details will be entered as follows-

|

Table No. |

Name of the Table |

Instructions |

|

3A |

Supplies received from registered persons including services received from SEZ units |

The details in these tables will be auto-populated from the following tables of the supplier’s FORM GST ANX-1 return: 3B – Supplies made to registered persons 3E – Supplies to SEZ units/developers with payment of tax 3F – Supplies to SEZ units/developers without payment of tax 3G – Deemed exports The recipient has the option to take action on the documents by either accepting, rejecting or marking them as pending. |

|

3B |

Import of goods from SEZ units/developers on Bill of Entry |

|

|

3C |

Import of goods from overseas on Bill of Entry |

|

|

4 |

Summary of the input tax credit |

This will be the total figure of input tax credit for the return filing period, based on action taken by the recipient of supplies such as: Total credit on all documents that have been rejected Total credit on all documents that are kept pending Total credit on all documents that have been accepted |

|

5 |

ISD credits received |

This table is for reporting eligible input tax credit that has been received from an input service distributor. This needs to be entered document-wise. |

What is the format of FORM GST ANX-2?

Key things for taxpayers to keep in mind while filing GST ANX-2

- The supplier can upload documents continuously and on a real-time basis in FORM GST ANX-1 and will be auto-populated in this annexure i.e. FORM GST ANX-2

- The details of the documents uploaded by the supplier shall be available for the recipient in FORM GST ANX-2 to take action such as to accept, reject or to keep the document pending

- If a document is accepted by a recipient, it means that the document has been received before the recipient has filed his return and that the details reported by the supplier are correct

- Any corrections in the rejected documents can be made only by the supplier through his FORM GST ANX-1

- If a recipient marks a document as pending, this means he has deferred his action on the said document for a later date, of either accepting or rejecting the document. Input tax credit on these documents will not reflect in the main return i.e. FORM GST RET-1

- The supplier cannot amend pending invoices until they are rejected by the recipient

- The status of whether the supplier’s return is filed or not will be made known to the recipient in his FORM GST ANX-2. However, this does not affect the eligibility of the input tax credit available to the recipient, which will be decided as per the Act along with the rules made thereunder

- A separate functionality will be available to search for and reject an accepted document, on which credit has already been availed. This credit will be shown under reversal in table 4B(1) of FORM GST RET-1, which can be adjusted in table 4A(11) of the same return, in order to arrive at the amount of input tax credit that has been availed

- FORM GST ANX-2 will be deemed filed based upon the filing of the main return i.e. FORM GST RET-1 relating to the particular tax period

- If documents have been uploaded by a supplier in his FORM GST ANX-1, but he has not filed his return for the previous two consecutive periods, then the recipient will not be able to take credit on these documents even if the same is made available to him in his FORM GST ANX-2. However, the option will be available to reject or keep these documents pending. For suppliers who file their returns quarterly instead of monthly, then the term ‘two consecutive periods’ are replaced by ‘one quarter’