1. Introduction to E-way Bill Portal

In GST regime, a nationwide E-way Bill portal namely www.ewaybillgst.gov.in has been implemented w.e.f. 01.04.2018 for inter-State movement of goods across the country and intra state movement of goods was proposed to be monitored through the same portal but not later than June 1, 2018.

2. Information That E-way Bill Portal India Carries

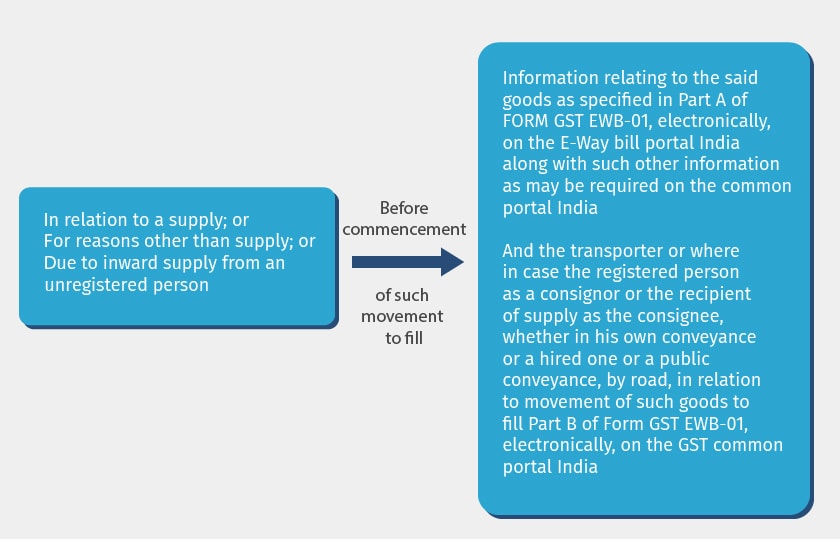

Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees, is liable to generate an e-way bill:

3. Registration On E-way Bill Portal India

- Registration on www.ewaybillgst.gov.in is not to be understood as registration under section 22 because persons who are already registered under section 22 are required to register on the E- Way Bill Portal as well.

- Registration on the GST Common portal India merely refers to creation of user login for use of its features.

The following can Register and use E-Way bill portal:

- Registered dealer

- Citizen/Unregistered dealer

- Transporter (Registered under GST as well as unregistered transporters)

Note: Citizen / Unregistered Dealer registration process is not provided yet on the portal

4. Format Of E-way Bill On E-way Bill Portal

The E Way bill on GST Portal India looks like this:

|

Part A |

Particulars |

Explanation |

|

A. 1 |

GSTIN of Supplier |

|

|

A. 2 |

Place of Dispatch |

Place of dispatch shall indicate the PIN Code of place of dispatch |

|

A.3 |

GSTIN of Recipient |

|

|

A.4 |

Place of Delivery |

Place of Delivery shall indicate the PIN Code of place of delivery |

|

A.5 |

Document Number |

Document Number may be of Tax Invoice, Bill of Supply, Delivery Challan or Bill of Entry. |

|

A.6 |

Document Date |

|

|

A.7 |

Value of Goods |

|

|

A.8 |

HSN Code |

HSN shall be indicated at : a. minimum two digit level for taxpayers having annual turnover up to Rs. 5 crore in the preceding financial year b. our digit level for taxpayers having annual turnover above five crore rupees in the preceding financial year. |

|

A.9 |

Reason for Transportation |

Reason for Transportation shall be chosen from one of the following:- a) Supply ; b) Export or Import; c) Job Work ; d) SKD or CKD; e) Recipient Unknown; f) Line Sales; g) Sales Return; h) Exhibition or fairs ; i) For Own Use; j) Others |

|

Part B |

Particulars |

Explanation |

|

B.1 |

Vehicle no. for Road |

|

|

B.2 |

Transport Document Number |

Transport Document number indicates Goods Receipt Number or Railway Receipt Number or Forwarding Note number or Parcel way bill number issued by railways or Airway Bill Number or Bill of Lading Number |

5. Registration: Regular Dealer On GST Common Portal India

|

Step 1 : |

Login www.ewaybill.nic.in |

|

Step 2 : |

Enter the GSTIN Number and Click on “Go” to submit the request |

|

Step 3 : |

Validate & Update Details |

|

Step 4 : |

Click on Send OTP & Verify OTP |

|

Step 5 : |

Set User Name & Password of user choice |

|

Step 6 : |

Registration process on GST E-Way bill portal is complete. |

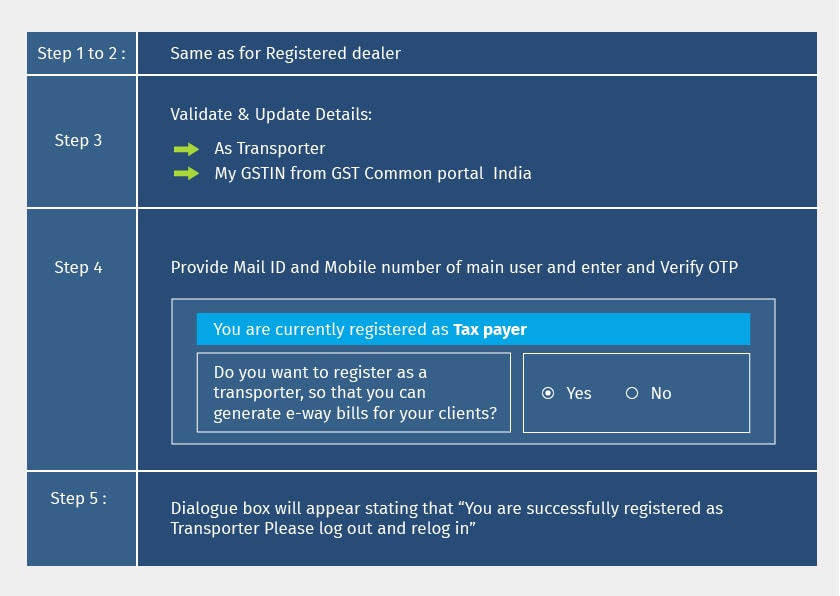

6. Registration ON E-way Bill Portal: Registered Transporters

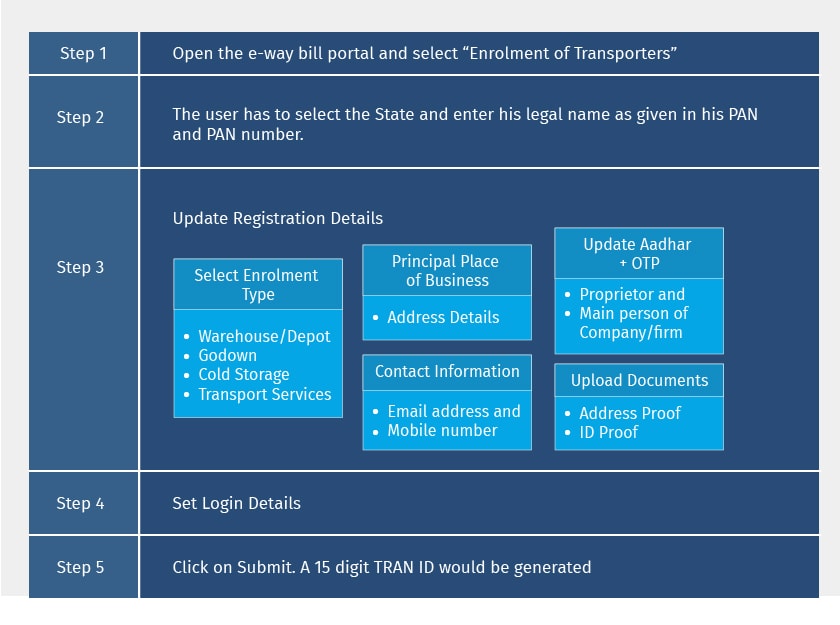

7. Registration On E-way Bill Portal: Unregistered Transporters

Know More about E-Way Bill

E-Way Bill, E-Way Bill Rules, E-Way Bill Verification, GST Exemption list for E-Way Bill, How to Generate E-Way Bill, E-Way Bill State Wise, How to Register E-Way Bill, How to Generate Bulk E-Way Bill, How to Cancel E-Way Bill, Minimum Distance required for E-Way Bill

GST

GST Software, GST Calculator, GST Exempted Goods & Services, GST Rates, HSN Codes, SAC Codes, GST State Codes, New GST Returns & Forms, Sahaj GST Returns, Sugam GST Returns