- Introduction

- Singular Study to Understand the Difference Between VAT and GST

- What is the Main Difference Between VAT and GST

- Are VAT and GST the Same?

Introduction

Goods and Service Tax India is a reality today and it has brought the Indian taxation system under its unique ideology ‘one nation, one tax’.

The rise of GST has subsumed all the indirect taxes in India, including Value Added Tax (VAT), Service tax, Excise duty, and Octroi. These various forms of indirect taxes and VAT were levied on each step of value addition of the product, thus creating a cascading effect.

The game of GST was introduced to bring down unwanted inflation in the economy. Both these taxes are levied on the value of sale or supply of goods. But still, there are lots of differences between VAT and GST India.

Singular Study to Understand the Difference Between VAT and GST

- What is VAT? Every commodity passes through different stages of production and distribution before finally reaching the consumer. At each stage of the production, value addition is made in the distribution chain. And Value Added Tax (VAT) is a tax on this value addition at each stage.

A dealer under VAT collects tax on his sales, retains the tax paid on his purchase and pays the balance to the government. Value Added Tax is a consumption-based tax because it is borne ultimately by the final consumer.

- What is GST? Goods and Service Tax which was introduced as a new league in the indirect taxation system replaced all most all Indirect Taxes in India. The Act which came into effect on 1 st July 2017 is a comprehensive, multi-stage, destination-based tax that is levied on every value addition.

Under GST, the tax is levied at every point of sale. In the case of inter-state sales, Integrated GST will be levied and in case of intrastate supplies, CGST and SGST will be charged.

What is the Main Difference Between VAT and GST

The main differences between VAT and GST could be understood from the following table

|

Point of difference |

Scenario under VAT law |

Scenario under GST Law |

|

Taxable Event |

Is on sale of goods |

Is on every supply and supply includes goods and services. |

|

Rates of Taxes and Laws in each state |

· Different VAT rates in each state. · Different VAT laws for each state. |

· Uniformed tax rates across India · For States we have State GST Act (SGST), for centre we have Central GST Act (CGST) and for supplies made between the states we have Integrated GST Act (IGST) and for Union territories involved in a supply transaction, we have Union Territory GST Act (UGST). |

|

Authority over taxes |

· Is a levy collected by respective state governments · Here the state government s have authority over the tax proceeds collected by such levy. |

· Whereas Goods and Service Tax is collected under SGST and CGST for every sale from the same state. · The corresponding centre and state amount then gets bifurcated. |

|

· Taxpayers can claim the credit of tax by netting the VAT liability with input VAT on goods purchased and from output VAT on goods sold. · The corresponding centre and state amount then gets bifurcated. |

· GST is a tax levy on Goods and services as well. A taxpayer can claim the credit on supplies (Goods and Services) received by him to be used or intended to be used in furtherance of business operations. · Subsuming of taxes into one pot of GST has made available the usage of credits at one place to be used in the returns. |

|

|

Compliances |

Movement of goods : · Different set of compliances for the movement of goods between states. · Preparation of various forms for moving the goods from one state to other. Returns : · Different returns in different states. So many annexures return to be prepared. · Concept of auto-populated return for inward supplies as in GST was absent under VAT law. Because there was no technology and ideology which is present today in GST act present back then. |

Movement of goods : · Unified set of compliances for movement of goods between states · Preparation of one e-way bill which is valid across India. Simplified Returns : |

Are VAT and GST the Same?

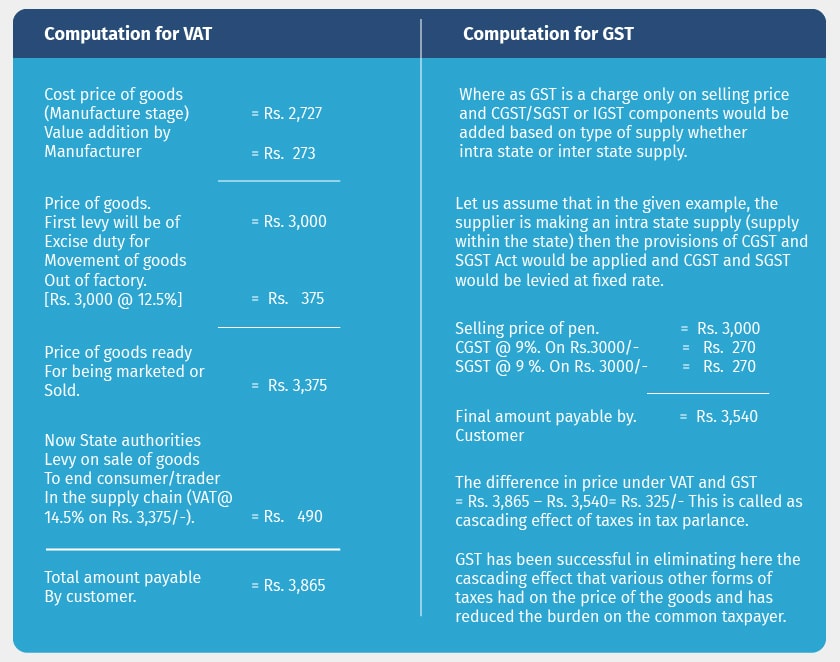

Though going by the words of many eminent economists, VAT and GST are just two names for one tax, but on evaluating minutely, one observes the contrast clearly. Let us take an example and arrive at a conclusion whether VAT and GST are really the same.

Ex : Manufactured cost of a pen = Rs. 2,727/- ; Margin added by manufacturer at time of sale = 10% = Rs. 273 (value addition by manufacturer) ; Excise duty leviable on the product @ 12.5% = Rs. 375/- ; VAT levied by State authority @ 14.5 % on ?

Let us now compute using the following information at hand and arrive at the GST vs. VAT calculation to understand the difference between VAT and GST

Watch Video Explanation on GST vs. VAT