- Creation of IGST Ledger

- Creation of CGST Ledger

- Creation of SGST Ledger

- Creation of Cess Ledger

- Highlight of Exceptions and Errors

- SGST Ledger Creation Screen with Percentage

In this episode we will understand, creating and managing of GST ledgers in Tally. You only need 4 types of ledgers for GST in Tally, Viz., IGST, CGST, SGST & Cess. Tally will take care of all percentage of tax rate and it will also handle Input GST and GST liability.

Tally can also allow users to create separate ledger for each rate of GST and wants to have ledgers for input and output GST differentiated, can also be created. We shall see the type of ledgers you can create from different users’ requirements.

Firstly, we shall read the creation of simple GST ledger and key components to be captured for right GST ledger creation.

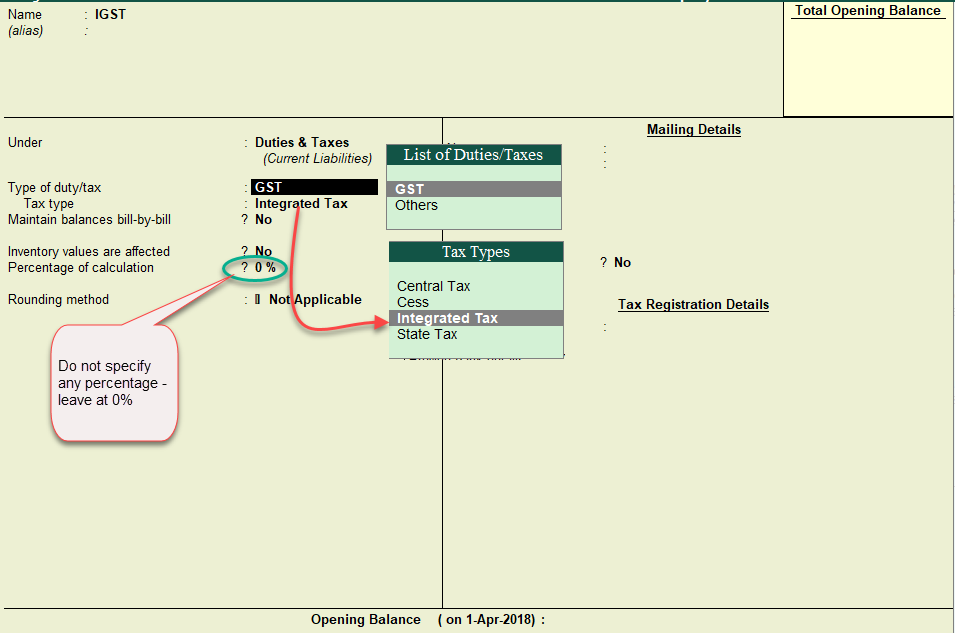

Creation of IGST Ledger

Steps to configure in Tally

- Gateway of Tally -> Accounts Info -> Ledger -> Create

- Name -> Enter the name as IGST

- Under -> select -> Duties & Taxese

- Tax Type -> Select -> Integrate Tax

- Percentage of Calculation -> Do not add any percentage, leave it at 0%

Note: The reason for not specifying the percentage in the ledger is, if you remember in our earlier series, we have mentioned about the ‘Tally’s Hierarchy & Inheritance’. Hence, base on the GST percentage specified at the company level or stock Group Level or stock item level, Tally will compute the percentage of GST accordingly.

Similarly, CGST, SGST and Cess ledgers are created

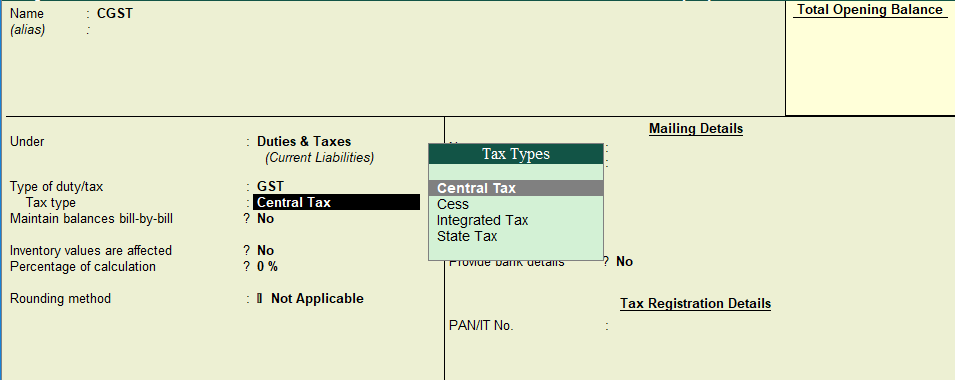

Creation of CGST Ledger

Steps to configure in Tally

- Gateway of Tally -> Accounts Info -> Ledger -> Create

- Name -> Enter the name as CGST

- Under -> select -> Duties & Taxes

- Tax Type -> Select -> Central Tax

- Percentage of Calculation -> Do not add any percentage, leave it at 0%

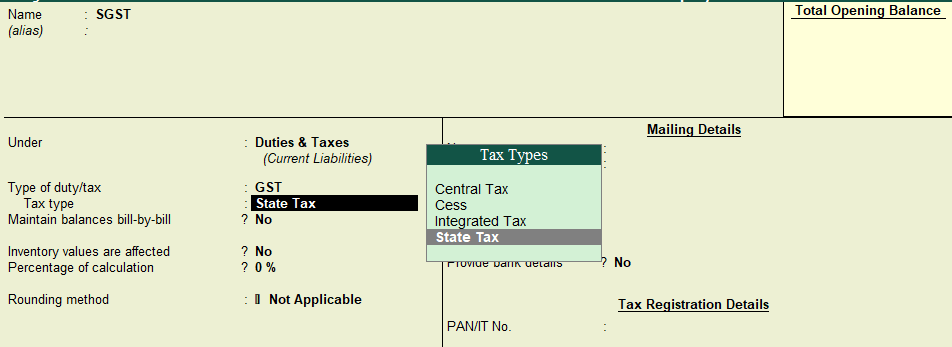

Creation of SGST Ledger

Steps to configure in Tally

- Gateway of Tally -> Accounts Info -> Ledger -> Create

- Name -> Enter the name as SGST

- Under -> select -> Duties & Taxes

- Tax Type -> Select -> State Tax

- Percentage of Calculation -> Do not add any percentage, leave it at 0%

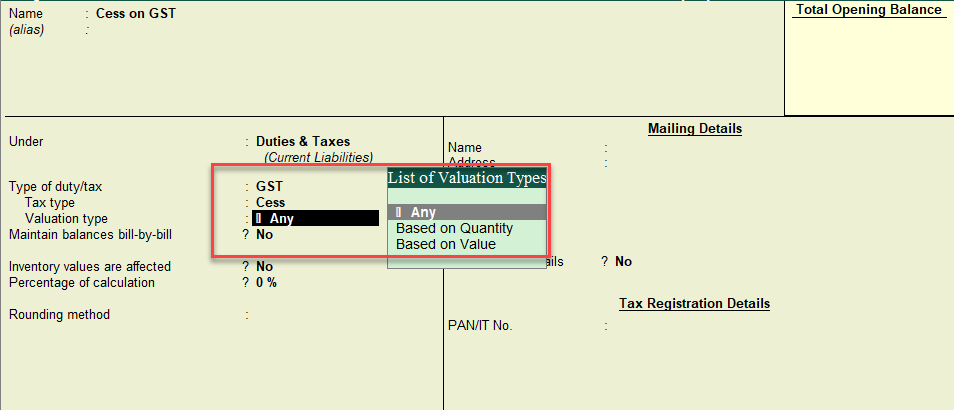

Creation of Cess Ledger

Steps to configure in Tally

- Gateway of Tally -> Accounts Info -> Ledger -> Create

- Name -> Enter the name as Cess on GST

- Under -> select -> Duties & Taxes

- Tax Type -> Select -> Cess

- Valuation Type -> select ‘Based on Value’ or ‘Based on Quantity’ as applicable (Note If you select ‘Any’ then you can have common Cess ledger and can select either ‘Based on Quantity’ or ‘Based on Value’ during the voucher entry)

- Percentage of Calculation -> Do not add any percentage, leave it at 0%

Highlight of Exceptions and Errors

Type of Duty and Tax Type: While create GST ledger it is important to select Type of Duty/Tax as ‘GST’ and the appropriate ‘Tax Type’, for example, while creating ‘CGST’ ledger the ‘Tax Type’ need to be ‘Central Tax’. In case, if wrong tax type is selected, then Tally will not compute tax.

(Note: Once the GST is configured in Tally, and in purchase invoice or sales invoice after selecting GST ledger, if Tally does not auto compute tax, it denotes that there are some errors in configuration of the masters)

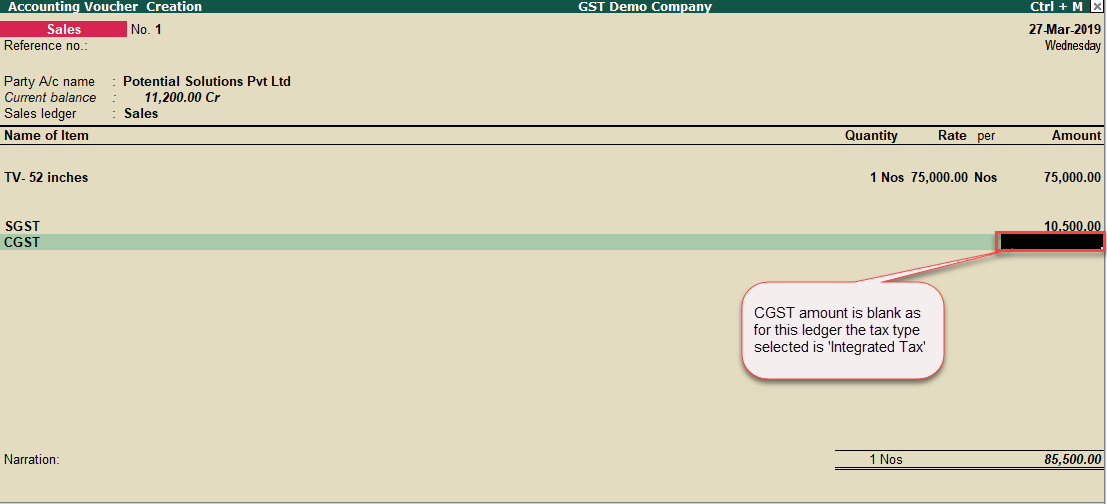

Let us take a Use case scenario:

The user has created GST ledgers, such as, CGST ledger but wrongly selected the tax type as ‘Integrated Tax’, and another ledger SGST and correctly classified under ‘State Tax’.

The user is raising an Intra-State tax invoice. After selecting the items and respective sales ledgers, he selects, CGST ledger, but the amount is not auto computing.

The reason being, Tally will determine the appropriate GST based on the Place of Supply, in case of Intra-State Supply, when CGST with central tax and SGST with state tax is selected, Tally will auto calculate.

In this case though the user has created a ledger in the name of ‘CGST’ but has wrongly selected the tax type as Integrated Tax. Hence, tax is not computed automatically. Tally will also not auto compute tax if both the ledgers selected are classified under Central Tax or State Tax, only one ledger will compute tax, which is either central or state and the other same tax type will not auto calculate.

Similarly, if the IGST ledger is not classified under ‘Integrated Tax’, you will not have tax calculated automatically.

In all the above case, you will have to revisit the GST ledgers, and ensure the tax types are selected correctly.

Error in wrong classification of CGST ledger to Integrated tax:

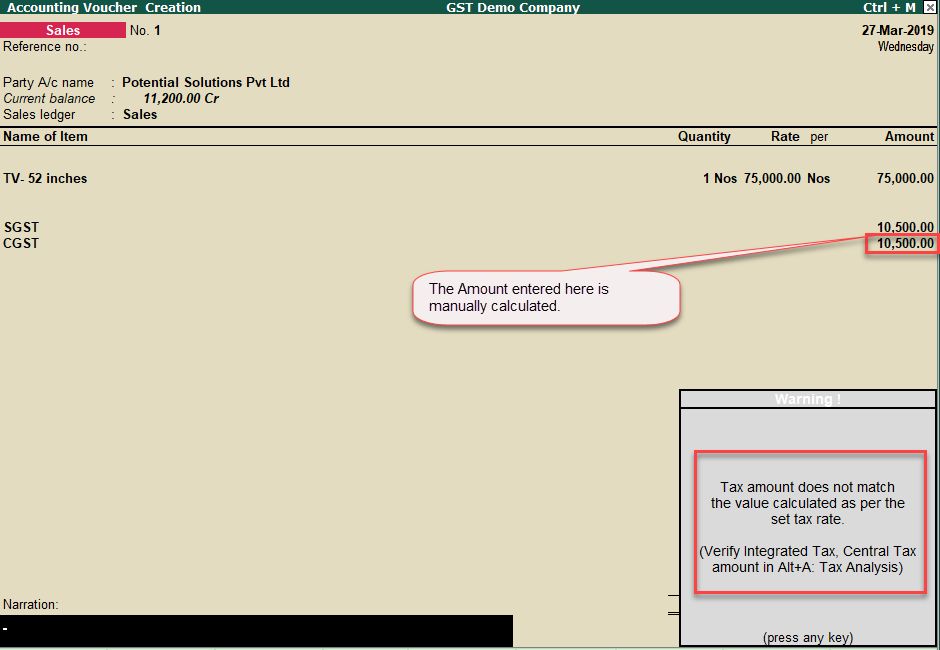

Note: In case the user, manually enters the amount and while saving the voucher, Tally will warn for mismatch of tax in the voucher.

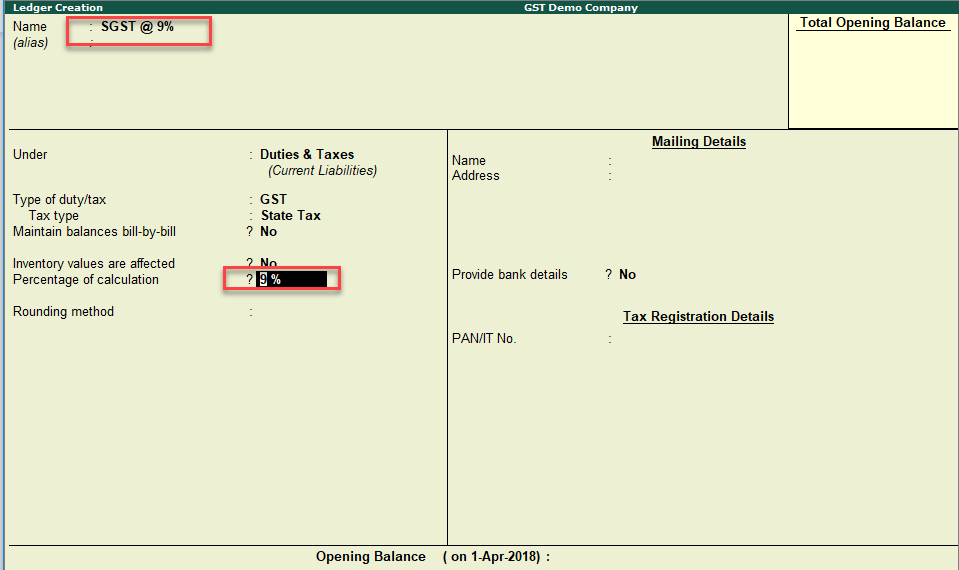

Rate- wise GST Ledger creation

In Tally you can create GST ledgers GST rate wise and specify the percentage of tax in the percentage of calculation column

SGST Ledger Creation Screen with Percentage

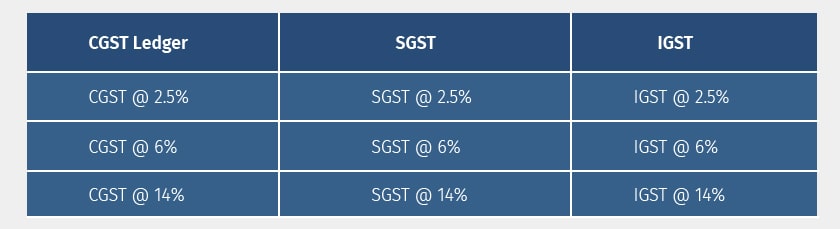

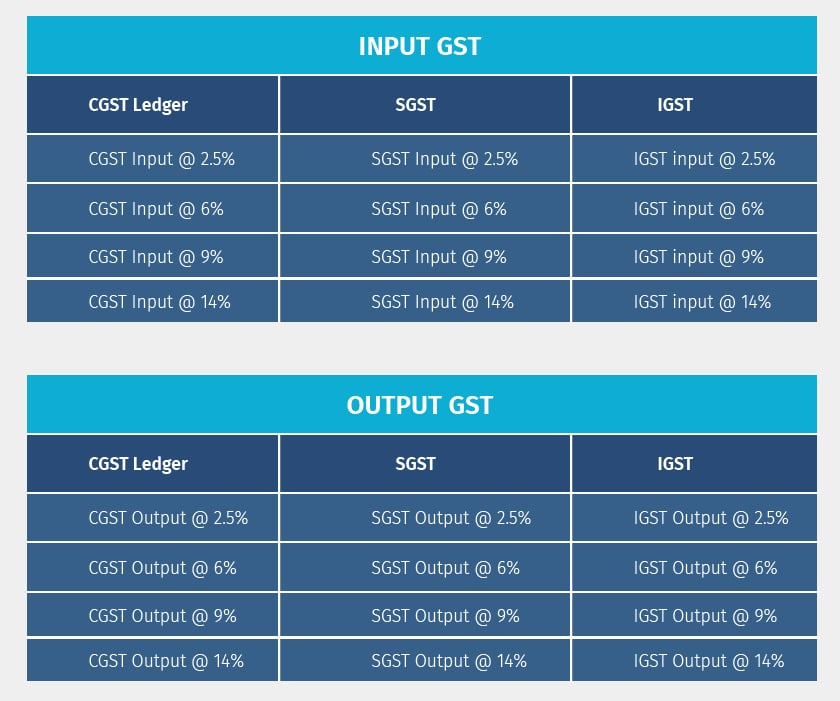

Similarly, other rate of GST ledgers can be created like

Another way of creating GST ledgers are as follows:

Note

- If the user has created rate wise GST ledgers, during sales or purchase entry, appropriate GST rate ledger need to be selected for auto computation of GST. Example, Item being sold has GST rate of 18%, but during the transaction, if CGST @ 6% or SGST @ 6% is selected, the value of tax will not be calculated.

- If GST ledgers are created based on categorization of ‘Input’ and ‘Output’, they it is important to select the all input GST ledgers for ‘Inward Supply’ and all output GST ledgers for ‘Outward Supply’, for the user to have correct analysis and maintenance of ledger balances.

Irrespective of the method in which the user wants to maintain GST ledgers, important thing to remember is the selection of the right ‘Tax Type’ for proper compliance of the user’s data.

In our next series we shall discuss on GST module ‘Design Principles’ to avoid errors in master configuration and while passing transactions.