Account receivables refer to the outstanding invoices or money which is yet to be paid by your customers. Until it is paid, such invoices or money is accounted as accounts receivables. Also known as bills receivables. You need cash all the time to keep your business running smoothly and ensuring the accounts receivables are paid on time is essential to manage cash flow efficiently.

It’s often said that ‘’if your customer owes you a hundred thousand, they have a problem, but if they owe you a million then it’s your problem’’. The first part of the above saying implies that your customer not paying a few hundred is an exception which is due to the inability of the customer to pay you back. But the next part of the statement sounds risky to the business. It clearly highlights the inefficiencies of business in managing the accounts receivables of your customer which has led to the pile-up of receivables.

As you know, accounts receivables are one of the key sources of cash inflow, any inefficiency in managing accounts receivables will impact your business in several ways and potentially hamper the growth of the business.

While we all know this, one of the key challenge businesses face is to make the customer pays bills on-time. In this article, we are sharing 6 key tips for managing account receivables efficiently and to get rid of unpaid bills.

Tip-1 Keep clean track of bills

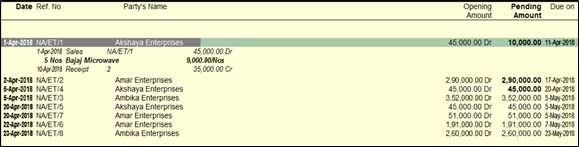

One of the key essentials for managing accounts receivables efficiently is to keep a clean track of bills that are accounted as accounts receivables. Bill-by-bill tracking i.e. tracking of each sales invoice and mapping with the subsequent receipts received from the customer will help keep the bills clean and easily track the accounts receivables.

By having a clean track of accounts receivables help in healthier customer relationship and settling the disputes easily.

Illustration of bill-by-bill accounts receivable management

Tip-2 Keep a close eye on long-pending bills

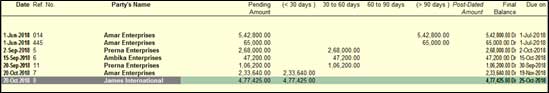

The longer an invoice sits as accounts receivable will block the cash inflow and if not tracked regularly, it may turn into bad debt. It's very crucial for you to keep a close eye on the ageing of bills. Most of the businesses prepare an ageing analysis of accounts receivables to identify the bills which are pending from long-time and accordingly schedule their collection.

Illustration of ageing analysis of accounts receivable

If you look at the above illustration, the ageing analysis of accounts receivables clearly indicates bills which older by more than 90 days. This gives you instant insights about the bills which you need to immediately follow-up to get it paid.

Tip-3 Payment performance of your customer

Payment performance of customers' is the average number of days the customers take to pay their bill. This is also known as receivable turnover in days or debtor collection days. Higher debtor collection days means the business must invest more cash into its unpaid accounts receivables. On the other side, a lesser number of debtor collection days implies that bills are paid faster by your customer and therefore more cash is made available for use.

It is also quite possible that the receivable turnover is low and the payment performance is high, indicating that the customers cleared their outstanding but took a long time to do it.

Therefore, periodically tracking the payment performance of your customers will help you to identify the customers who have a poor payment record and accordingly plan.

Tip-4 Collection schedule and following up

Regularly preparing the collection schedule and following up with the customers will play a vital role in getting bills paid faster. Using ageing analysis of accounts receivables will help in preparing the collection schedule with a list of customers whose bills are overdue. e-Mailing reminder letters with details overdue bills will be very handy to follow up with the customers.

Tip-5 Internal credit control techniques

To ensure better credit management, you can define maximum Credit Limit based on the credibility, the volume of transactions, the capacity of repayment etc. for your customers. This will help business owners to avoid overselling to a customer beyond the defined credit limit. Also, having an internal alert system to notify the overdue bills during invoicing will help the business.

Tip-6 Use accounting software to manage accounts receivables

We all know, efficient accounts receivables management is the key for faster realization of your sale to cash and provides much-needed cash inflow for your business for growth and expansion. Using accounting software to manage accounts receivables will help in better tracking of bills, faster payments, healthier customer relationship and better cash flow to the business. By using accounting software, it saves time and efforts involved in manually dealing with accounts receivables, easy to track the pending invoices and real-time status of accounts receivables and ageing of bills.

Now you know the ways to manage accounts receivables efficiently and how it helps in managing healthier cashflow, it's important to know far more ways and tips to increase to cash flow into the business. Read our next article '6 Tips to Manage Cash Flow'.