- What is negative cash flow?

- Is negative cash flow bad?

- What are the reasons for negative cash flow?

- How does negative cash flow affect small businesses?

- 4 ways to recover from negative cash flow

What is negative cash flow?

Cash flow is the real cash that is available in your business. Negative cash flow is when your business is spending more than it is earning in a given period. For example, let us say your revenue was $20,000 in August and your expenses were $25,000 during the same month. This means you had a negative cash flow of $5,000 in August. Almost all businesses have negative cash flow at some point because the expenditure exceeds revenue. Negative cash flow is normal as long as it isn’t long term. If you feel your business is experiencing unmanaged negative cash flow for months on end, it is time to make changes before you incur losses and have to sell your business.

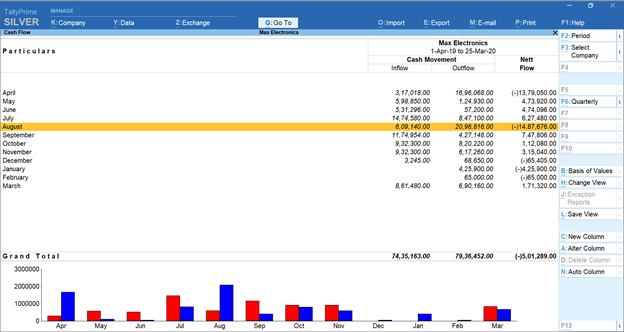

Monthly cash flow report in TallyPrime showing positive and negative cash flow

Is negative cash flow bad?

Negative cash flow is not bad if it is short-term. However, trouble arises when your business has negative cash flow for a long time. Startups are likely to experience negative cash flow in the initial months of their operations because they have just invested in resources and they are yet to make profits. However, that doesn’t mean that well-established businesses won’t have a negative cash flow situation. Many businesses have periods when their expenses are surpassing their revenue but they are doing well because they are making profits at other times of the year. Seasonal products and expansion to new markets are some reasons why a business can experience a negative cash flow.

What are the reasons for negative cash flow?

Negative cash flow can occur due to a variety of reasons. Some of the most common are as follows.

Lack of financial planning

Financial planning is vital for businesses to sustain in the long run. If you don’t review and analyze your cash flow statements, then you will have negative cash flow sooner rather than later. For example, if you invest the profits of the previous month and you realize you are unable to meet your target this month, this can lead to negative cash flow. Spending and investing without planning can have grave ramifications for your small business. You need to plan every small move to ensure your business stays afloat even in unpredictable times.

Sudden expenses

Planning is great but it is impossible to predict everything that can happen to your small business. Perhaps a natural disaster occurred and your office furniture was damaged. Such unforeseen expenses can occur without a warning and those businesses which don’t save for such expenses often then experience negative cash flow. It can also occur when despite planning, you ended up spending more than you expected. Such expenses, if they occur now and then, can be managed. However, if the expenditure amount is too high, your business might have negative cash flow for a long time.

Incorrect product pricing

Product pricing can influence your profit and cash flow. If you are selling a product at the optimal rate, you will enjoy high profits and a positive cash flow statement. However, if you are charging much less than you should, you are not earning enough profits even though you may be making loads of sales. Product pricing is tricky business. But as long as you know how to balance value and price, you will do fine. A negative cash flow can be the case when you discount your products thereby lowering the value of your product and not many people buy it because they have better options elsewhere.

Investing too much or too often

While it is a good idea to invest even if you are a small business, it isn’t always a wise decision to do so. Sometimes overinvesting can become an issue which can lead to negative cash flow. Let us say you think that investing in a new machine will bring in profits. However, you soon realize that the upkeep of the new machine is exceeding your expectations and incurring more recurring expenses. This can cause problems down the line especially if you cannot replace or return the machine. Investing in too many places can also lead to negative cash flow.

Inefficiency in accounts receivables management

The lack of managing accounts receivables can lead to negative cash flow sooner rather than later. If you are not on top of your accounts receivables management, then you are in trouble. Accounts receivables is the foundation of cash inflow. Delay in tracking account receivables is not good because it can lead to negative cash flow. The reason for this is that you won’t be getting the cash inflow on time which can hurt your business. Eventually, if you continuously delay tracking accounts receivables then it can lead to bad debt.

How does negative cash flow affect small businesses?

Small businesses can have problems such as the following due to negative cash flow.

Problems in business growth

Negative cash flow can stunt or slow down the growth of your small business because it takes effort to manage negative cash flow. When you are busy managing negative cash flow you will be spending more effort and energy into managing cash flow rather than look for ways to make your business grow. Negative cash flow can cause your employees to feel pressured about giving results. This can decrease employee morale which can directly impact your business growth. Your business won’t be seen in a good light if you cut expenses by firing employees which can further damage your reputation.

Investors won’t be happy

Small businesses depend on investors. Investors look at the cash flow statement to understand how your business handles financial activities, operating activities, and investing activities. If they find out that you are unable to manage inflow and outflow of cash then they won’t be as willing to invest in your small business again. This is particularly the case if you have had cash flow management issues for a long period. You can run into trouble as you won’t be able to pay dividends which can further strain your relationship with your investors.

Cutting expenses

Negative cash flow can lead to problems in the future. Let us say you sell eye makeup and you notice that you have negative cash flow for 4 months. In order to cut down on expenses, you limit how much you spend on paid advertising. Instead, you post about a 30% discount on your products. This can help your small business come out of the problem for some time but it won’t be the same for your customers. As your customers perceive the new value of your product to be lesser than the original, they won’t be willing to pay more in the future. That is, after the discount is over. This can directly affect revenue.

4 ways to recover from negative cash flow

You are in the midst of a negative cash flow. Now what? Here are 4 ways you can get out of the problem.

Analyze cash flow

You need to know the extent of the damage before you can do something about it and so use a cash flow statement. Ideally, analyzing your cash flow twice a month is good so you can start doing recovery-related activities if you find out you have a negative cash flow. Cash flow forecasting can also help to see if you can balance your negative cash flow in the near future or if you need to do something else to manage your cash flow.

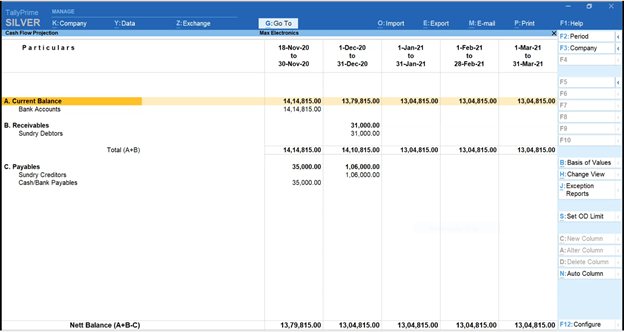

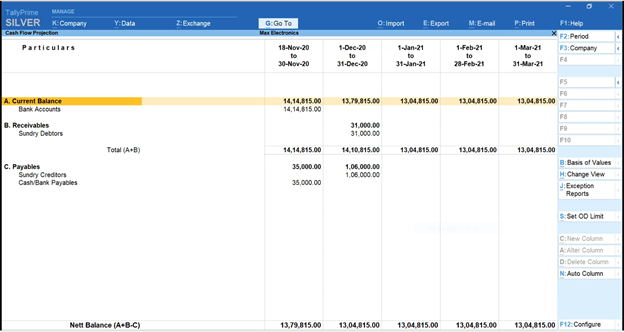

Cash flow projection report in TallyPrime

Be prepared for the worst

Negative cash flow means things can get worse from there for your small business. But they don’t have to. To manage cash flow, it is advised that you keep an emergency fund where you keep extra cash. If you already have an emergency fund with sufficient money in it, then use it to manage negative cash flow. However, always having an emergency fund and ensuring you store money in it can help you during the most unexpected times

Review and cut expenses

Reviewing your expenses can save you from a negative cash flow as your recurring expenses and unnecessary expenses are unveiled. Think of ways you can cut down on excess spending such as by outsourcing certain aspects of your business and completely stopping a particular activity. You should do this review regularly to find over-expenditure and cut down so you can save and bring your cash flow statement into balance again.

Manage accounts receivables efficiently

You must pay attention to your late paying customers and give incentives to encourage them to pay on time. You can send reminder letters so they make the payment. Performing aging analysis can help along with following up with a closure. Another way to avoid negative cash flow is to perform a payment performance analysis regularly.

Pending bills ageing analysis in TallyPrime

Every business owner must focus on thorough and regular cash flow analysis through cash flow statements. Cash flow analysis ensures there is enough cash flow so you can sustain your business without taking a loan or drowning in debt eventually. Using a business management software like Tally can make generating cash flow statements and analysis much simpler than ever before. It makes accounting easy so you can manage your business without hiring a professional to do so. TallyPrime ensures you can manage negative cash flow in time so that your business can flourish.