- Accounting profit vs. economic profit

- What are economic and accounting profit differences?

- How to calculate accounting vs. economic profit?

- Accounting profit vs. economic profit example

- Get a complete picture with accounting and economic profit

As a business person, one of the most important words that get your attention is ‘profit’. The ultimate aim of every business is to be profitable. One of the most vital reports extracted from an accounting system or software is the profit and loss account. It tells you if you are making or losing money through your business. The majority of companies are interested in the actual amount of profit that they make. We do not often study the profits missed out on due to the company’s decisions. We should analyze both the accounting profit and economic profit to get a balanced analysis of the companies profitability and decision making.

The Goal Of Every Business Is To Be Profitable

Accounting profit vs. economic profit

There are two types of profit that are of interest to a businessperson. They are accounting profit and economic profit.

What is accounting profit?

Accounting profit is the exact profit in figures on your business income statement and other accounting reports. It may also be termed as net income or the bottom line. This figure is calculated by calculating the total revenue and then subtracting the cost of goods sold and expenses from it. It is the money that you have left after you have paid for the production of your goods or services and paid for all expenses. These expenses are the costs that you incur in the process of running the business.

The costs that you may deduct from the revenue can include:

- Labor

- Inventory

- Raw material purchase

- Production costs

- Rent and overheads

- Interest on outstanding amounts

- Taxes

- Transportation

- Sales and marketing costs

- Depreciation and amortization

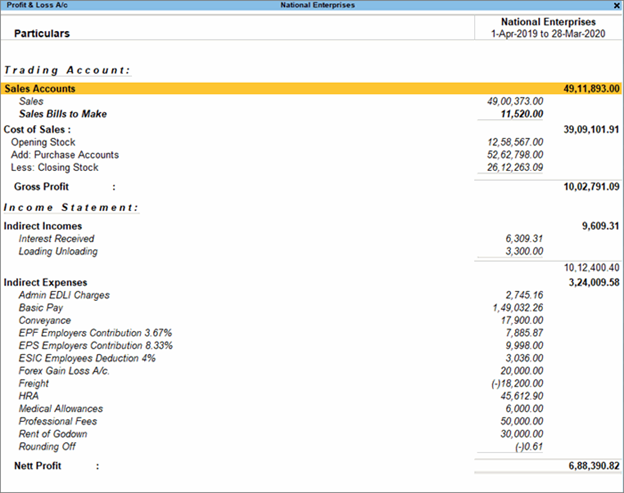

Accounting profit is calculated by business management systems such as TallyPrime in accordance with the generally accepted accounting principles (GAAP). The report on accounting profit is usually submitted to the authorities and investors. It is a good measure of the health of your business.

Profit And Loss Account From TallyPrime

What is economic profit?

Determining the economic profit is not as straightforward as calculating the accounting profit. It also studies the revenue, but it includes explicit costs, implicit costs, and opportunity costs.

Opportunity cost is one of the main differentiating factors between accounting profit and economic profit. Opportunity costs study the advantages and benefits that the business missed out on by making a choice. For example, if the company is faced with two options, the management will decide on one. But, after the decision is made, it may be realized that the business missed out on a great opportunity by not making the other choice. This missed potential opportunity has a cost that is called opportunity cost. This cost is also factored in the calculation of economic profit. It is more difficult to calculate the opportunity cost and economic profit than accounting profit, but they are all very important.

As economic profit includes opportunity cost, it tells us if the company missed an opportunity by making certain choices and decisions. Economic profit is a good indicator of the decision-making and resource allocation in the company and how they influence the bottom line. It can be used to make crucial decisions such as whether to invest in something or not or even to decide on whether the company should exit or enter a market.

What are economic and accounting profit differences?

The primary differentiating factors that differentiate between economic and accounting profit are the following factors:

- Implicit vs. explicit costs

As seen earlier, accounting profit factored in explicit costs. However, economic profit factors both implicit and explicit costs into its calculation.

Explicit cost: This is the actual costs of the business towards rent,Wages, purchase of materials, cost of goods sold, etc.

Implicit cost: This is the opportunity cost that the company gave up by missing out on making certain choices or decisions. One example is the cash flow you could have earned from stocks if you had sold your company. Or the rent that could have been earned if the company had let out one of its premises instead of using it for its own operations.

- Usage for official submissions

The accounting profit and the reports that detail it are used for submissions to local agencies and authorities. Economic profit is of no interest for official purposes. It is a report that is of interest to the managers and key people in the company to gauge if the company’s decision making is optimal.

- Calculation and accounting

The accounting books of a company record all the factors used to calculate the accounting profit. The accounting profit is determined and calculated after analyzing and computing the various accounting transactions of the company. However, the factors used to calculate the economic profit are subjective and are not recorded in the books of accounts at all.

- Uses

Accounting profit is an indicator of the company’s financial performance and tells you exactly how profitable it is in terms of money.

Economic profit is used to determine the effect of decision-making, choices, and investments. It is primarily used by a company when deciding when to enter or exit a market.

How to calculate accounting vs. economic profit?

Accounting Profit

To calculate accounting profit, you need to know the total revenue and the explicit costs as described above. Both these values are readily extracted from accounting software such as TallyPrime. The formula to calculate accounting profit is:

Accounting Profit = Total Revenue – Explicit Costs

Economic Profit

You need to know the total revenue, explicit costs, and implicit costs to calculate economic profit. Implicit costs cannot be extracted from the books of accounts. They have to be calculated by the company subjectively. The formula for economic profit is:

Economic Profit = Total Revenue – (Explicit Costs + Implicit Costs)

Or

Economic Profit = Total Revenue – Explicit Costs – Implicit Costs

The profit and loss statement generated by your accountant or by a business and accounting management software such as TallyPrime will give you the values for explicit costs and total revenue on the profit and loss statement report.

Accounting profit vs. economic profit example

Let us look at examples for both types of profit calculations.

Accounting profit

Your accounting reports show that the company’s total revenue in the specified period is $50,000. You have spent 10,000 as total expenses and 5,000 as cost of goods sold.

Accounting Profit = Total Revenue – Explicit Costs

Total Revenue= 50,000

Explicit Costs= 10,000 + 5,000 = 15,000

Accounting Profit = 50,000– 15,000 = 35,000

So, you can say that the calculated accounting profit for the period is 35,000.

Economic profit

Let us take the same example as above. We can add a scenario where the company could take up a new project but did not. This project could have fetched them more money but they missed the opportunity. The opportunity cost was worked out and the implicit cost of that bad decision is $10,000.

Economic Profit = Total Revenue – (Explicit Costs + Implicit Costs)

Total Revenue= 50,000

Explicit Costs= 10,000 + 5,000 = 15,000

Implicit Costs= 10,000

Economic Profit = 50,000 – (15,000 + 10,000) = 50,000 – (25,000) = 25,000

So, the economic profit for the given time is 25,000, which is less than the accounting profit. We can see that the company could use better decision-making in the future to increase the economic profit.

In the example, we see that though the accounting profit was higher, the internal review by the company shows that they could have made better decisions and made more money. Reviewing both accounting profit and economic profit is essential to ensure that companies perform well in strategy as well as in terms of money.

Get a complete picture with accounting and economic profit

Most businesspeople are satisfied by merely calculating and analyzing the accounting profit of a company. It is effortless to obtain this value instantly using a good business management system such as TallyPrime. But, it is in the best interest of the higher-level management to reflect on their business decisions. The economic profit of a company is a value that monetizes the results of its decisions. Calculating and auditing the opportunity cost and economic profit leads to better decision-making. The comparative study and analysis of the accounting and economic profit of the company helps the company continually evolve and stay ahead of the competition.

Read more: