- Common Size Balance Sheet Definition

- What is Common Size Balance Sheet Analysis?

- Format and Example of Common Size Balance Sheet

- Advantages of Common Size Balance Sheet analysis

Definition

Common size analysis, also referred to as vertical analysis, is a tool that financial managers use to analyse financial statements. It evaluates financial statements by expressing each line item as a percentage of the base amount for that period. The analysis helps to understand the impact of each item in the financial statement and its contribution to the resulting figure.

The technique can be used to analyse the three primary financial statements, i.e., balance sheet, income statement and cash flow statement. In the balance sheet, the common base item to which other line items are expressed is total assets, while in the income statement, it is total revenues.

What is Common Size Balance Sheet Analysis?

The term “common size balance sheet” refers to the presentation of all the line items in a balance sheet in a separate column in the form of relative percentages of total assets, primarily. This technique is convenient for comparison of the number of assets, liabilities and equity among different companies, especially when they are used for an acquisition analysis.

It is convenient to build a common size balance sheet as it helps in building trend lines to discover the patterns over a specific period. In short, it is not just an upgraded variety of the balance sheet per se, but it also captures each single line item as a percentage of total assets, total liabilities and total equity besides the usual numeric value.

Format and Example

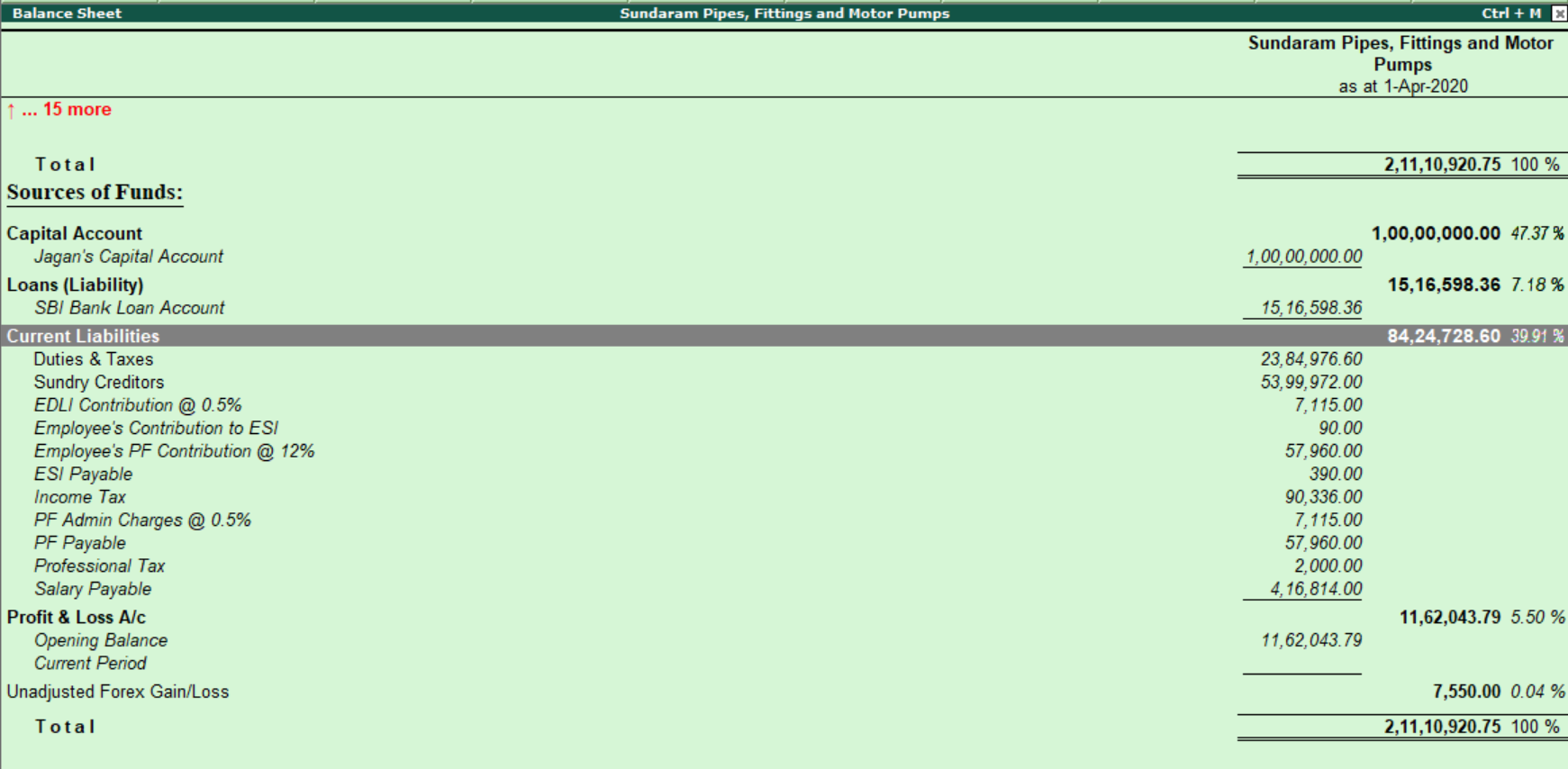

Let’s look at the common size vertical format balance sheet of Sundaram Pipes, Fittings and Motor Pumps.

As you can see that a common size balance has drawn comparisons between assets and liabilities and even called out the percentage of the base amount for that period. The analysis helps to understand the impact of each item in the financial statement and its contribution to the resulting figure.

As you can see that a common size balance has drawn comparisons between assets and liabilities and even called out the percentage of the base amount for that period. The analysis helps to understand the impact of each item in the financial statement and its contribution to the resulting figure.

Here are some of the advantages of Common Size Balance Sheet analysis

- It aids the reader of the statement to understand clearly the ratio or percentage of each individual item in the statement as a percentage of total assets of the company

- It aids a user to determine the trend related to the percentage share of each item on the asset side and percentage share of each item on the liability side

- A financial user can also use it to compare the financial performances of different entities at a glance since each item is expressed in terms of percentage of total assets, and the user can determine any required ratio quite easily

Watch this Video on How to View and Analyse Balance Sheet in TallyPrime

Read More on Balance Sheet

What is Balance Sheet, How to Prepare Balance Sheet, Components of Balance Sheet, Format of Balance Sheet, Consolidated Balance Sheet