- Different types of audit

- How accounting software helps businesses be ready for audit?

- How tallyprime can help?

An audit is an investigation and assessment that ensures the accuracy of information presented by a business. Auditors objectively determine whether the information provided is error-free or not. The information being assessed can differ according to the type of audit being conducted. In case of financial audit, the financial report is checked by auditors. This report contains an income statement, balance sheet, cash flow statement, and statement of equity changes. An audit report may contain notes as well. Auditing standards and procedures must be followed during an audit. An audit generally takes place once a year. It can be conducted internally or externally.

Different types of audit

Below are the different types of audit:

External AUDIT

The external audit is performed by people who are not associated with your business in any way. An external audit can be done by financial institutions or government agencies. Auditors must follow the GAAS or the Generally Accepted Auditing Standards. The outcome of an external audit is an audit report that outlines whether the financial information given by your business is accurate or not. When compared to an internal audit they are more professional and stricter because they determine whether the details you shared with auditors are reliable or not. Lenders can ask for an external audit to be performed.

| Statutory Audit & Reporting: Definition and Example | Audit Report: Definition, Types, Format, Tools and Sample |

Internal audit

An internal audit is performed by an in-house team or an individual who works in your business. Internal audits enable you to understand how well your business is doing and whether it is legally compliant or not. It throws light on whether the current business processes are efficient, the state of policy compliance, and assessments of the various controls in the business. The audit report is reviewed by the management which then goes on to make the required changes as necessary. Your business might have an audit committee that reviews the audit reports internally.

IRS tax audit

An IRS tax audit is an external audit that investigates whether the tax returns filed by your business are correct or not. A person who isn’t connected to your business in any way performs an IRS tax audit. It focuses on determining whether the tax payments you made are accurate and whether you have reported everything clearly. There are three ways an IRS tax audit can be performed; digitally, on your company premises, and over the phone. IRS can choose which businesses it wants to audit. Just because the IRS conducted a tax audit doesn’t guarantee that a business is involved in fraud and misinformation.

Financial audit

Financial audits are one of the common types of audit. All businesses that are publicly held must get a financial audit conducted. A financial audit is performed to ensure that the information revealed in the financial statements is correct. Auditors verify the business’ financial details pertaining to revenue, assets, and expenses. It investigates if recording and reporting have been done justifiably. Financial audits are generally of value to shareholders and investors who can base their decision on the final outcome of a financial audit report. CPA firms conduct financial audits as these audits must be conducted by people outside of the business.

Operational audit

Operational audits are performed to analyze the effectiveness of the operating processes of a business. They are generally conducted by an internal team but some businesses can choose for an external team of auditors. An operational audit can help uncover inefficiencies and wastage in a business. It determines the efficient use of resources to meet business goals and can identify how business operations can improve. Procurement can be subject to an operational audit whereby procurement processes are thoroughly examined and investigated. An operational audit can be conducted to determine the culture and policies of a business. An operational audit can result in cost reduction.

Compliance audit

A compliance audit is one of the types of audit that is conducted by educational institutions and industries where regulation is vital. It checks whether your business is complying with internal and external regulations. A compliance audit can be conducted department-wise. Compliance audits reveal if the business is complying with regulations such as those for safe working conditions. It takes into account the laws, local regulations, and the standards set by the business. For instance, a manager can ask for a compliance audit to be conducted to ensure workers are adhering to safety guidelines when they are working in a factory.

Information system audit

An information system audit is performed to verify that your business is using the best security practices so that no external entity such as a hacker can get access to the business data. It involves checking if the best practices are being utilized by the business to ensure the proper functioning of the IT systems in the business. Information system audits help in the proper evaluation of data processes and checks that determine the accuracy of data from these systems. Information system audits can reveal improvements such as new software recommendations that can drive the business to do better and excel. It also takes into account backup plans.

Payroll audit

A payroll audit is one of the types of audit that are usually conducted by internal teams. The HR team may perform a payroll audit. The payroll audit examines and investigates the precision of the information in relation to payroll processing. This includes the wages, employee-related information, tax data, and pay rates. It is a specific type of compliance audit that focuses on the payroll. Payroll audit helps businesses spot internal human errors that exist. A regular payroll audit can prevent costly mistakes from taking place before other types of audits take place such as an IRS tax audit. Payroll audit ensures compliance with employment laws.

Pay audit

A pay audit is required for pay analysis. It determines whether your business is equally paying people from different backgrounds and nationalities. A pay audit can find out if unfair practices are part of the business such as different pay rates for people of different genders, ages, and races for the same position. A pay audit compares the pay rates of your business with those that work similarly. The pay audit can be done by a single person or by a team, depending on the size of your business. Based on the audit report, your business may need to make changes to ensure fair pay to every employee.

How Accounting Software Helps Businesses Be Ready For Audit?

An audit can be beneficial to a business, whether done internally or externally. It can uncover inconsistencies, inefficiencies, and errors found within the business. An accounting software solution can make a business audit-ready by ensuring all the financial transactions are stored in an easy-to-find manner. Accounting software that comes with an audit trail can ensure compliance, transparency, and integrity. Businesses that use accounting software conduct audits much faster compared to businesses that use manual methods. Robust accounting software solutions such as TallyPrime make auditing simpler for all businesses so no business has to fail when the time for audit arrives.

How TallyPrime can help?

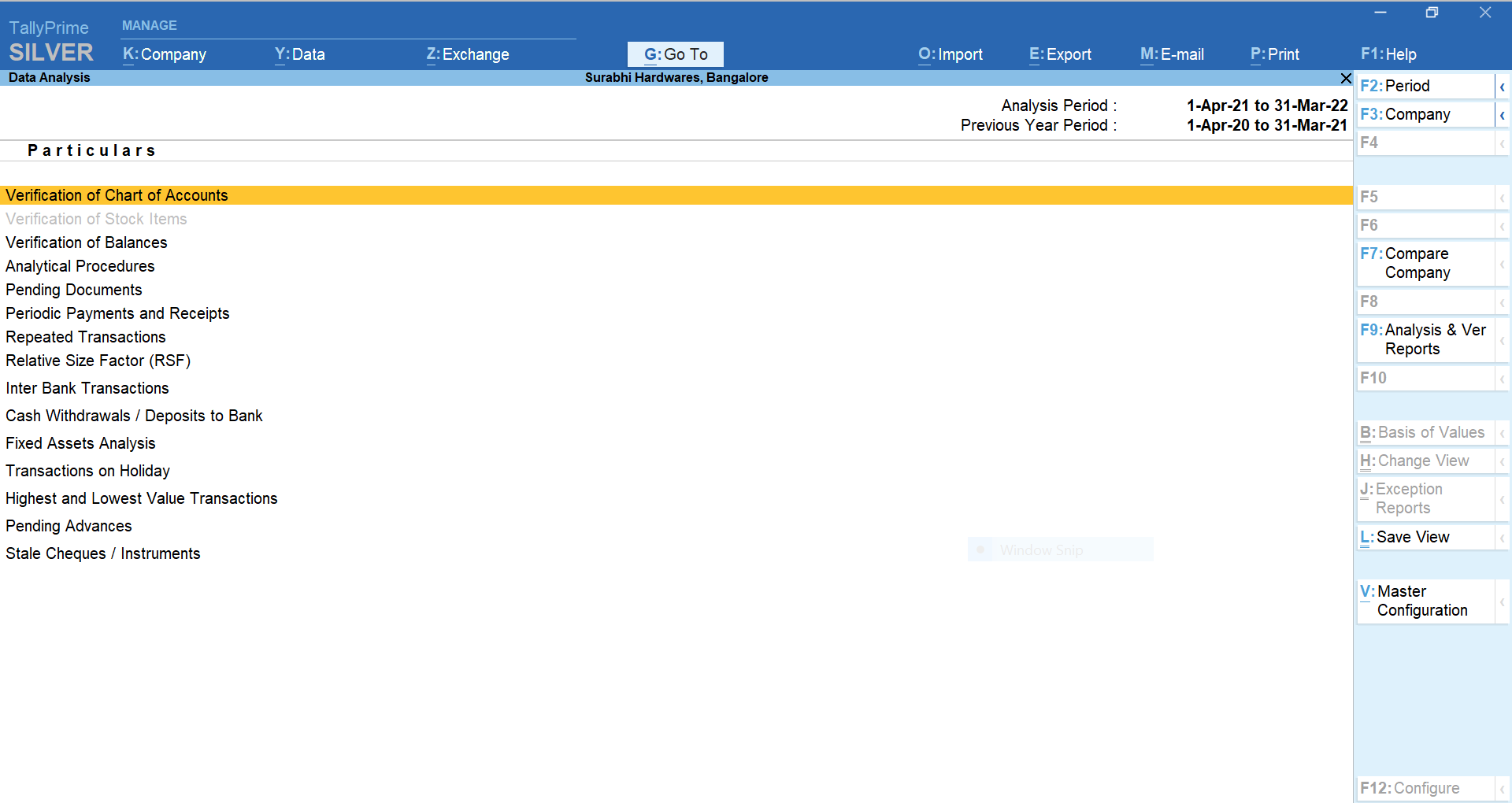

Tally makes life easier for your accountants, auditors and other users. Auditors will find their work easier with inbuilt audit/verification tools available in TallyPrime. The data analysis tools facilitate in conducting internal analysis and verification of the company's financial data. Thus, helping in identifying exceptional areas and thereby ease the process of verification.

TallyPrime also comes with a voucher verification tool that helps you verify all the transactions or apply the required sampling method and verify only the sampled transactions to form the auditor opinion. The same process applies can be applied for forex vouchers as well.

Read more: