- Trial balance vs. balance sheet

- What is trial balance?

- What is the balance sheet?

- What are the key differences between trial balance vs. balance sheet?

- How to generate trial balance and balance sheet easily?

A trial balance and a balance sheet are two very important financial documents for any business. However, many differences distinguish these reports from each other. A trial balance is usually prepared as the first step towards preparing the balance sheet of the company. A trial balance summarises the closing balance of the different general ledgers of the company, while a balance sheet summarises the total liabilities, assets, and shareholder’s equity in the company. To know more about trial balance vs balance sheet, read on.

Trial balance vs. balance sheet

A trial balance is a report that is used internally within the company, while the balance sheet is usually released to investors and financial institutions outside the company. The primary function of the trial balance is to see if the total credits and debits in the books of account balance with each other. You can prepare a trial balance for every month or even every quarter. The balance sheet, however, is a document that is prepared for each financial year. The key differences between trial balance vs balance sheet can be summarized in the following table.

|

Trial Balance |

Balance Sheet |

|

Records all the closing balances of the general ledgers of accounts |

Records the assets, liabilities, and equity of the company |

|

It is used to verify if the total credits and debits of all the ledgers are balanced |

It is used to check if the assets of the company are equal to the liabilities plus equity. It is also used to demonstrate the accuracy of the company’s finances |

|

It is not a financial statement |

It is a financial statement |

|

All the accounts are divided into the balances of debits and credits |

All the accounts are divided into assets, liabilities, and equity |

|

It is used internally within the company |

It is used for external purposes |

|

It is recorded at the end of the quarter, half-year, and year |

It is recorded at the end of every financial year |

|

It does not need the signature of an auditor |

Requires the signature of an auditor |

|

There is no particular rule according to which the ledgers are to be arranged |

There is a particular format by which the items are arranged |

|

It is not a component of the final accounts |

It is an essential part of the final accounts of the company |

What is trial balance?

A trial balance records the closing balance of all the general ledgers of the company. It is helpful to check if these credit and debit balances balance each other. If the numbers do not balance each other, it indicates that the books of accounts have to be checked to see if there is an error in recording. As per the principles of double-entry bookkeeping, the debits and credits must balance each other. To properly understand the need for balancing figures in the trial balance, we must first understand the concept of debits and credits.

| What Are T Accounts? Definition and Example | What is the NOPAT Formula? – Net Operating Profit After Tax |

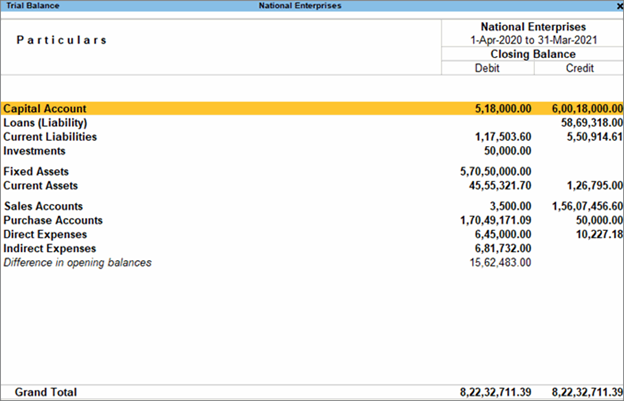

Trial Balance From Tally

In a trial balance, the closing balances of the general ledgers are arranged in credit and debit columns of the trial balance. If every transaction was recorded properly, there should be a perfect match between the sum of credits and the sum of debits in the given time period. If there is a mismatch, an account called the suspense account is used to adjust the difference value and balance the trial balance. The books of accounts would then have to be examined to trace the source of the error. This would then be rectified so that the trial balance is perfectly balanced. Trial balances are recorded for every month or quarter so that any errors in the accounting records can be identified and corrected as soon as possible. It is an excellent way of internally keeping an eye on the accurate recording of all accounting transactions. It is the most straightforward method of detecting any wrong or improper entries made in the books of accounts.

The trial balance is useful for the following purposes:

- Verifying the arithmetic accuracy of the entries in the books of accounts

- It can also help detect errors in posting

- Comparing the figures of the current period with historical data easily. For example, a trial balance can be prepared for a set period and then compared with the same period in the previous year

- It helps to prepare budgets and other financial estimates for the set period

- It is an essential first step in the audit process that checks for errors and then follows the audit trail

- The preparation of the trial balance is also the first step in preparing the other annual financial reports and statements

- A balanced trial balance is the indication that the books of accounts are free of clerical errors

- It is a handy summary of all the books of accounts of the company that can be used for meetings and decision making

A trial balance cannot do the following:

- It cannot find if an entry has been missed altogether

- It cannot detect if the wrong amount has been recorded as a debit and a credit

- Double posted entries

- If the right amount was posted in the wrong account

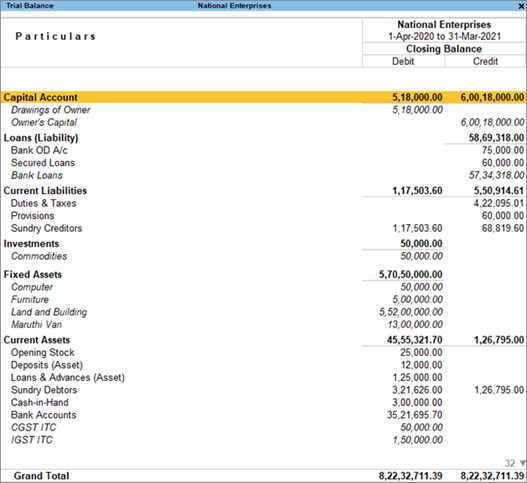

Example Of Detailed Trial Balance From Tally

What are debits and credits?

When a transaction is posted, it is recorded in the form of debits and credits. The transaction amount is recorded as a debit in one ledger and a credit in another. The general rule for recording transactions is:

- Debit the account whose assets/expenses increase and the liabilities/revenues decrease

- Credit the account whose assets/expenses decrease and the liabilities/revenues increase.

So, if you make a sale and collect the cash, you would account for it as follows. The cash of the seller sees an increase in revenue. So the company’s cash account will be debited and the sales account will be credited to record the transaction. It is this double entry of debit and credit that is the basis of the double entry accounting system.

What is the balance sheet?

A balance sheet also balances two columns; assets and liabilities. It gives a clear picture of the overall financial status and health of a company. Let us take an example of how a transaction would reflect on the balance sheet. If a company were to take a bank loan of $10,000 in cash it would add cash to the cash account. So, it would be an addition of $10,000 to the cash item on the asset side of the balance sheet. It would also add $10,000 to the debt item on the liabilities side. This is a simplistic illustration of how a balance sheet gets balanced. To fully understand a balance sheet, we must understand what assets and liabilities are.

The limitations of a balance sheet are:

- The balance sheet states the value of acquired assets. However, if a company has generated an asset internally, it is not valued or mentioned on the balance sheet. This could be the result of internal research or a website or web platform that is developed in house

- The valuation of the internal assets such as machinery even when depreciation is calculated does not always reflect the actual value of the asset after wear and tear

- It is only a snapshot of the financial health of the company at year's end. If the company has settled all its debts on the last date, the balance sheet will still look good and one would presume that the company was in good financial health that year

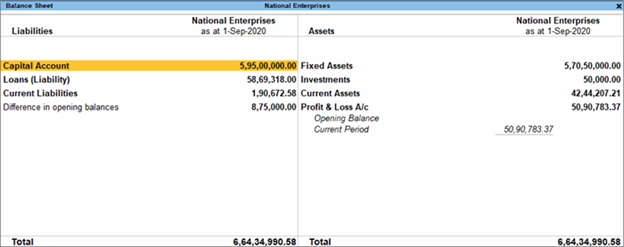

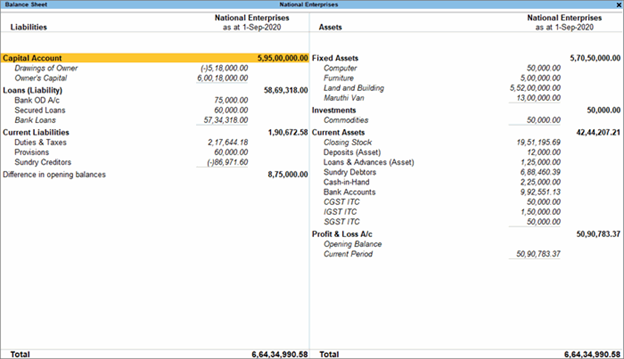

A Comprehensive Balance Sheet Generated By TallyPrime

Detailed Trial Balance From TallyPrime

Learn How to View & Analyse Balance Sheet in TallyPrime

What are the key differences between trial balance vs. balance sheet?

The main differences between trial balance vs balance sheet can be summarised as follows:

- The trial balance is an internal statement for use within the company. A balance sheet is an external statement

- The trial balance is divided between debit and credit. A balance sheet is divided into assets, liabilities, and shareholders’ equity. The balance sheet should always maintain the equation; assets = liabilities + shareholders’ equity

- The trial balance lists the closing balances from the general ledgers. A balance sheet uses the trial balance as a source

- The trial balance is recorded to ensure the accuracy of financial records. A balance sheet gives the overall picture of the financial affairs of the company to the stakeholders

- A trial balance need not be signed by an auditor, while a balance sheet must bear the signature of an auditor

- The trial balance is recorded every month, quarter, half-yearly, and annually whereas the balance sheet is prepared at the end of every financial year

How to generate trial balance and balance sheet easily?

Take the pain out of generating the trial balance and balance sheets using an intelligent business accounting software such as TallyPrime. It helps you balance your books and audit all transactions efficiently and quickly.

Why Choose TallyPrime for Trial Balance and Balance Sheet

You have the option to examine the Trial Balance report in TallyPrime according to your company needs. When reading the report, you have the option of include the Opening Balance or not. Similar to this, you may check several account features by adjusting the options inside the report. You may use this report to identify the cause of any balance discrepancies and make the necessary adjustments to the ledger accounts.

TallyPrime's Balance Sheet gives you a tidy overview of your company. For a more thorough overview of your assets and liabilities, including taxes, loans, mortgages, and accounts payable, you may also enlarge the report. Your assets include cash in the bank, inventories, cars, equipment, buildings, and accounts receivable. You may inspect the balance sheet and alter the order of groups to suit your needs. In order to facilitate information comparison, the Balance Sheet may also be seen in vertical format, which shows the source and use of money in a single column. You may manually set your Closing Stock in TallyPrime. You may also examine the consolidated Balance Sheet if you own a group business.

Frequent Ask Questions

-

What is trial balance vs balance sheet vs profit and loss?

A trial balance is a report that is used internally within the company, while the balance sheet is usually released to investors and financial institutions outside the company. The balance sheet reports the liabilities, assets, and equities at a particular time, and P&L statement summarized the company's revenue, costs and expenses for a period of time.

-

Is a trial balance the same as a balance sheet and income statement?

No. A balance sheet states what a company owns at a specific date, whereas an income statement states how a company performed during a specific period. The trial balance summarizes the closing balance of the different general ledgers of the company.

-

How often should I review the Trial Balance and Balance Sheet in TallyPrime?

A trial balance can be prepared for every month or every quarter

Explore more Products

Best Accounting Software in USA, Accounting Software for Small Businesses in USA, Factors to Consider before Buying Bookkeeping Software in USA, Benefits of Payroll Management Software for Small Businesses in USA, Invoicing & Billing Software in USA That Best Suits Your Business

Read more on Accounting

COGS vs Expenses, What is Revenue Recognition?, Financial Accounting Vs. Managerial Accounting, Real Estate Accounting in US Best Practices and Bonus Tips, Difference Between an Estimate, Quote, Bid, and Proposal, How to Easily Build Great Estimates for Your Projects?

Popular Articles

What is the NOPAT Formula?, What is A Pay Stub?, What Are T Accounts?, What is a credit note?, How to Find Gross Profit?, What are Operating Expenses?, Break Even Point Formula, What is the Gross Margin Formula?, What is the Direct Write Off Method?, What Is Interest Expense?