- What is COGS?

- COGS for a company that sells physical products

- COGS for a company that sells services

- What are operating expenses?

- OPEX for a company that sells physical products

- OPEX for a company that sells services

- COGS vs. OPEX: why they matter to every business

- Business management software for in-depth insights

What is COGS?

COGS is short for the cost of goods sold and is also known as the cost of sales or the cost of revenue. COGS is the value that represents all the costs that are linked to the production or manufacturing of the goods and services that you sell to your customers. It does not take selling, general, and administrative expenses into account and also does not include interest expenses in its calculation. COGS is an important metric that your business should pay attention to. This is mainly because the cost of sales shows you at what cost and how well you are able to deliver goods and services to your customers.

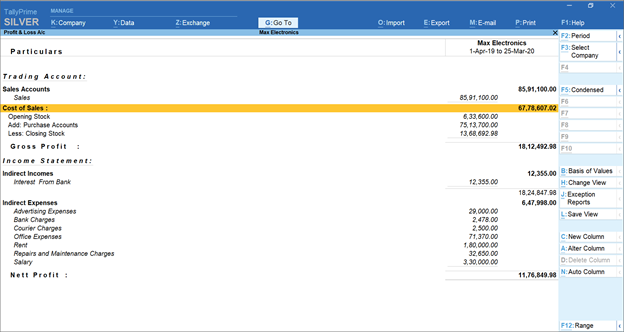

Vertical Profit & loss A/C in TallyPrime

A cost of sales formula used to calculate the cost of goods sold is as follows.

Cost of sales = Beginning inventory + Purchases – Ending inventory

Let us see how it works with an example. DogBark Ltd. had $50,000 worth of inventory in September 2021. By the end of the month, it had $5000 worth of inventory left with the business. In the same month, it incurred several expenses that were directly related to the production of the product it sells to its customers online. Let us say that DogBark spent $1,000 on the packaging, $5,000 on salaries, and $200 on delivery.

You can calculate the purchases first which are $1,000 added to $5,000 plus $200 which equates to $6,200. Now using the formula and plugging in the values, we arrive at $51,200 by adding $50,000 with $6,200 and then subtracting by $5,000. The COGS for DogBark is $51,200.

It can get confusing to figure out what to include and what to exclude from the COGS calculation because different businesses operate differently. A simple way of figuring out what to include and what to exclude can be determined by the effect of an expense on the production. Any expense that you must pay otherwise the manufacturing will come to a stop should be included. All other expenses won’t be included. For example, the cost of packaging, storage costs, wages, and raw materials must be included in the COGS calculation. You should exclude the commission you pay your employees, product development costs, and overhead costs.

COGS for a company that sells physical products

For a business that sells products, calculating the COGS is a much easier and smoother process. You need to calculate and add all the costs that went into making the final product. These include the raw materials you use to manufacture the product and the labor costs associated with manufacturing the final product. The COGS calculation will also include the costs that are associated with the product reaching your customer. If the product needs to be shipped to your customer, then you will include the shipping costs in your final calculation.

COGS for a company that sells services

If you are a business that provides services then it might be a little difficult to calculate COGS because you are not dealing with manufacturing costs such as raw materials and components. But you are going to include the costs that you incur in providing the services to your customers. If you are providing a digital service then you are going to include the hosting charges in the cost of goods sold calculation. Let us say you run a coaching center where you have several experienced teachers. The COGS calculation will include the teacher salaries depending on how many hours they work for each day.

What are operating expenses?

COGS vs expenses are two different concepts even though they might appear to be the same on the surface. Operating expenses are also often referred to as OPEX are the costs incurred by your business in the process of producing goods and services. OPEX is also known as an expenditure. Operating expenses are important for creating an annual plan for your business because it matters in budget allocation for production and delivery phases. OPEX shouldn’t be confused with overheads because operating expenses won’t be incurred once production halts. Overhead costs go on even if business production has stopped. Examples of operating expenses include packaging, materials, machinery, and labor.

OPEX is different from capital expenditure or CAPEX. Operating expenses exclude acquiring costs. If you are moving to a bigger building because your business has expanded, then these expenses will come under CAPEX rather than OPEX. This is because the expenses are not directly linked to the production of the final product or service. What truly differentiates CAPEX and OPEX is the value. When you invest in an asset, it adds value to your business as opposed to just allowing you to run your operations. CAPEX is included in your statement of cash flows rather than with your operating expenses.

The operating expenses ratio or OPEX ratio is a vital ratio calculated by businesses to find out how much expenses are incurred compared to the net sales. This ratio can indicate whether you are succeeding in keeping expenses as low as possible while selling more or not. The OPEX ratio is calculated by adding the operating expenses with the cost of goods sold then dividing the sum by net sales. If your operating expenses are high compared to net sales, then it means you must look for ways to decrease your operating expenses so those expenses are not eating away your net sales.

OPEX for a company that sells physical products

The difference between COGS vs expenses will be clear with an example of a company that sells physical products. Let us say you operate a bakery and you incur expenses along the way which are operating expenses. You have rented the shop which is right beside a major road. You post your ads on your Facebook page, Instagram, and Twitter. You have business insurance. You pay wages to those who deliver orders to customers’ homes. You are required to pay for the maintenance of the equipment you use. You pay for the cleaning supplies and you pay for the training of new employees. All of these are included in the operating expenses.

OPEX for a company that sells services

COGS vs expenses will be clearer with the help of another example, this time a business that provides services. Let us say you have a coaching center. Your operating expenses will include the banners or advertisements that you put out to get students enrolled. It will include the rent you pay for the building where the coaching center is located. The operating expenses will include the employee salaries except for those who are teaching. For example, the salaries of HR, legal, sales, and marketing departments will get included in the operating expenses. The operating expenses will include CRM, office utilities, and insurance too.

COGS vs. OPEX: why they matter to every business

COGS and OPEX are insightful for every business because they show you the current state of your business. They both let you know if you are spending way too much on expenses and when changes need to be made. Any business needs to sustain itself and ensure that it is able to earn higher than what it is spending. For startups and small businesses, the story might be different initially when they are finding their footing in their industry. However, over time it is imperative that businesses understand their operating expenses and costs of getting goods sold to ensure they are making money instead of spending more.

COGS enables businesses to understand their efficiency levels in manufacturing a product or service. Are you able to have a high gross profit from selling a particular product? Or is the product becoming more expensive to manufacture? Some products might be bringing in the cash into the business but if they are too costly to manufacture and their cost is likely to become more expensive in the future, then it might be time for your business to change its course. Your business needs high profits because you should be able to afford your operating expenses at the very least. The only way to ensure lower costs is to think of ways where you can save such as negotiating with a supplier.

OPEX lets you discover how well you can manage running your business. They show you if you need to take matters into your own hands and cut down spending on everyday tasks. For instance, many businesses resort to halting their hiring for some time if their operating expenses are going through the roof. Other businesses choose to cut down on facilities that aren’t mandatory at their business premises. As a business, you need to be aware of both the operating expenses and cost of goods sold to get a better picture of your business efficiency so changes can be made sooner rather than later.

Business management software for in-depth insights

A business management software such as TallyPrime provides deep insights and empowers you to manage your business with ease. It can be used by growing businesses, startups, and even enterprises. TallyPrime is the best accounting software solution with ERP capabilities that gives you the ability to integrate your business finances and be on top of the game. It has superb report generation capabilities so you can get detailed analysis of any aspect of your business when you need it. The round-the-clock access, security features, and features such as inventory management ensure you can manage different aspects of your business.

Explore more Products

Best Accounting Software in USA, Accounting Software for Small Businesses in USA, Factors to Consider before Buying Bookkeeping Software in USA, Benefits of Payroll Management Software for Small Businesses in USA, Invoicing & Billing Software in USA That Best Suits Your Business

Read more on Accounting

What is Revenue Recognition?, Financial Accounting Vs. Managerial Accounting, Real Estate Accounting in US Best Practices and Bonus Tips, Difference Between an Estimate, Quote, Bid, and Proposal, How to Easily Build Great Estimates for Your Projects?

Popular Articles

Differences Between Trial Balance & Balance Sheet, What is the NOPAT Formula?, What is A Pay Stub?, What Are T Accounts?, What is a credit note?, How to Find Gross Profit?, What are Operating Expenses?, Break Even Point Formula, What is the Gross Margin Formula?, What is the Direct Write Off Method?, What Is Interest Expense?