- What is revenue recognition?

- What are the benefits of revenue recognition?

- Which businesses need to worry about revenue recognition?

- What is recognized revenue, accrued revenue, and deferred revenue?

- Revenue recognition examples

- How can accounting software ease your burden?

What is revenue recognition?

Revenue recognition is a principle that refers to how a business recognizes its revenue. Revenue recognition is an important part of GAAP or generally accepted accounting principles. It also has to do with the way a business accounts for its revenue. People who want to understand your financial position such as investors who aren’t directly a part of your business require that you comply with GAAP so that revenue recognition is easy and a standard format is being used for recording transactions. When your business uses the accrual method of accounting, revenue is recognized in your income statement when the services are offered or when you sell the physical products.

Note that just because you offered the service or the customer received the product does not necessitate that he pays for it at the same time or before he gets the product. In the case of retail stores, businesses receive the cash instantly as customers buy what they need and they pay for it. This way the revenue is recognized and earned as soon as the money reaches the business bank account or the cash register. This is different for businesses that provide services or products that take time such as a subscription that is valid for 12 months or a longer period of time. Typically, in such cases, the payment is taken before the service is provided.

What are the benefits of revenue recognition?

There are numerous benefits of revenue recognition. The following are the three main ones.

Insight into profits

Revenue recognition makes it easier and accurate for you to know how profitable your business has become as well as the losses component. Knowing your profit and loss margin shows you how well you are able to balance your profits with your losses. When you look at the profit and loss margin over a course of time you can better tell how your business has been doing for that period and how your business profits improved or worsened over time. This tells you about your business’s financial health which can be used for making changes.

Accurate accounting records

Correctly recognizing revenue and recording it precisely ensures your accounting records are credible and can be trusted for financial reporting purposes. The accuracy of accounting records is fundamental for a thorough overview of your business’s financial position. As a business owner, you want to make decisions that encourage improvement in how much profit you make and minimize losses in the process. By understanding revenue recognition, you ensure you are able to make changes to your business that are reliable.

Helps in financing

Revenue recognition can aid you when you need financing. For example, people outside your business such as lenders, creditors, and investors will appreciate that you recognize your revenues as they can decide based upon that whether they should help you out with financing or not. If your business is stable, then these individuals will be willing to lend you long-term loans or provide funds so you can generate higher profits. They are also more likely to invest in your business. If you need financing, then ensuring you follow the revenue recognition principle is crucial.

Which businesses need to worry about revenue recognition?

Revenue recognition isn’t reserved for a few businesses as it is important for all types of businesses. However, there are some businesses that need to think about revenue recognition more than others because of how they operate and provide products and services to their customers. Subscription-based businesses such as those which provide memberships require proper revenue recognition. These subscription businesses also include software companies that offer SaaS and publication businesses. Revenue recognition should matter to businesses that collect a retainer which is an agreement whereby the customer pays upfront and then gets access to the services offered by the business.

Businesses that will be providing a service for the long term need to pay special attention to revenue recognition. For example, if you are in the construction business then you will charge your clients upfront before the work begins. You will have to reach milestones along the way and then the complete construction can take months depending on the particular construction. Correctly recognizing revenue is vital to ensure you are recording and balancing your books precisely. If you are still confused, then you can take the help of an expert. A financial professional can help you to figure out if you should be thinking about revenue recognition or not.

What are recognized revenue, accrued revenue, and deferred revenue?

You will often hear the terms recognized revenue, accrued revenue, and deferred revenue when you are dealing with revenue recognition. Here are the terms explained with examples.

Recognized revenue

Recognized revenue is also known as earned revenue and it is when your business receives cash deposit or transfer for products or services it provides. When recording recognized revenue in your accounting books, you will write it as income. Let us say you have a physical bakery store in New York. A customer walks in and buys a red velvet cake. He makes an immediate payment with his debit card or pays cash up front. This is earned revenue because you received the money immediately upon giving the red velvet cake to the customer.

Accrued revenue

Accrued revenue is another term often used in revenue recognition. It differs from earned revenue because accrued revenue is when you have provided the good or service, but have not received cash for it. It is written on the balance sheet as a receivable because it is owed to you by the customer. Let us say you need to provide a service that will take a year to complete. The accrued revenue is recorded over the course of the year which is once a month most probably. Even though you have not received the payment yet, you will record the accrued revenue. This is generally the case for businesses that take full payment once the project has reached its completion.

Deferred revenue

Deferred revenue differs from accrued revenue and earned revenue. Deferred revenue is when the payment has been made by your customer, but you have not provided the products or services to them yet. Deferred revenue is seen as a liability and recorded as one because the product or service hasn’t been provided yet. In this sense, your business owes it to the customer. Take the example of subscriptions such as Amazon Prime and Netflix. Customers need to pay for the subscription before their current subscription ends or if they wish to continue the service. The prepayment is deferred revenue as the service is going to be provided after the payment has been made.

Revenue recognition examples

The following examples will clarify revenue recognition for different businesses.

Revenue recognition for businesses that sells physical goods

A business called Fab Purses sells purses and bags in-store. Your customer comes into your store in the morning and falls in love with a hand-designed purse. She pays $100 in cash for the purse and leaves. This is an example of earned revenue since you received the payment in your hands then and there as soon as you handed over the purse to her. You will recognize this payment as income in your books.

In another scenario, someone spots your purses and places an order of 10 purses which amounts to $5,000 for those specific purses. There is a contract involved and they say that once you deliver the 10 purses to them, they will pay the $5,000 in one go. Rather than record $5,000 as complete payment, you will write it as accrued revenue. As you complete each purse and send it to the customer, you will move $500 to your earned revenue. When you have completed the purses and delivered them to your customer, only then will you recognize your earned revenue as $5,000.

Revenue recognition for a business that is based on a subscription model

A SaaS company sells subscriptions whereby a customer is required to pay $600 upfront before he has access to particular software. The subscription is for 12 months of access. Instead of recognizing the $600 payment as revenue for the month that the customer paid it for, you will recognize a part of the payment every month. That is, you will recognize $50 of revenue every month until the end of the subscription. For instance, you will have $50 as your earned revenue and $550 as your deferred revenue. As the months pass, the deferred revenue value will decrease and the earned revenue value will increase because you are delivering the service.

How can accounting software ease your burden?

Business owners have way too much on their plate. A business management and accounting software solution such as TallyPrime can ease your burden by making accounting a simple and insightful process. It produces hundreds of reports, enables you to manage your inventory efficiently, helps in the bank reconciliation process, and makes billing and invoices generation easy and quick.

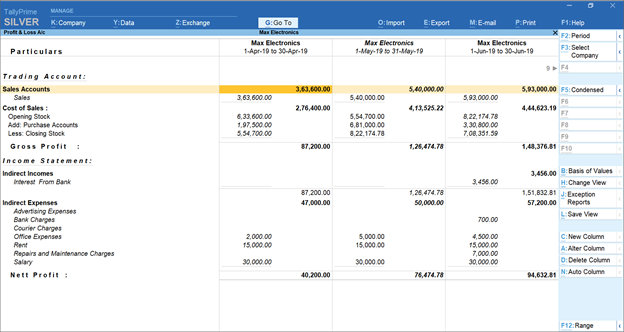

Monthly comparative Profit & loss account in TallyPrime

There is much more on offer by TallyPrime as it is a complete robust accounting solution that helps you track, do more, and make decisions for your business that will benefit it in the short and long term.

Explore more Products

Best Accounting Software in USA, Accounting Software for Small Businesses in USA, Factors to Consider before Buying Bookkeeping Software in USA, Benefits of Payroll Management Software for Small Businesses in USA, Invoicing & Billing Software in USA That Best Suits Your Business

Read more on Accounting

COGS vs Expenses, Financial Accounting Vs. Managerial Accounting, Real Estate Accounting in US Best Practices and Bonus Tips, Difference Between an Estimate, Quote, Bid, and Proposal, How to Easily Build Great Estimates for Your Projects?

Popular Articles

Differences Between Trial Balance & Balance Sheet, What is the NOPAT Formula?, What is A Pay Stub?, What Are T Accounts?, What is a credit note?, How to Find Gross Profit?, What are Operating Expenses?, Break Even Point Formula, What is the Gross Margin Formula?, What is the Direct Write Off Method?, What Is Interest Expense?