- TDS on purchase of goods under section 194Q

- Scenarios of TDS deduction u/s 194Q

- Steps to manage TDS on purchase u/s 194Q in TallyPrime

In India, businesses are required to deduct TDS (Tax Deducted at Source) on certain payments like interest, salary, rent, and professional fees. However, from 1st July 2021, a new rule has been added under Section 194Q of the Income Tax Act. This section makes it mandatory for buyers to deduct TDS when purchasing goods if the purchase value crosses a certain limit. The main aim of this rule is to keep a better track of large transactions and improve tax compliance. It’s especially relevant for businesses with high turnover or those involved in bulk buying.

In this guide, you’ll learn when Section 194Q applies, how to calculate TDS and key exceptions.

What is Section 194Q?

Section 194Q of the Income Tax Act, 1961, mandates Tax Deducted at Source (TDS) on the purchase of goods by buyers in India. This provision requires that a buyer deduct TDS at the rate of 0.1% on the amount exceeding ₹50 lakh in a financial year when purchasing goods from a single resident seller, provided the buyer's turnover exceeds ₹10 crore in the preceding financial year. The TDS must be deducted at the time of crediting the purchase amount to the seller’s account or at the time of payment, whichever is earlier. If the seller does not furnish their PAN, the TDS rate increases to 5%. Section 194Q aims to enhance tax compliance and transparency in high-value goods transactions. It applies only to resident sellers and replaces the earlier system of Tax Collected at Source (TCS) on goods sales under section 206C(1H) from April 1, 2025.

Applicability of Section 194Q

Section 194Q of the Income Tax Act is applicable under these key conditions:

- The buyer’s total turnover, gross receipts, or sales in the previous financial year exceed ₹10 crore.

- The buyer purchases goods from a resident Indian seller.

- The aggregate purchase value from a single seller exceeds ₹50 lakh during the financial year.

- TDS has to be deducted on the amount exceeding ₹50 lakh at the rate of 0.1%.

- The provision applies only to purchases of goods (both capital and revenue goods), not services.

- TDS must be deducted at the earlier of crediting the purchase amount to the seller’s account or at the time of payment.

Section 194Q does not apply if:

- The purchase is from a non-resident seller.

- TDS is deductible under any other provisions.

- Tax is collectible under other sections like Section 206C(1H) of TCS.

- Purchases are exempted by the law, such as imports.

Once the buyer crosses the ₹50 lakh threshold for purchases from a specific seller, all subsequent purchases from that seller in the financial year attract TDS deduction.

TDS Rate under Section 194Q

The TDS rate under Section 194Q is 0.1% and applies to the purchase of goods from a resident seller when the value exceeds ₹50 lakh in a financial year. If the seller does not furnish their PAN, the rate increases to 5%

Who needs to deduct TDS under Section 194Q?

You must deduct TDS under Section 194Q if:

- Your business turnover was more than ₹10 crore in the previous financial year.

For example, if you are checking for the financial year 2024–25, your turnover in 2023–24 must have been above ₹10 crore. - You are purchasing goods worth more than ₹50 lakh from a single seller during the current financial year.

If both of these conditions are true, you are required to deduct TDS on the amount that exceeds ₹50 lakh.

Calculation of TDS under Section 194Q

Once you're required to deduct TDS under Section 194Q, the next step is to calculate it correctly. The TDS is not on the full value of the purchase, but only on the portion that exceeds ₹50 lakh from a single seller in a financial year.

Calculation Method:

Use the following formula:

TDS Amount = (Total Purchase Value – ₹50,00,000) × TDS Rate

Where:

- TDS Rate = 0.1% (if PAN is available)

- TDS Rate = 5% (if PAN is not available)

Example:

If your purchases from a seller total ₹80 lakh during the year, then:

- Amount liable for TDS = ₹80 lakh – ₹50 lakh = ₹30 lakh

- TDS (assuming PAN is available) = ₹30,00,000 × 0.1% = ₹3,000

This amount must be deducted from the payment and deposited with the government.

Scenarios of TDS deduction u/s 194Q

|

Details in a financial year |

Use Case-1 |

Use-case-2 |

Usecase-3 |

Use case-4 (PAN not Available) |

|

Turnover of Buyer |

15 Cr |

20 Cr |

8 Cr |

14 Cr |

|

Sale Value or consideration |

60 Lakhs |

8 Lakhs |

20 Lakhs |

70 Lakhs |

|

TDS deduction by buyer |

Yes |

No |

NO |

Yes |

|

Taxable value |

10 Lakhs |

-- |

-- |

20 Lakhs |

|

Rate of TDS |

0.1% |

-- |

-- |

5% |

*Taxable value refers to the value more than 50 lakhs i.e., the remaining amount of purchase after 50 lakhs. In cases where the buyer is not eligible to deduct TDS, the seller can collect tax on meeting threshold criteria.

Impact on GST on TDS Calculation

- TDS under Section 194Q is generally calculated on the amount exceeding ₹50 lakh, and whether GST is included in the base for TDS depends on how the invoice is raised.

- If GST is shown separately on the invoice, TDS is typically deducted only on the value of goods excluding GST.

- However, if payment is made before the invoice is raised or GST is not separately identified, TDS may be deducted on the total amount including GST.

- GST is excluded from turnover calculations for Section 194Q applicability but may be included for TDS calculation depending on the specific transaction structure and timing.

These provisions help ensure correct TDS compliance and avoid excess tax deduction or non-compliance penalties. Proper invoice and purchase documentation are essential for accurate calculation.

Steps to manage TDS on purchase u/s 194Q in TallyPrime

For ease of recording TDS on purchases u/s 194Q in TallyPrime, follow the steps mentioned below. To know step-by-step by details to configure and recording translations, please read Record TDS on Purchase of Goods (Under Section 194Q)

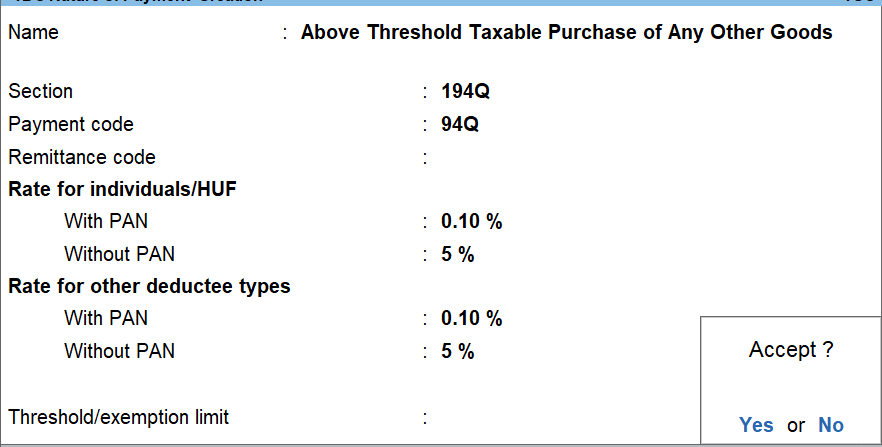

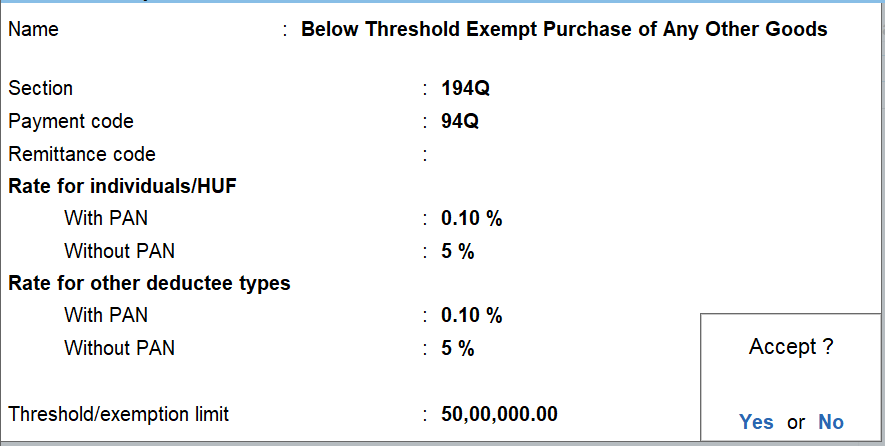

Creation of TDS nature of payment

Create two ‘TDS Nature of Payments’ and configure one above the Threshold Limit (of Rs 50 lakhs) and one below the limit as shown in the images below. You can name the nature of payment accordingly for easy identification. Also, mention the rate as 0.10% with PAN and 5% in case of without PAN.

To create, navigate from Gateway of Tally > Create > type or select TDS Nature of Payments. Alternatively, press Alt+G (Go To) > Create Master > type or select TDS Nature of Payments.

Purchase ledger and GST ledgers configuration

Configure the purchase ledger and GST ledgers to ensure that both GST and TDS is applicable, and set the TDS Nature of Payment to ‘Any’.

Recording transactions

While recording the purchase transaction, you have to select the relevant nature of payment in the ‘TDS Nature of Payment’ details sub-screen.

- If the total value of purchases from a party crosses the Threshold Limit across transactions, you have to select the nature of payment configured above the Threshold Limit

- if the total value of purchases from a party continues to be below the Threshold Limit, you have to select the nature of payment configured below the Threshold Limit

Read Record TDS on Purchase of Goods (Under Section 194Q) to know more on managing advance TDS payment, adjust TDS in purchase as per advance payment, purchase return/cancellation and TDS exemption for government-listed seller

Exceptions and Exemptions

Although Section 194Q applies to many buyers, there are some situations where this rule does not apply. Knowing these exceptions helps avoid unnecessary confusion and ensures compliance only when required.

|

Exception |

Explanation |

|

Turnover is below ₹10 crore |

Buyer is not required to deduct TDS |

|

Seller is a non-resident |

Section 194Q applies only to purchases from resident sellers |

|

TDS is already applicable under another section |

Example: Section 194-O (E-commerce transactions) |

|

TCS under Section 206C(1H) applicable and buyer not liable under 194Q |

Seller may collect TCS if the buyer is not required to deduct TDS |

Compliance and Penalties

When you deduct TDS under Section 194Q, it’s important to follow all the compliance rules carefully to avoid penalties.

What you need to do to comply:

- Deduct TDS on time: You must deduct TDS when making the payment or crediting the amount to the seller, whichever happens first.

- Deposit TDS with the government: The deducted TDS amount should be deposited with the government within the prescribed time.

- File TDS returns: You must file TDS returns regularly, providing details of TDS deducted and paid.

- Provide TDS certificate: You need to issue a TDS certificate (Form 16A) to the seller as proof of tax deducted.

Penalties for non-compliance:

- Disallowance of expense (Section 40A(IA)): If you fail to deduct TDS under Section 194Q, 30% of the purchase amount on which TDS was not deducted will not be allowed as a business expense.

This means:- That 30% will be added to your taxable income

- You will need to pay tax on it as part of your total income

- Prosecution in serious cases: In cases of wilful failure, legal action may be taken, including fines and imprisonment.

Following these rules ensures you stay compliant and avoid unnecessary fines or legal trouble.