Oops! I missed the payment assuming it had 45 days credit days, but it was supposed to be paid in 15 days. I delayed the payment but later I discovered my supplier is a Micro enterprise registered under MSMED Act.

If you are dealing with MSMEs, we are sure, you might have got into these situations.

Many businesses transacting with micro and small enterprises frequently mixes up the 15-day, 45-day, and actual credit period which results in missing the payment deadlines. It is not because businesses want to delay the payment but, in most cases, it is the inability to track the MSME payables with the details such as upcoming dues, due days etc. in line with MSME payment rule. This becomes even more complex given the diversity of suppliers you deal with.

Now, TallyPrime comes with powerful enhancements that will help you to drive your payment processes compliant with the MSME rule, specifically addressing the latest section 43b(h), which entails the disallowance of expenses related to overdue bills, thereby ensuring enhanced compliance measures.

Let’s look at how TallyPrime helps you manage MSME payments compliance effortlessly.

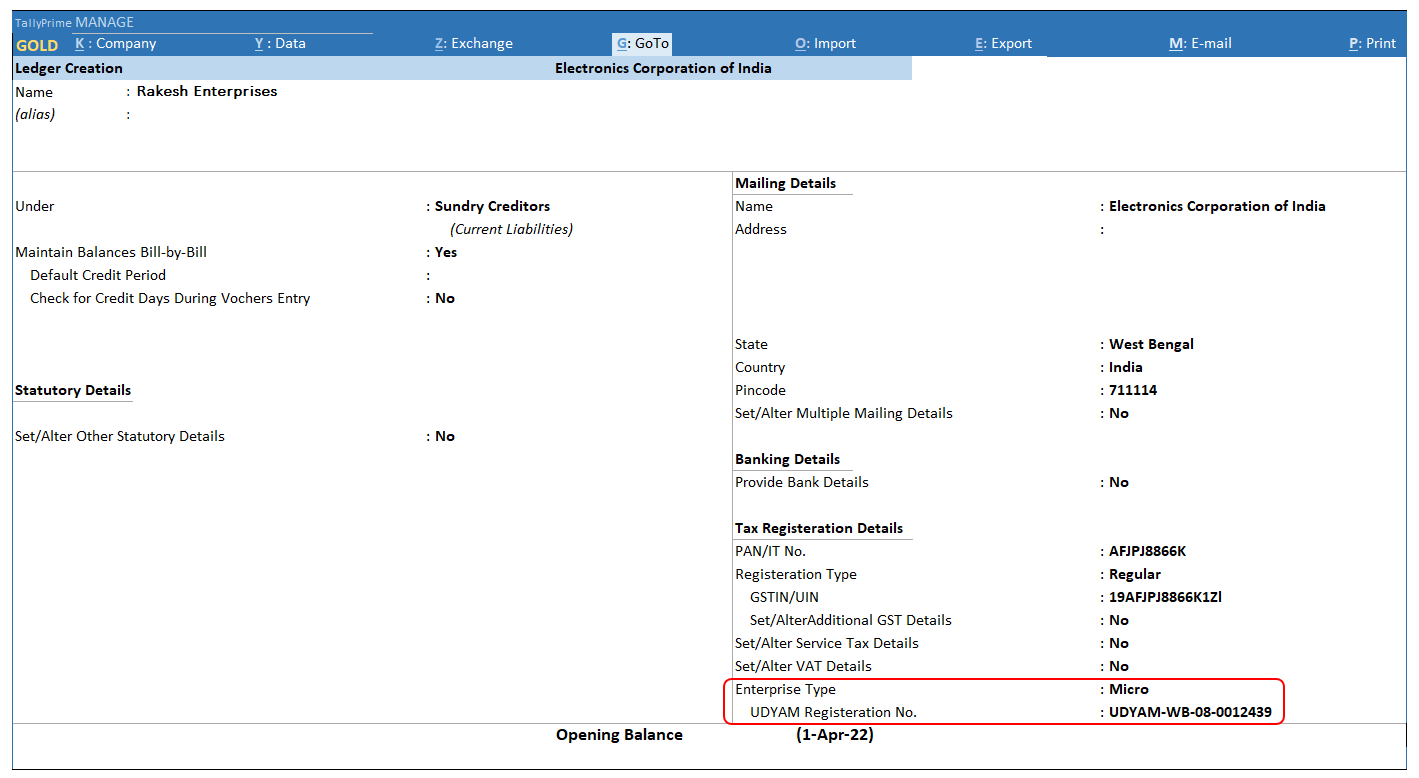

Identification of MSME parties with TallyPrime 4.1

The latest release of TallyPrime introduces an MSME feature that significantly simplifies the way businesses, regardless of their size, manage and categorize their suppliers, particularly those identified as MSMEs. Recognizing the varied compliance requirements across different types of companies, the lates release allows for the efficient updating and tracking of UDYAM registration numbers and categorizes enterprises as Micro, Small, or Medium.

Businesses input these details for each supplier ledger or do it bulk, using Updated Party MSME details or Excel spreadsheets.

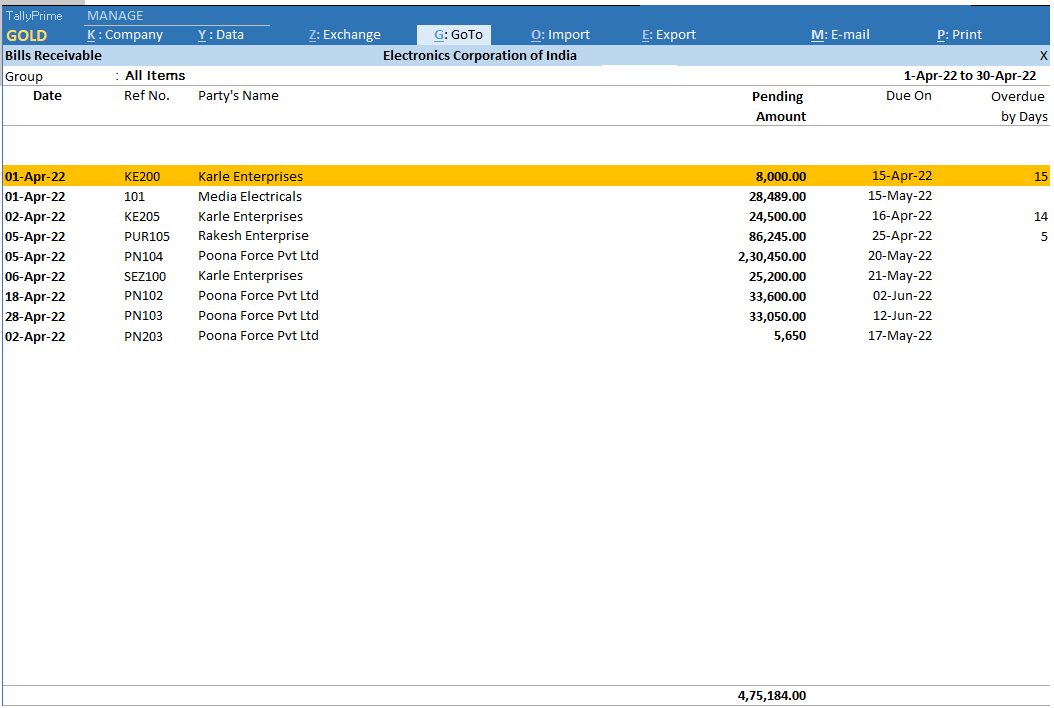

Quick access to overdue bills

With the lates release of TallyPrime, you can track the payables to MSME suppliers, including a detailed segregation between Micro and Small enterprises. You can quickly identify the upcoming payables to MSMEs and ones that are overdue. The best part is that you can track the upcoming due days based on the MSME payment rule, i.e. the 45-day and 15-day rule or the agreed date.

This feature not only provides a comprehensive view of the bills due but also assists in managing payments within the stipulated timeframes.

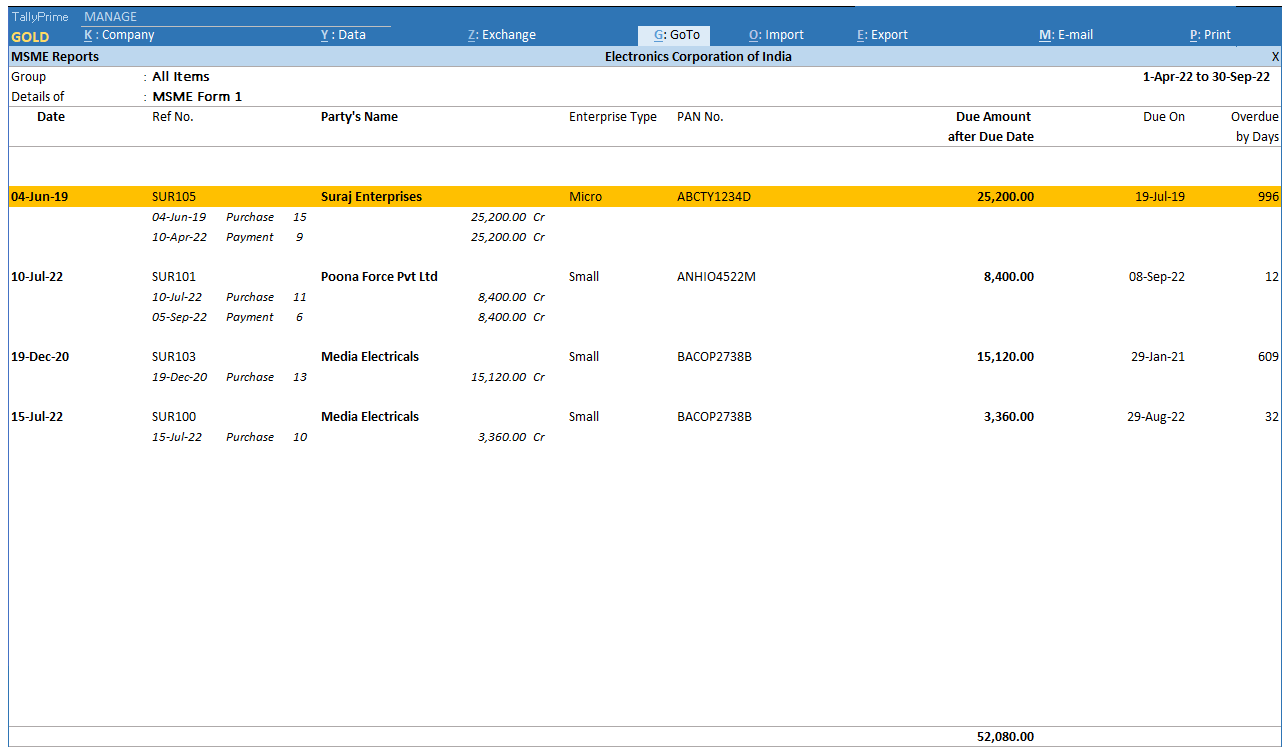

MSME form 1 reporting

Effortlessly access overdue bills and conveniently report them in MSME Form 1, thereby saving valuable time and effort for businesses.

The MSME Development Act, 2006, enhances protections for MSMEs against delayed payments by setting a maximum credit period and penalizing interest for late payments. Companies must explain any payment delays in their accounts. If a payment to an MSME is overdue by more than 45 days, companies are required to submit Form MSME-1, detailing the delay's reason.

|

Navigating Supply Chain Disruptions: Strategies for Resilience in Uncertain Times |

Companies are required to submit MSME Form 1 twice a year, detailing any overdue payments to MSME suppliers.

Simplification of the CA auditing process

With the critical data on MSME classification readily available, the auditing process for Chartered Accountants (CAs) becomes much more straightforward. This accessibility ensures that compliance checks and financial audits can be conducted efficiently, without the need for extensive data gathering and verification processes.

Facilitating compliance with section 43b(h)

Another critical aspect of TallyPrime 4.1 is its ability to help businesses comply with section 43b(h), which pertains to the disallowance of expenses on overdue bills. The software enables users to filter bills that have crossed their due date within the financial year but remain unpaid, thereby facilitating appropriate action to maintain compliance and avoid potential penalties.

Conclusion

The introduction of MSME payment compliance streamlines compliance and payment processes for businesses. By providing tools for easy identification of MSME parties, simplifying the CA auditing process, offering quick access to overdue bills, and assisting in compliance with relevant legal requirements, TallyPrime ensures that businesses can focus more on growth and less on administrative burdens. This new release underscores Tally's commitment to enhancing the efficiency of business operations and supporting the vital ecosystem of MSME suppliers.