As the day of GST filing approaches, some businesses run helter-skelter in search of documents. Where is the sales statement for the sale made to Amar Enterprises? Check the invoice number and invoice date for the steel shipment received for filling in the GST return! We need the invoice for the new machinery we have got to claim a tax deduction, now where is it?

Now GST filing must be done every month or every quarter, businesses have found it necessary to stack away all the invoices in a neat pile! What a pain right? Not only invoices, GST filing asks you for stock details of goods, debit and credit notes, etc.

You have to hunt for all the data and your purchase and sales invoices every month or once every three months to file your returns and remit the GST collected. What if you miss something? A penalty or a fine will be on the way soon to your registered business address.

So how to simplify this process? While you can’t do anything about the filing deadlines, you can take steps to make your filing easier and smoother without making it feel like a hassle to complete.

Importance of Keeping GST Records Organized

There are two critical reasons why a business should keep GST records organized:

- To make GST filing easier

The importance of keeping all GST records organized for GST filing is the ease of filing. If you don’t have all the records in one place where it is easily accessible, GST filing will be your monthly crucifix.

Keeping an organized log of all your sales and purchases invoices is mandatory if you want to easily file GST returns. You also need to have other records of TDS and TCS credit received, Input Tax Credit claimed, etc.

Since there might be many invoices and multiple TDS and TCS documents, it is wise to keep this arranged sequentially so you can get through the filing process without getting furious and distressed.

- To be legally compliant to GST laws

The first thing to know is that the Government of India has put forward certain GST rules that all businesses are mandated to follow for smooth filing. These rules are designed to make GST filing as easy as possible for the taxpayer and the government.

The most important rule is that accounts related to GST filing must be captured in the format that the government has given and stored for 5 years from the date of GST filing. Your books should accurately reflect the GST liability you have paid and the Input Tax Credit you have claimed and received.

Must Have Accounting Records for GST filing

The GST authority will scan GSTR 3B you have filed, study how you have arrived at your GST liability by scrutinizing the deductions you have claimed. Under GST laws, every business is required to maintain correct accounts of:

- Production or manufacture of goods

- Inward or outward supply of goods and services

- Stock details of goods

- Input tax credit availed

- Output tax payable and paid

Maintaining these records chronologically devising an easily accessible system of organization can help you file your taxes without getting frazzled and make you a GST complaint entity.

Best Practices for Managing Records and Books

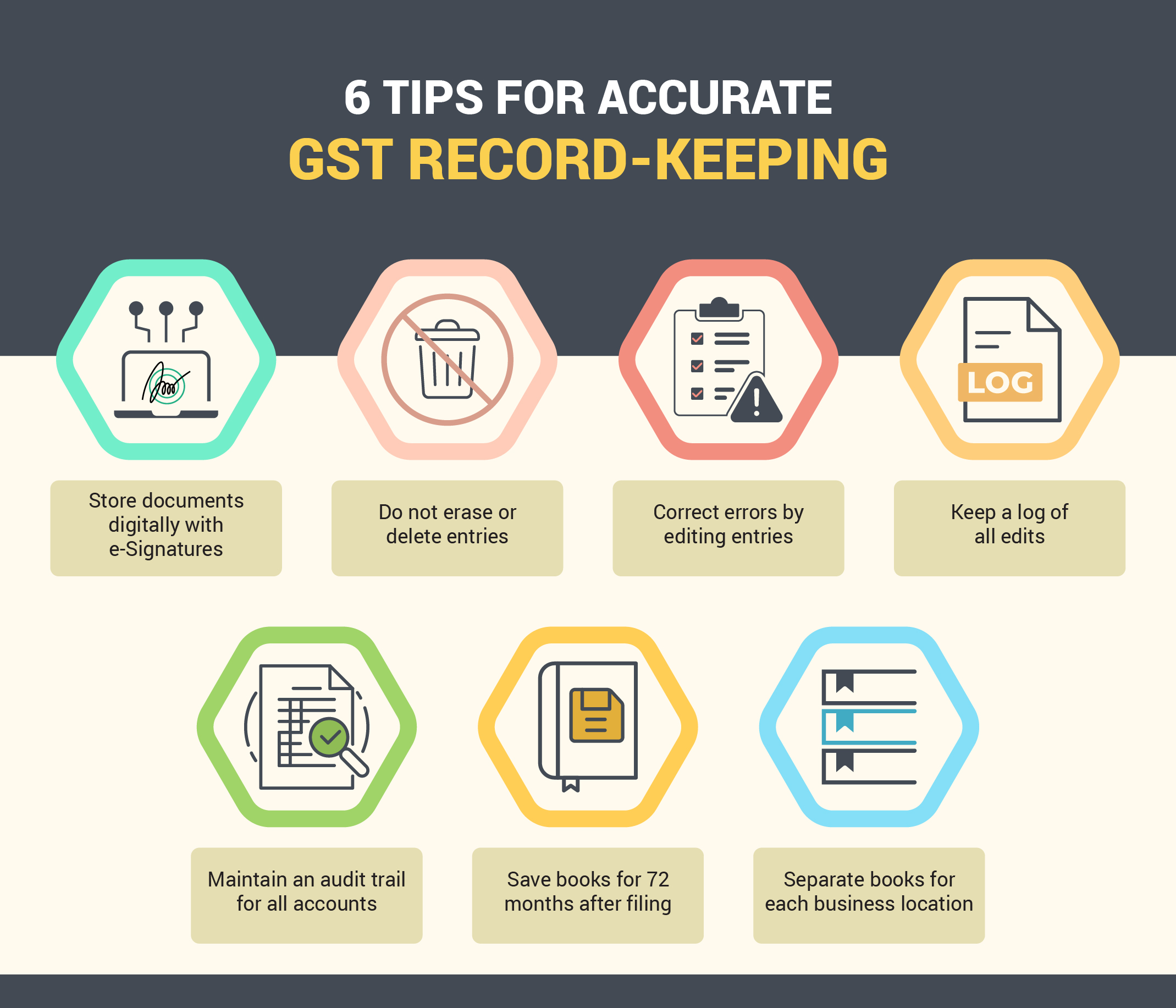

Now you know every purchase and sales transaction your company has engaged in must be recorded in your books of accounts. Here are a few best practices that can help you deal with GST filing:

- Make sure to record all transactions accurately as they happen.

- Set up a clear action plan to make sure all steps are taken to meet GST filing deadlines consistently.

- Make sure to set up reminders to notify you about upcoming due dates for filing GSTR 1 and GSTR-3B.

- Regularly reconcile your sales and purchase invoices with your accounting records.

- Reconcile your books of accounts with the GSTR-3B return to eliminate any errors.

- Regularly self-assess your tax and find out the tax liability to be paid.

- Regularly matching your GSTR-3 returns with GSTR-1 and GSTR-2A is key to keeping your filing consistent and accurate.

Winning the Compliance Game with Accounting Software

If you have been filing GST for a few years, you already would know that filing GST manually is a hassle. Taking each sales invoice, inputting details in GSTR 1 and then reconciling the invoice with GSTR 2A, this must take place regularly and is a time-consuming process. Plus, the task of storing invoices is no easy mountain to cross.

Most businesses have adopted an accounting software to handle these redundant tasks. This is because they realized handling a full-fledged accounting department reconciling invoices and ITC claims requires significant financial investment compared to using a software.

Once they adopted an accounting software, they realized that not only accounting became DIY all the invoices and other records got automatically stored. They had an audit trail to show authorities with sequentially arranged invoice data captured by the software. Not only did the accounting software make bookkeeping easy but GST compliance was handled as well.

Have a look at how an accounting software can automate and simplify GST compliance:

- Integrated way of managing books of accounts

The ‘integrated way’ means that invoices issued by you will be linked to the e-Way bill issued and then connected to your inventory. This means that once you initiate a sale, the software will record the e-invoice created, quantity of stock being depleted in the inventory, the e-way bill being issued for movement of goods and the money received in your bank account for the transaction.

- Records all transactions and logs an audit trail

Once you enter your invoices into the software it stores it away and captures an audit trail. You can go back and refer to this audit trail and present this to the tax authorities.

- Auto generation e-Invoices and e-Way bills

With connected accounting software, you can now generate an e-invoice instantly with no changes to the invoicing process that you follow. You can also instantly generate an e-way bill for a single invoice while recording an invoice.

- Auto reconciliation of GSTR-2A and GSTR-2B

Accounting software is now capable of automatically reconciling GSTR-2A and GSTR-2B. The software will give you a quick and comprehensive summary of reconciled transactions and the mismatches.

- Prevention, detection and correction capability

Accounting software can warn you when you are doing a wrong tax rate entry for a transaction. This ensures that your tax entries are accurate and the ITC you claim is correct. The software can automatically trace a wrong entry and then give you the correct entry.

Using an accounting software is the easiest way to win the GST compliance game. You no longer need to worry about missing invoices and wrong ITC claims. With the auto reconciliation feature for GSTR 2A and GSTR 2B life becomes even easier with your regular reconciliation practice done within minutes.