Managing cash flow is like steering a ship through a storm. Cash flow Management is a key part of keeping any business financially stable. While things may run smoothly sometimes, unexpected costs can throw you off course. Good cash flow management isn’t just about staying in business – it’s about helping your business grow and succeed.

Now, let’s explore the top financial risk management strategies so that you’re always prepared with enough cash to cover basic expenses and reinvest in growth.

What is cash flow management?

Cash flow management ensures enough funds are coming into and going out of your business. You need sufficient cash inflows because you need to keep your business running, pay your employees, and ensure equipment is being maintained.

Cash outflows are also important as you need to invest in better procedures and equipment to speed up the current processes. Maintaining the optimum cash flow levels is important in India, so your business generates sufficient funds.

Why is cash flow the heartbeat of your business?

Think of cash flow as the energy to run your business, much like water in a marathon. Cash flow is that ‘water’ for your business. It’s not just the money coming in and out— it’s the fuel for paying bills, expanding operations, and having a safety net during tough times.

Stats reveal that 59% of businesses in India struggle to maintain healthy cash flow. Managing cash flow isn’t just about balancing the books but also having the right strategies to grow your business without cash shortages.

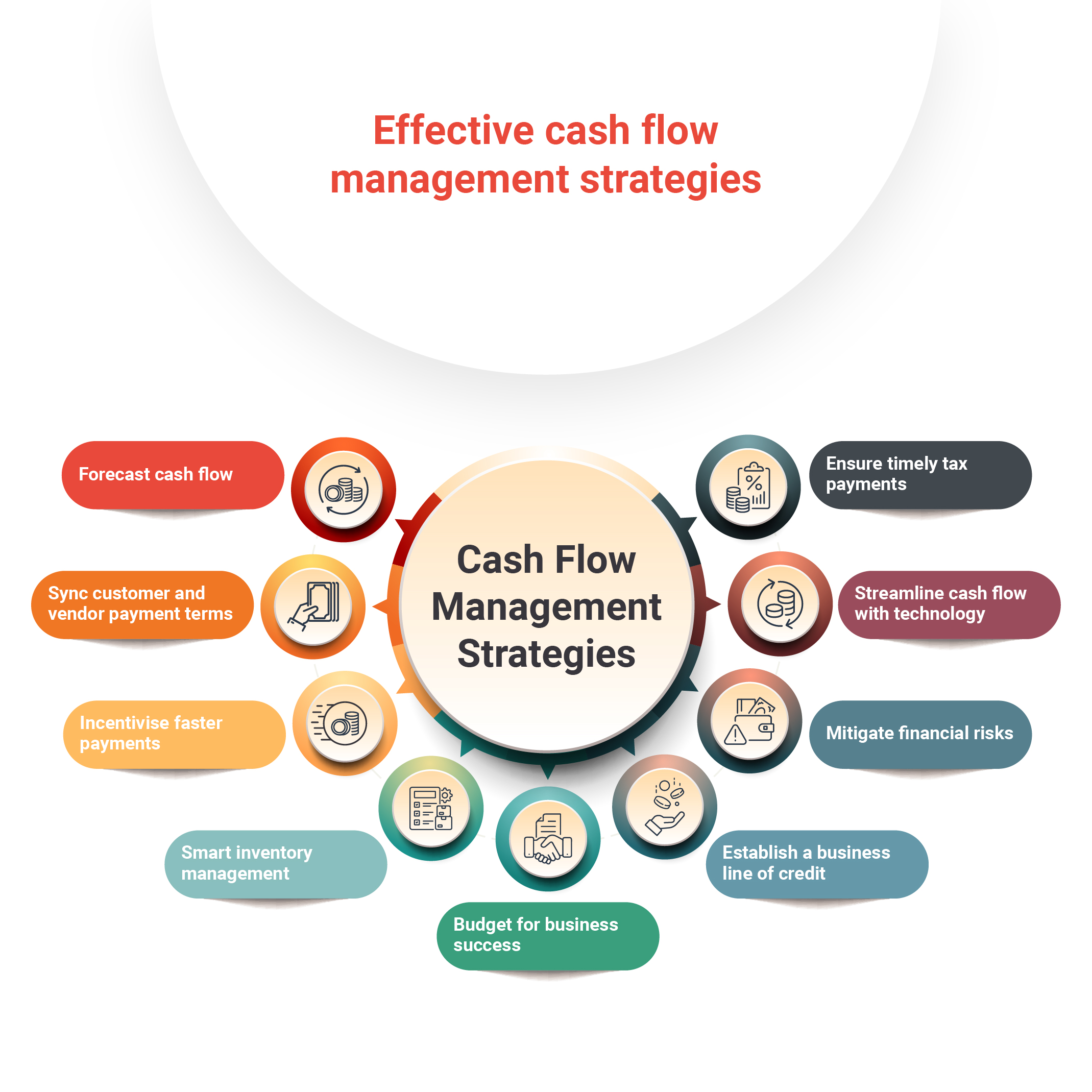

The 9 best cash flow management strategies

So, how can you effectively manage cash flow and avoid becoming part of that statistic? Let’s explore this key concept of financial analysis:

1) Create a cash flow forecast

Think of a cash flow forecast as your business’s GPS. It tells you where your money is coming from and where it’s going, helping you navigate potential financial bumps. By forecasting cash flow, you can spot periods where you might run short on cash and take action before it becomes a crisis.

With our cash flow generator tool, you can easily create a customized forecast, helping you make data-driven decisions and stay on top of your cash flow needs.

2) Align customer payment terms with vendor terms

If your vendors require payment in 15 days, but your customers take 30 days to pay, you’re left holding the bag. This misalignment can lead to negative cash flow, where more money goes out than comes in.

To fix this, synchronize your vendor and customer payment terms. If your clients pay after 30 days, negotiate the same terms with your suppliers.

3) Offer incentives for faster payments

Cash in hand is always better than a promise on paper. Want to encourage clients to pay you quickly? Try offering them a small discount for early payment. For example, give a 2% discount if they pay within 10 days. It’s a simple way to get your money sooner, even if you give up a little bit.

4) Stay on top of inventory management

Think of your inventory as stacks of cash sitting on your shelves. The longer it stays there, the more it drains your cash flow. Efficient inventory management ensures you’re not tying up too much cash in stock that doesn’t sell.

5) Budget like a pro

Budgeting is your business’s financial roadmap. It gives you a clear picture of how much money you’ll need to cover costs and whether you’ll have enough coming in. Ensure to have a budget in place for fixed expenses like rent, utilities, and taxes and factor in variable costs like wages and equipment.

6) Secure a bank business line of credit

Getting a business line of credit is like setting up an umbrella before the storm. Even if your cash flow is healthy now, unexpected expenses or delayed payments can happen. Setting up a line of credit when things are going well gives you a safety net for tough times.

7) Mitigate financial risks

Running a business comes with risks, but that doesn’t mean you can’t prepare for them. A contingency plan can help you stay afloat despite unexpected costs or a slow sales period. Set aside a portion of your profits as a financial buffer or ask for deposits on large custom orders to avoid getting stuck with unsold inventory.

Take the example of a printing business. Request a deposit upfront if you get a custom order for 1,000 t-shirts. This way, you’re not stuck with the costs if the client delays payment.

8) Automate cash flow management with technology

Managing cash flow with spreadsheets is inefficient and prone to errors. Automating your cash flow management helps reduce human error, improve efficiency, and give you a clearer picture of your financial metrics.

Financial analysis tools, like AI-powered reporting systems, are designed to make your life easier. Instead of spending hours manually tracking expenses, you can instantly generate reports that give you insights into key financial metrics, helping you make better and faster decisions.

9) Plan for tax payments

Taxes shouldn’t catch you off-guard. By planning for them throughout the year, you can avoid facing a huge bill all at once. Set aside money regularly to cover what you owe, so you're not scrambling to find cash when it's time to pay up.

Conclusion

Cash flow management is not a one-time task—it’s an ongoing process that’s key to sustainable business growth. By implementing effective cash flow management strategies, you can keep your business financially healthy and positioned for future success. It's also a big part of achieving the objective of financial analysis, helping you understand and plan for your company’s needs.

Our cash flow generator makes it simple to forecast, track, and optimize your cash flow, so you can focus on growing your business. Let’s keep the cash flowing and your business thriving!