In business, the return of goods by customers is common. The return of goods can be of the entire quantity supplied or of a partial quantity. This could be due to various circumstances, such as goods being damaged during transit, goods not received as per the specification, etc.

With the introduction of VAT in UAE, the tax aspect on the goods supplied and returned also comes into play. When the goods are sold, VAT is charged at the standard rate. When the goods sold are returned by the recipient partially/fully, the VAT charged on the goods returned has to be reversed. The document to be issued by a supplier when goods sold are returned by a customer, is called Tax Credit Note. A Tax Credit Note serves the purpose of reducing the tax payable to the FTA by the supplier on the supply by as well as reducing the input tax eligible to be recovered by the recipient on the supply. Let us understand how a supplier can issue a Tax Credit Note for return of goods by customers.

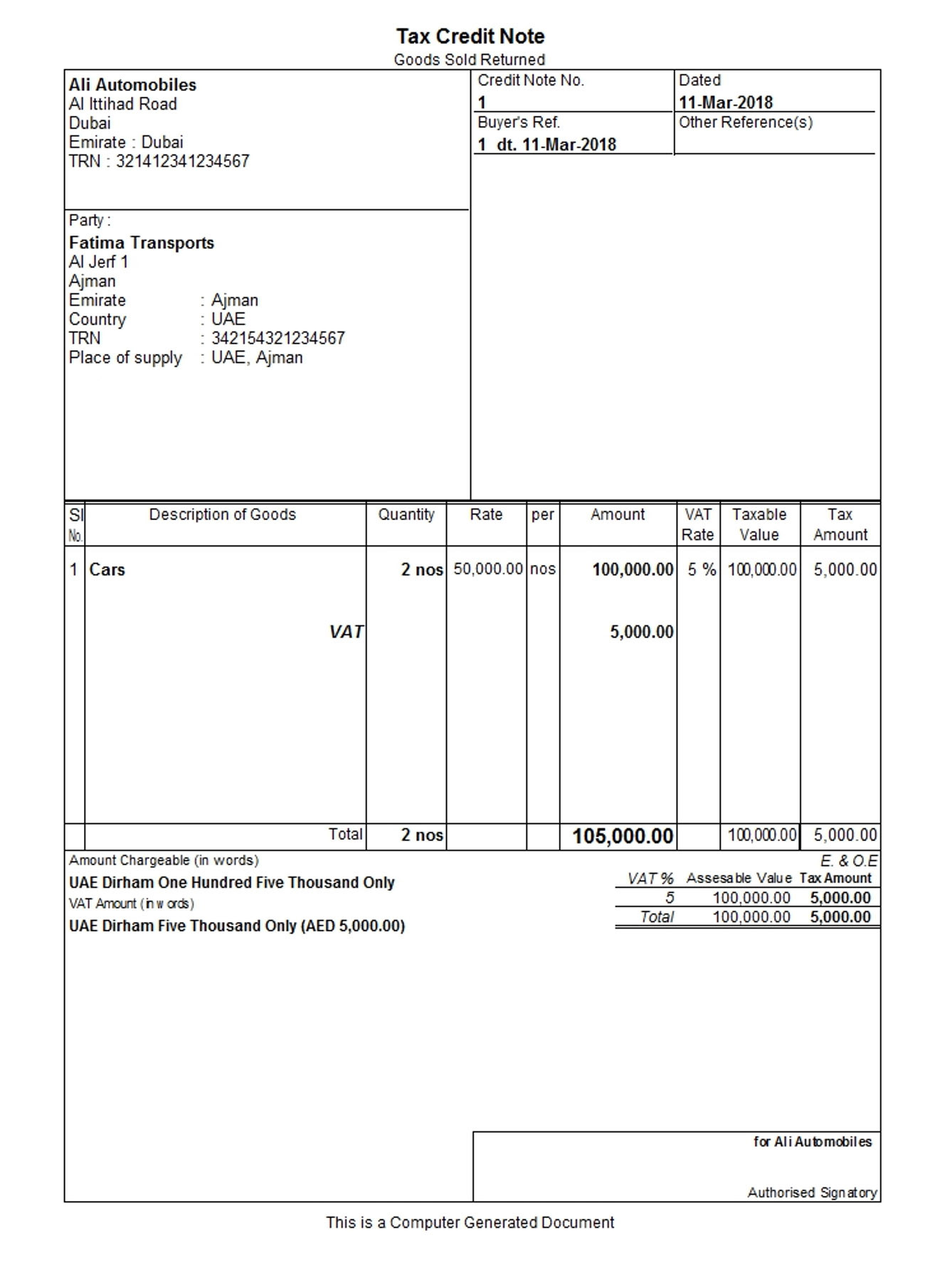

Example: Ali Automobiles, a registrant in Dubai, supplies 10 cars @ AED 50,000 each to Fatima Transports, a registrant in Ajman. VAT @ 5%, amounting to AED 25,000 has been charged on the supply. Out of the cars supplied, Fatima Transports returns 2 cars as they are damaged during the transportation. The Tax Credit Note to be issued by Ali Automobiles for return of 2 cars by Fatima Transports appears as shown below:

A Tax Credit Note is an important document under VAT in UAE. The VAT Law has laid down the details that are mandatorily required in a Tax Credit Note. Registered businesses should ensure that these details are given in every Tax Credit Note issued.

Let us now answer some FAQs that businesses have, with respect to Tax Credit Note.

FAQ 1: Should the Tax Credit Note necessarily contain details of the sales invoice to which it relates?

Answer: Yes, a Tax Credit Note should provide the details of the Tax Invoice, i.e. the supply to which it relates. In the above Tax Invoice, the ‘Buyer’s Ref’ field shows the details of the Tax Invoice to which the Tax Credit Note relates.

FAQ 2: Is there a time limit within which a Tax Credit Note relating to a supply has to be issued?

Answer: No, no time limit has been laid down for the issue of a Tax Credit Note for a supply.

FAQ 3: Should a Tax Credit Note necessarily contain the reason for its issue?

Answer: Yes, a Tax Credit Note should contain a brief explanation of the circumstances leading to the issue of the Tax Credit Note.

Read more about UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

VAT Rate

VAT Rate in UAE, VAT Rates Applicable to Education Sector in UAE, Difference between Zero Rate, Exempt and Out of Scope Supplies in UAE VAT, UAE VAT Rates- Handbook, Standard Rated Purchases/Expenses in VAT Form 201, Zero-Rated and Exempt Supplies in VAT Form 201, Zero-Rated Supplies in UAE VAT

VAT Invoice

VAT Invoice in UAE, Simplified Tax Invoice under VAT in UAE, What Consumers Must Check in a Tax Invoice in UAE, Checklist for a Tax Invoice under VAT in UAE, How to issue a Tax Invoice to unregistered customers, How to issue Tax Invoice to registered customers, Tax Invoice under VAT in UAE