In our previous article 'Process to pay VAT through e-guarantee', we have learnt about the scenarios of import of goods by non-registrants. We have learnt of the 2 modes of payment of VAT by non-registrants:

- Pay VAT on import

- Provide e-guarantee

We have also learnt the process to be followed by non-registrants to pay VAT on import through an e-guarantee. In brief, the process is as given below:

- Prepare and submit customs declaration in Customs portal

- A Customs official will validate the declaration details and approve the same. A notification on the approval will be sent to the importer and to the FTA

- Obtain e-guarantee from a bank for value equal to the value of VAT due

- The importer has to create an e-Services account

- Login to the FTA portal and make the VAT payment

In this article, let us understand the steps to be followed by a non-registrant to submit an e-guarantee in the FTA portal.

Steps to submit e-guarantee in FTA portal in UAE

Step 1: Login to FTA e-Services portal.

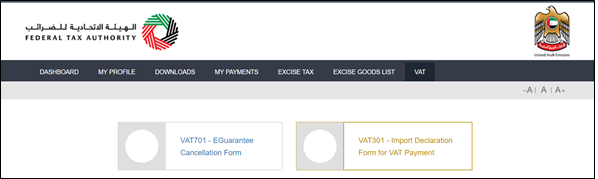

Step 2: Click the 'VAT' tab as shown below:

Step 3: Click 'VAT 301- Import declaration form for VAT Payment' .

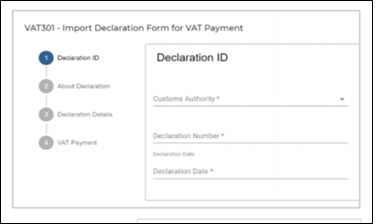

Step 4: Fill in the Customs Authority, Declaration Number and Declaration Date. Click Next.

Step 5: The screen 'About Declaration' will open and the declaration details (Import date, destination, etc.) will be automatically retrieved. Click Next.

Step 6: The screen 'Declaration Details' will open and the declaration details [e.g. HS (Harmonised System) Code, Import Value, Customs Duty, CIF (Cost, Insurance and Freight) value, etc.] will be automatically retrieved. Click Next.

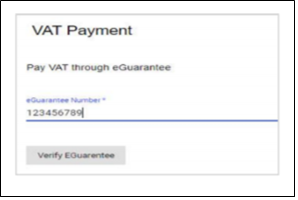

Step 7: As the scenario of import requires an e-guarantee, the VAT Payment screen will verify the e-guarantee number to proceed. Fill in the e-guarantee number and click 'Verify e-guarantee' button.

Step 8:Once the submission of the e-Guarantee is processed successfully, a confirmation message will appear on the screen providing the transaction ID and the amount. Further, you will receive an email confirmation that the e-Guarantee has been successfully submitted. After this, the customs clearance process can be completed.

Hence, the FTA has made a simple process to submit an e-guarantee in the FTA portal. Unregistered persons who are required to pay VAT on import through an e-guarantee in specified scenarios should follow the above process for the same.

Read more about FTA

e-guarantee Cancellation in FTA portal, Administrative Penalties under Tax Procedures Law by FTA in UAE, Change in business details to be notified to FTA, FTA Accredited Tax – Accounting Software Requirements, What is FTA Audit File (FAF), Benefits of using FTA Approved Tax Accounting Software in UAE, VAT Support Channels by FTA in UAE

UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT

FAQs on VAT

VAT FAQs on Education Sector in UAE, VAT FAQs on supply of real estate in UAE, VAT FAQs on implementing VAT in your business, VAT FAQs on Zero Rate and Exempt Supplies in UAE, VAT FAQs on UAE Free Zone, VAT return FAQs